- Rep. Warren Davidson says US crypto laws are undermining self-custody and financial freedom.

- He criticized the GENIUS Act for favoring banks and enabling CBDC-like systems.

- Davidson urged opposition to digital IDs, CBDCs, and account-based crypto models.

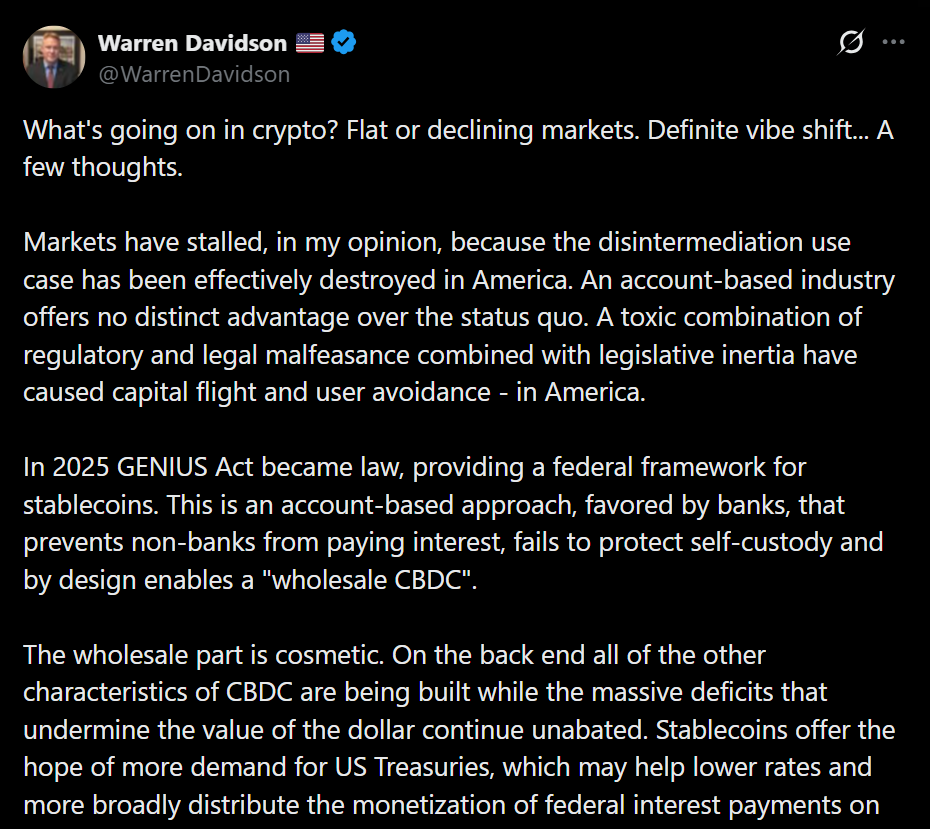

Rep. Warren Davidson has issued a sharp warning about the direction of US crypto regulation, arguing that recent legislation is quietly reshaping digital assets into something far removed from their original intent. In a year-end post shared Wednesday, the congressman said laws like the GENIUS Act and the pending CLARITY Act are steering crypto toward account-based systems that weaken self-custody, expand surveillance, and threaten Bitcoin’s foundational promise of financial freedom.

Davidson, who recently introduced legislation to allow Americans to pay federal taxes using Bitcoin, framed the issue as existential rather than technical. In his view, current policy choices are eroding the disintermediation use case that once defined crypto in the United States.

Markets Stall as Disintermediation Fades

According to Davidson, regulatory overreach has played a direct role in the crypto market’s recent stagnation. He argued that America’s failure to protect permissionless finance has flattened innovation and demand. “Markets have stalled,” Davidson wrote, saying the destruction of disintermediation has removed crypto’s most compelling value proposition for everyday users.

Without meaningful self-custody and peer-to-peer use, crypto risks becoming just another gated financial product, rather than a parallel system.

GENIUS Act Criticized for Favoring Banks

Davidson was especially critical of the GENIUS Act, which became law in 2025. He said the legislation creates a stablecoin framework that heavily favors banks by enforcing an account-based model. According to Davidson, this structure blocks non-bank innovation, discourages individual custody, and effectively enables a wholesale central bank digital currency by design.

In his view, the law lays the groundwork for permissioned money systems that mirror traditional finance rather than challenge it.

CLARITY Act Raises More Questions Than Answers

While the CLARITY Act is often framed as a fix for regulatory gaps, Davidson expressed skepticism about its real impact. He warned that even if the bill passes the Senate, any language protecting individual freedom or self-custody may be largely symbolic. The underlying account-based regime, he said, would remain firmly intact.

That outcome, Davidson believes, would do little to stop the slow erosion of financial autonomy.

Digital IDs and the Surveillance Risk

Looking ahead, Davidson predicted a growing push toward digital identity systems that link access to money with verified IDs. While such systems may be marketed as convenient or secure, he argued they would enable deeper surveillance and control over financial activity.

“The promise of Bitcoin was not an illiquid, inflating asset,” Davidson wrote, “but a permission-less, peer-to-peer payment system.” He warned that account-based dominance has already placed that promise under threat.

A Call to Defend Financial Freedom

Davidson concluded by urging Americans to take action. He called on constituents to pressure Congress to ban central bank digital currencies, oppose mandatory digital ID frameworks, and protect self-custody rights. The right to transact freely, he argued, should be treated as a fundamental liberty, restricted only with probable cause.

Absent those protections, Davidson believes decentralized encryption systems like Bitcoin and Zcash may become the last line of defense against unchecked financial surveillance.