The value of NFTs sent to marketplaces this year has already surpassed $37 billion, which is approaching the whole amount delivered in all of 2021.

Blockchain technology and smart contracts may bring about a new era of cryptocurrencies. In 2021, investors sent $40 billion in virtual currencies to smart contracts related to NFT collections and marketplaces, according to a Chainalysis study.

NFT Collection Activity Still Stands Strong Yet Inconsistent

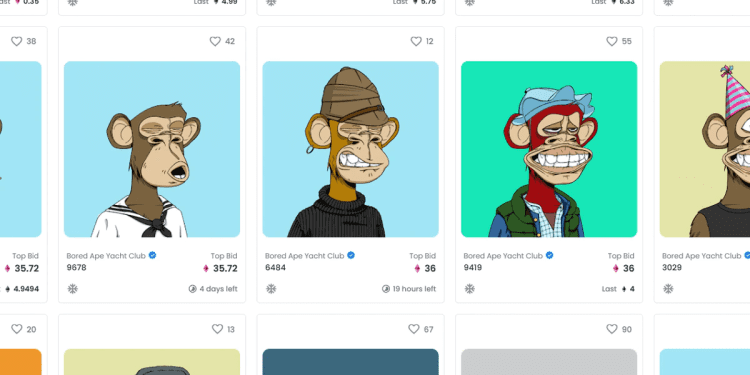

According to the study, NFT transaction volume has been decreasing since mid-February. The NFT market made a brief resurgence in mid-April owing to the recent excitement surrounding Moonbirds and the Bored Ape Yacht Club’s metaverse project, Otherside, according to reports.

Despite the fact that the value of non-fungible token transactions has increased considerably since last year, industry growth has been patchy.

Despite brief-term changes in NFT transaction volume, the number of people buying and selling NFTs globally has remained consistent, with 950,000 distinct addresses buying or selling NFTs in Q1 2022.

As of May 1, 2022, 491,000 distinct addresses have used NFTs to conduct transactions, keeping the market on track to continue its participation increase.

The Global Influence of NFTs

By analyzing the online traffic of the leading NFT collectors’ marketplaces, Blockchainalysis found that NFTs attract users from all over the world. Central and Southern Asia are in first place, followed by North America and Western Europe.

According to the new report, the NFT market has not collapsed. The Wall Street Journal published a story claiming that NFT sales had stagnated, but the findings of this new research directly contradict this conclusion. According to the article, “the NFT market is collapsing.”

According to the WSJ, data from Nonfungible indicates that NFT sales have decreased by 92% since an all-time high in September 2021. Since a peak in November 2021, wallets in the Ethereum (ETH) NFT market have fallen by 88%.

On May 5, 2018, Chainalysis released a detailed study revealing how blockchain technology may be used to fight money laundering and terrorist financing in the global financial system. This comes just one day after CoinBase’s debut of its in-house NFT marketplace failed to generate much buzz. On May 4th, on-chain data revealed that only 150 transactions took place in the new market.

NFT investors have been cashing out since February, but the number of people in the market has remained consistent. According to the study, 95% of CoinBase’s users are involved in NFT transactions.

As with other digital assets, NFTs attract a wide range of investors from all over the world. However, when it comes to geographic regions, Central and Southern Asia had the highest level of engagement in Q1 2022.