- A 11.64M XRP transfer into Coinbase signals ETF custody, not selling.

- Coinbase is the primary custodian for XRP ETF issuers in the U.S.

- Cold storage removes XRP from circulation, tightening supply as ETF demand grows.

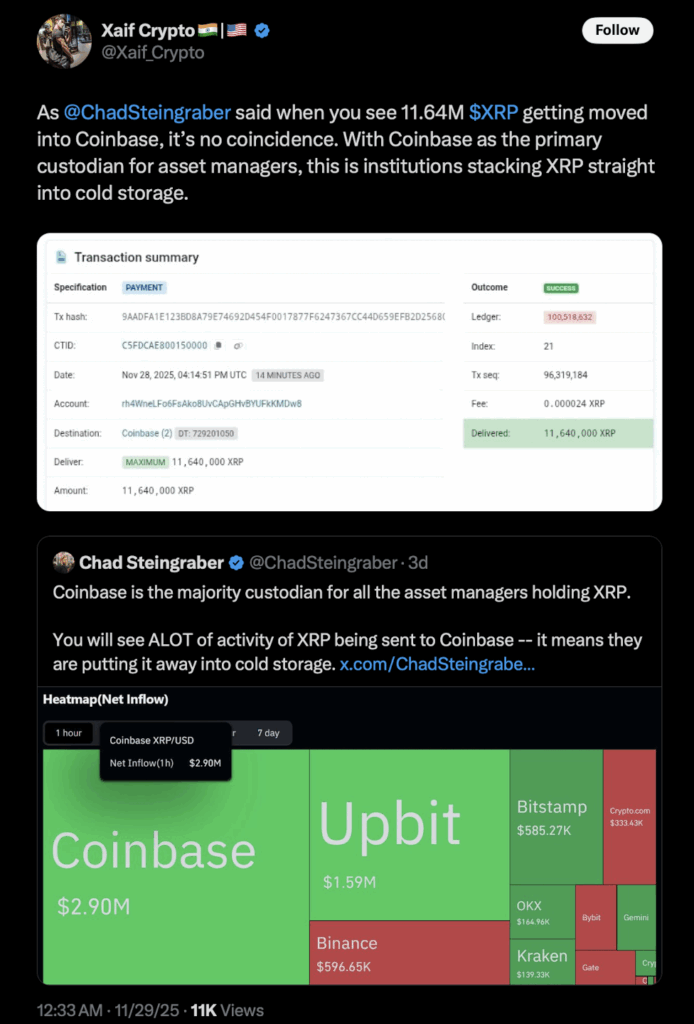

Crypto watcher Xaif (@Xaif_Crypto) grabbed attention on X after posting a screenshot showing a massive 11.64 million XRP transfer straight into a Coinbase wallet. The image showed a successful transaction from a private account into Coinbase’s custody — and the timing couldn’t have been more interesting, coming right as activity around XRP ramps up following the launch of new spot ETFs.

Xaif connected the transfer to earlier comments made by analyst Chad Steingraber, arguing movements of this size shouldn’t be brushed off as random whale behavior. Instead, he suggested the transfer likely points toward institutional flows, not casual traders. And with Coinbase serving as the main custodian for ETF issuers, the reasoning makes sense: big players send their XRP in, Coinbase locks it away for ETF backing.

ETFs reshape how XRP moves — and who controls it

Ever since XRP spot ETFs hit the market, inflows have surged. These products give institutions exposure to XRP through regulated markets instead of trading directly on exchanges. The twist is simple but important: funds must hold the underlying asset with a regulated custodian.

In the U.S., that custodian is almost always Coinbase.

Because of that structure, large XRP transfers moving into Coinbase no longer mean dumping or sell pressure. They mean custody — ETF backing, long-term storage, and assets being effectively removed from the open market. Each time an ETF buys XRP, the tokens get taken off exchanges and placed into cold storage.

Steingraber pointed out this pattern earlier, saying large Coinbase inflows often reflect institutional positioning rather than exchange usage. Xaif’s post supported that idea with real transaction data to show what’s happening behind the scenes.

The cold-storage effect: shrinking supply and rising demand

Once XRP enters cold storage, it disappears from active circulation. These tokens don’t hit order books, don’t contribute to liquidity, and usually don’t re-enter the market for long periods — if ever. And the trend is visible. Public data already shows exchange balances declining steadily.

With ETFs pulling in huge inflows and supply tightening at the same time, the pressure dynamic around XRP is shifting fast. The 11.64M XRP transfer Xaif highlighted fits perfectly within that trend. It reflects a system forming behind the ETFs: asset managers don’t day-trade, they accumulate — then they hold.

And this isn’t an isolated transfer. Similar large movements have popped up across the network in recent weeks. Taken together, they paint a clear picture: as ETFs expand, more and more XRP is being removed from liquid markets and locked into long-term institutional storage.