- NBA Top Shot creator, Dapper Labs, must face a lawsuit accusing it of selling unregistered securities.

- Purchasers of Top Shot Moments allege that Dapper violated US securities law by offering the items without registering them with regulators.

- The case is part of a wider legal and regulatory battle over whether digital assets, such as NFTs and crypto tokens, are securities and must be registered with the US Securities and Exchange Commission.

The popularity of non-fungible tokens (NFTs) has been on the rise since their inception, and they have become a favorite among crypto enthusiasts and investors. However, the legal classification of NFTs has always been a subject of debate. Now a recent lawsuit filed against Dapper Labs, the creator of the NBA’s Top Shot NFTs, has sparked another controversy.

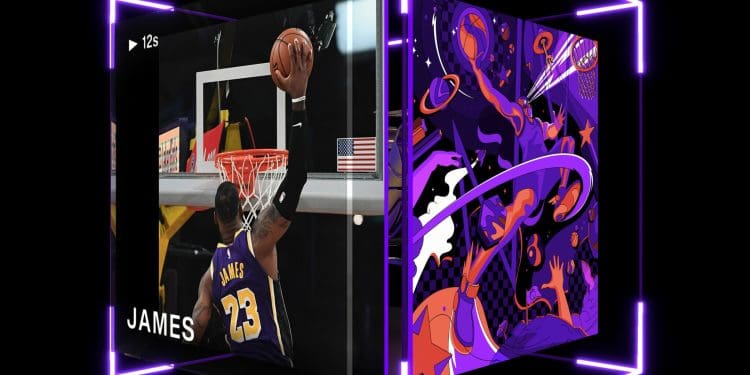

In the lawsuit filed in 2021, purchasers of Top Shot Moments, digital video clips of highlights from NBA games, accused Dapper Labs of violating US securities law by offering the items without registering them with regulators. They alleged that Dapper improperly used its control over the popular collectibles to prop up the Flow Blockchain, the only place where trading of Moments is allowed.

US District Judge allows the case to proceed to trial

On Wednesday, US District Judge Victor Marrero denied a request by Dapper to throw out the suit before trial, finding that the plaintiffs had adequately alleged that Moments are securities for the case to go forward. Marrero said that the trading of Moments is limited to the company’s Flow blockchain and that purchasers, therefore, rely on Dapper’s expertise and management “as well as its continued existence.”

The judge also highlighted the difference between NFTs and physical sports trading cards. Saying that the value of trading cards would remain unaffected even if the producers went out of business. Unlike Moments, where the pooling of capital generated from their sale propped up the Flow Blockchain.

The decision appears to be the first addressing whether NFTs are securities, Marrero said, cautioning that it doesn’t mean all of them are. The case is part of a wider legal and regulatory battle over whether digital assets, such as NFTs and crypto tokens, are securities and must be registered with the US Securities and Exchange Commission.

Dapper Labs has stated that the case is far from over, and courts have repeatedly found that consumer goods – including art and collectibles like basketball cards – are not securities under federal law. A spokesperson for Dapper Labs said, “We are confident the same holds true for Moments and other collectibles, digital or otherwise, and look forward to vigorously defending our position in court as the case continues.”

Top Shot’s success and the NFT market

The NBA’s Top Shot NFTs were launched in 2020 and quickly became a sensation, with trading volumes reaching $982 million. However, the market for NFTs has been volatile, with sales plunging last year before rebounding in recent months. The value of the cheapest token in each collection, known as the price floor, has been relatively stable for some of the most popular collections.

The case against Dapper Labs has significant implications for the NFT industry, as it could set a legal precedent for how NFTs are classified and regulated. NFTs have gained mainstream attention due to their potential to provide a new revenue stream for creators of digital content, from artwork to music and even tweets.

The lack of regulation has also led to concerns about the potential for fraud and market manipulation. In addition, the environmental impact of NFTs has also been a topic of discussion, with critics citing the massive energy consumption required to mint and trade them.