- Monero gained 1 percent while the crypto market dropped nearly 3 percent, showing clear relative strength.

- A recent breakout, strong privacy-sector demand, and short-heavy positioning supported XMR’s stability.

- XMR is consolidating constructively and could target the $470–$500 range if it breaks above the low-$400s.

Monero gained roughly 1 percent over the past 24 hours while the broader crypto market fell nearly 3 percent — a clear sign of relative strength during a risk-off session. Instead of reacting to the macro selloff, XMR steadied itself around the $400 zone, supported by firm demand and technical buyers waiting at lower levels. This divergence shows Monero isn’t simply avoiding volatility; it is consolidating after a well-defined bullish breakout that has introduced new buy-side interest into the chart.

Privacy Demand Gives Monero Its Own Market

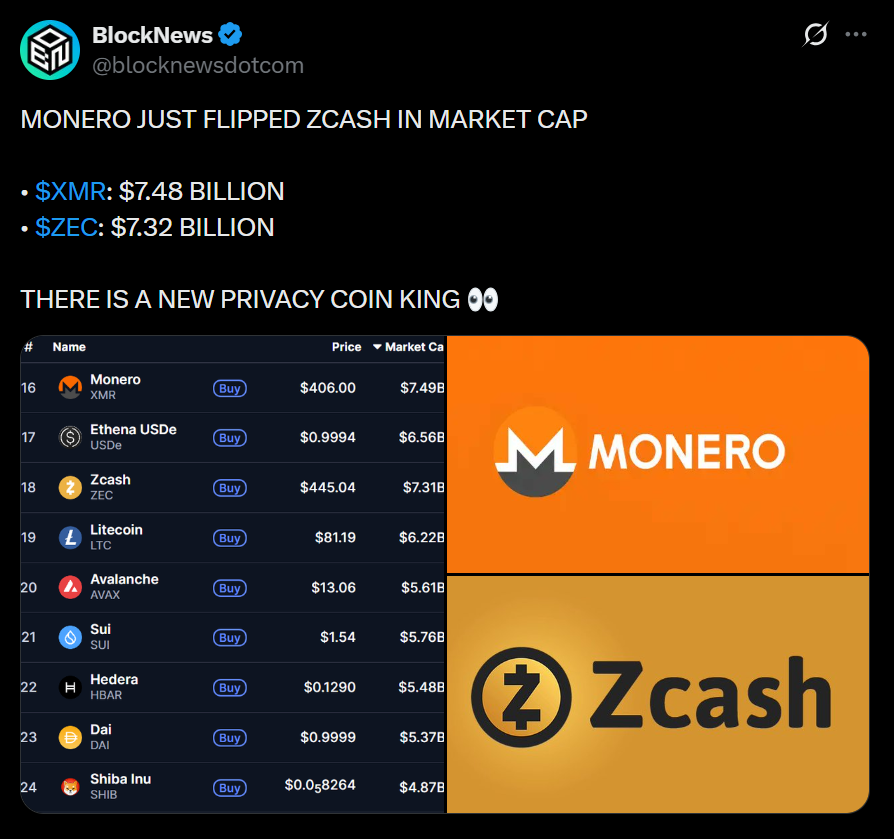

While most altcoins trade as extensions of macro conditions, Monero continues to benefit from strong privacy-sector demand. Recent reports show privacy coins attracting steady flows from MENA, CIS, and Southeast Asia, with Monero capturing the largest share. Development efforts, such as new security audits and infrastructure updates, further reinforce confidence among long-term holders. This is sticky, utility-driven demand — not fleeting speculation — which helps explain why XMR rose while most other altcoins slid.

Shorts Cushion the Downside as Macro Headwinds Hit

Deeply short-heavy derivatives positioning has also helped Monero resist the market pullback. Negative funding rates indicate traders leaning short into XMR, and when an asset with strong spot demand and a bullish chart is heavily shorted, selloffs are often absorbed instead of amplified. Shorts covering on dips — combined with Monero’s historically resilient holder base — kept XMR stable even as macro volatility sent other alts sharply lower. This structural advantage helps explain why XMR oscillated tightly rather than joining the broader decline.

Why Monero Stayed Firm When Everything Else Fell

Monero’s ability to flip green during a market-wide red day stems from three converging forces: a completed bullish breakout, a rising narrative around privacy-focused assets, and derivatives positioning that reduces downside pressure. Together, these factors allowed XMR to sidestep the selloff and build strength while other cryptocurrencies lost momentum. For now, the $395–$400 band remains the key demand zone — and if resistance breaks, the next leg higher could unfold quickly.