Potential Margin Call on Their $2 Billion Debt

Software Vendor Microstrategy might be forced into a margin call on their massive Bitcoin sum. The company has amassed a sum of 129,000 Bitcoin (worth around $2 Billion) since they started buying Bitcoin with debt in 2020.

During a call between the company and Business Insider, Microstrategy was asked “how far would Bitcoin have to fall for Microstrategy to receive a margin call on the Silvergate loan?” The Company rep responded with, “As far as where Bitcoin needs to fall, we took out a loan at a 25% loan-to-value. So essentially, bitcoin needs to cut in half or around $21,000 before we’d have a margin call.”

The impending and increasingly lowering of the value of Bitcoin could offer a significant setback for the company, and could potentially affect the FUD surrounding bitcoin already. To offset a margin call, the company will need to add more collateral to its loan. “Before it gets to 50%, we could contribute more bitcoin to the collateral package, so it never gets there, so we don’t ever get into a situation of a margin call.”

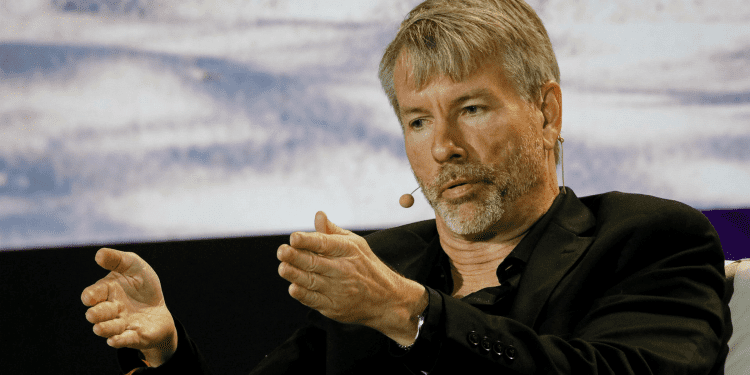

In March, Microstrategy took out a $205 million bitcoin-collateralized loan with Silvergate Bank to buy additional Bitcoin. The software company’s total bitcoin holdings are now worth more than billion and have an average cost of about ,700. CEO Michael Saylor iterated he doesn’t plan to ever sell Microstrategy’s bitcoin stockpile.

Microstrategy is trading at a market valuation of only $4.4 billion, meaning the stock is trading at a discount to its underlying crypto holdings. This could make their investors uneasy that the company is billions of dollars in debt. This is also made worse because the company has also been seeing a decline in its own software business, and has been suffering from the extreme volatility of the company’s crypto asset.

To add, MicroStrategy’s stock price has taken on the appearance of a bitcoin ETF as it has been closely mirroring the price of bitcoin to the point that some consider it a quasi-bitcoin ETF. Note that at the moment there is no true bitcoin ETF yet approved in the US.

The Company’s Stock Price is Dependent on the Price of Bitcoin

At the moment, MicroStrategy’s stock price lives or dies in accordance to the health of bitcoin, which is down a whopping 44% since its record high of $69,000 in November 2021. The company’s stock price is down 62% since bitcoin topped out in November, and is down 37% year-to-date.