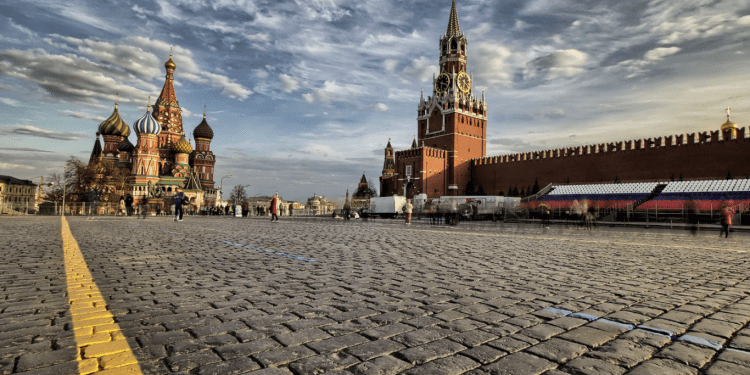

In his speech at the International AI Journey Conference organized by Sberbank, Russia’s largest bank in Moscow, on November 24, Vladimir Putin, Russia’s current President, called for the establishment of a new system for international settlement. During his address, he also criticized the monopoly in the global financial payment systems.

The Russian President believes there is a necessity for an updated digital payment system for international transactions “independent from external interference.” He mentioned that the system would be based on cryptocurrencies and blockchain technologies, noting that international transactions using digital money and technologies that use distributed ledgers will be much easier in the future.

According to him,

“The technology of digital currencies and blockchains can be used to create a new system of international settlements which will be more convenient, absolutely safe for its users, and most importantly will not depend on banks or interference by third countries. I am confident that something like this will certainly be created and developed because nobody likes monopolists’ dictate, harming all parties, including the monopolists themselves.”

The Russian President, in his address, emphasized that financial flows and payments between nations are currently in jeopardy amid rising tensions between Russia and the West following Ukraine’s invasion. Furthermore, he stated that the sanctions imposed have greatly affected the country’s access to the global financial market.

He elaborated thus, “We all know very well that under today’s illegitimate restrictions, one of the lines of attack is through settlements. And our financial institutions know better than anyone because they are exposed to these practices.”

Putin also pointed out that “the existing international payment system is expensive; a narrow club of states and financial groups controls the system of its correspondent accounts and regulations.” The Russian President also stressed the need for global financial institutions to “reflect the realities of a multipolar world. One based on open democratic principles, which excludes dictates, abuse, and monopolism”.

Russia on Cryptocurrencies

Earlier in February, the Russian Ministry of Finance presented a crypto bill to the parliament, which intended to provide a regulatory framework for cryptocurrencies and digital assets despite opposition from the Bank of Russia, which advocated for the prohibition of cryptocurrencies.

The use of utility tokens and digital securities as a payment method for goods, services, and products was made illegal in Russia by legislation signed into effect by the President at the time. However, since officially banning cryptocurrencies and other digital assets as payment in Russia barely four months ago, Putin has come a long way.

This news comes in light of reports that Russian legislators have been discussing significant amendments to the country’s existing crypto regulation to increase support for the legalization of cross-border payments.

According to these reports, posted a day before Putin’s announcement, The State Duma, the lower chamber of the Russian parliament, has been in discussions with significant market stakeholders concerning the amendment to the country’s existing legislation “On Digital Financial Assets.”

As reported, this amendment will lay down the legal framework for the launch of a National Crypto exchange. And both the Ministry of Finance and the Central Bank of Russia are on board and in support of this initiative.

Sergey Altuhov, the Duma’s Committee on Economic Policy member, stated, “It makes no sense to deny the existence of cryptocurrencies; the problem is they circulate in a large stream outside of state regulation. These are billions of tax rubles of lost tax revenues to the federal budget.

On November 17, a bill legalizing cryptocurrency mining and the sale of crypto mined was introduced to the Russian State Duma. And as expressed by Anatoly Aksakov, “The passage of the law will bring this activity into the legal field, making it possible to form law enforcement practice on the issuance and circulation of digital assets.”