- Both OpenSea and BinanceUS changed their official X profile pictures to Bored Ape Yacht Club (BAYC) NFTs, sparking a surge in NFT chatter.

- The move coincides with turbulent crypto markets and growing scrutiny of exchanges.

- Analysts see it as a nostalgic signal to reignite NFT enthusiasm during a bearish cycle.

October 15, 2025 — The crypto community is curious why OpenSea and BinanceUS swapped their official X (formerly Twitter) profile pictures for Bored Ape Yacht Club NFTs. The switch — OpenSea choosing Ape #3125 and Binance selecting Ape #5822 — marks a symbolic return to NFT culture that dominated the 2021 bull run.

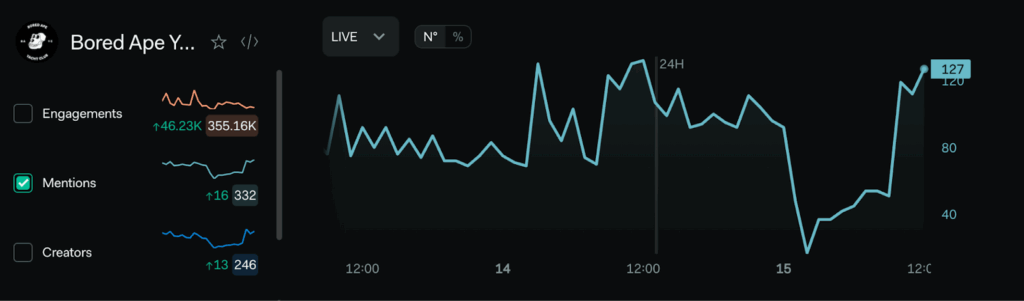

According to LunarCrush data, mentions of “Bored Ape” surged 150% across social platforms in just 24 hours. OpenSea’s selected ape is a rare laser-eyed variant valued around $200,000, while Binance’s ape carries an estimated $150,000 tag. Both come from the original Yuga Labs collection — the holy grail for NFT collectors.

Market Context and Timing

The timing has many raising eyebrows. Bitcoin recently dipped below $100,000 following tariff-related volatility and a $20 billion liquidation event that battered exchanges. Binance, still dealing with the fallout from reimbursing users $283 million in losses, made the switch just as OpenSea battles a 40% decline in trading volume compared to last year.

Neither company has made an official statement. However, one NFT trader described the move as “a show of solidarity with the creator economy.”

Why BAYC, and Why Now?

The Bored Ape Yacht Club launched in 2021 and became the ultimate status symbol in crypto. Its holders gained access to exclusive events, merch, and metaverse perks through Yuga Labs’ Otherside project. Even as floor prices fell from 150 ETH to around 12 ETH today, BAYC remains a cultural icon.

For OpenSea, the BAYC tie-in could be a subtle marketing effort. NFT sales have dropped 70% since 2022 highs, and this gesture might re-energize collectors. For Binance, it doubles as distraction and nostalgia — a morale boost as the exchange faces scrutiny and pushes forward with a $45 million airdrop for memecoin traders.

LunarCrush analyst Mia Chen summed it up: “In a bearish market, nostalgia sells. BAYC reminds people of when crypto was fun.”

The Social Response

Reactions exploded across social media, with 1.2 million engagements and a 67% positive sentiment score. Memes of apes “liquidating bears” flooded feeds, while others criticized the move as tone-deaf given current market losses. Redditors accused exchanges of “cosplaying as elites while retail gets rekt,” and one viral thread claimed the stunt distracts from Binance’s recent liquidation troubles. Still, BAYC holders celebrated, noting a 5% rise in the collection’s floor price within hours.

Looking Ahead: Revival or Risk?

Some analysts view this as a clever publicity play that could revive interest in NFTs. For Binance, it’s a small but effective way to redirect conversation after weeks of negative headlines. For OpenSea, it might remind users of its cultural roots before competitors like Blur and Magic Eden took market share.

But critics warn that regulators might not find it amusing. With both Binance and Yuga Labs under varying degrees of U.S. scrutiny, the “Ape PFP era” could invite more attention than either company bargained for.