- The New York State Department of Financial Services proposes clearer guidelines for crypto firms on coin listings and delistings, emphasizing a more robust framework to protect consumers.

- Superintendent Adrienne Harris highlights that the new guidelines will be open for public comments until October 20.

- Crypto firms registered with NYDFS must follow stricter assessment criteria involving legal, reputational, and market risks, and formulate detailed delisting protocols.

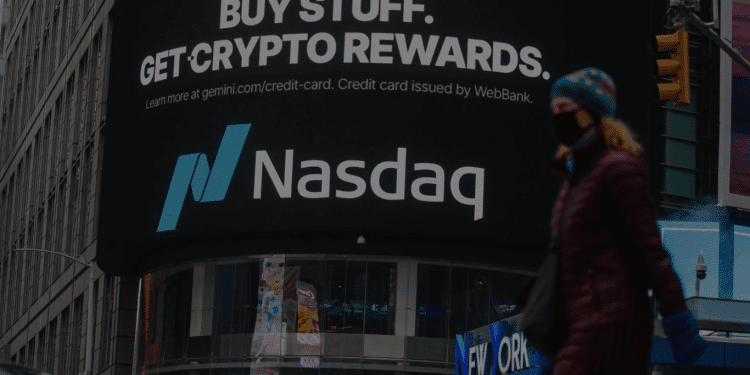

The New York State Department of Financial Services (NYDFS) has recently proposed stringent frameworks that are set to redefine the rules of the game for crypto firms operating in the state. Superintendent Adrienne Harris is urging cryptocurrency companies to be more transparent in how they go about listing and delisting crypto coins. The proposed guidance aims to craft a blueprint for firms to develop specific policies surrounding coin listings and delistings.

This mandate compels registered virtual currency companies to put forth fresh policies for coin listings and delistings. What stands as a remarkable first is the detailed guidance on delisting, which requires firms to specify the criteria and procedures that would trigger the removal of a coin.

This significant move comes as Harris celebrates her two-year tenure at the helm of NYDFS. A period marked by a decisive approach towards crypto regulation that saw the imposition of $132 million in fines against major players like Coinbase and Robinhood.

Unveiling the Greenlist: The Future of Coin Listings

Pioneered in 2020, the original framework guided crypto firms to devise coin listing policies tailored to their business dynamics, while seeking NYDFS approval for the listing or offering custody of coins, barring those featured on the NYDFS “greenlist.” The revised framework carries forward this premise, urging firms to draft policies focusing on three pivotal areas — setting up governance structures, conducting risk assessments, and initiating procedures to constantly monitor the coins.

Significantly, firms have been given a degree of autonomy, being able to self-certify a listing post-regulatory approval of their coin-listing policy, albeit with the condition of notifying NYDFS prior to employing a coin and keeping the agency informed about their coin offerings.

A spotlight in this proposed framework is the “greenlist,” a curated list of coins pre-approved by the regulator. While offering a fast track for coins featured on it, this greenlist has notably been pruned to include only bitcoin, ether, and six stablecoins, marking a stringent approach compared to its predecessor that featured around two dozen coins.

Navigating the New Terrains of Crypto Regulation

With the public commentary window open till October 20, 2023, the crypto world is keenly watching the unfolding dynamics. The guiding principles set by NYDFS are poised to echo far and wide, given New York’s preeminent role in the financial landscape.

As NYDFS gears up to review feedback and finalize the guidance, crypto firms are racing against time to align with the potential norms that await them post-January 31, 2024, a critical deadline for submitting the de-listing policies.

Despite the critics pointing at an over-regulated landscape potentially stifling growth, advocates argue in favor of a robust regulatory regime averting catastrophes and fostering a secure and transparent crypto ecosystem. As Harris underscores the proactive role of NYDFS in steering a risk-based analysis, the crypto realm stands at the cusp of witnessing a regulatory makeover aimed at consumer protection and maintaining the “safety and soundness” in coin listings and delistings.