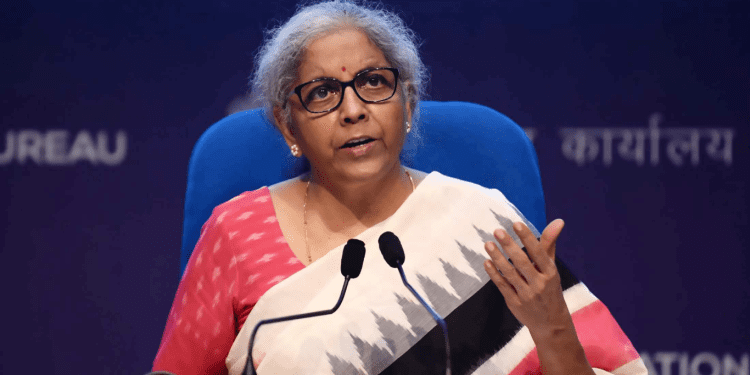

The International Monetary Fund (IMF) should take the lead in regulating cryptocurrencies, said India’s Finance Minister Nirmala Sitharaman. Sitharaman raised the issue during her meeting with the IMF Managing Director Kristalina Georgieva in New Delhi on September 7.

Coordinated and Synchronized Approach to Crypto Regulation

At their meeting last week, the Finance Minister and the IMF director discussed the significance of regulating digital assets. They agreed that there was a need for global coordination to achieve a synchronized approach to crypto regulation.

Sitharaman then urged the IMF to take the lead in regulating cryptocurrencies to ensure global coordination and synchronization. The Indian finance ministry also tweeted regarding the matter, saying, “Ms. Kristalina Georgieva @KGeorgieva MD, IMF, @IMFNews met with FM Smt. @nsitharaman in New Delhi, today, to discuss India’s upcoming G20 Presidency and IMF’s support to India for the Presidency.”

They also expressed concerns over critical issues currently pulling down the global economy and the cross-border impacts in the wake of a volatile geopolitical situation, increasing inflation, and tighter financial conditions.

IMF’s View On Crypto Regulation

Sitharaman advocated for a global framework regulating cryptos during the IMF and World Bank spring meetings in April. The finance minister also raised concerns about terror financing and money laundering actions associated with cryptocurrencies.

In a September 2022 publication, the IMF acknowledged that cryptocurrencies are fast becoming mainstream, but policymakers still struggle to monitor the risks associated with the market. This has posed challenges to applying existing regulatory frameworks to digital assets or developing new ones. The IMF noted:

“Regulators are struggling to acquire the talent and learn the skills to keep pace given stretched resources and many other priorities. Monitoring crypto markets is difficult because data are patchy, and regulators find it tricky to keep tabs on thousands of actors who may not be subject to typical disclosure or reporting requirements.”

The IMF then called for a global regulatory framework that is comprehensive, consistent, and coordinated to address the regulatory, legal, technological, and supervisory challenges associated with cryptocurrency adoption.

Regulation using technology may not be a panacea to crypto regulation issues, but it could be a good starting point. Such a framework should be dextrous to ensure that it is top-notch. It is worth noting that no one country can handle it alone. It has to be “coordinated and collaborative,” the IMF said.

During the April meeting, the IMF vowed to expand its work on digital assets as Sitharaman emphasized the need to have a global consensus on the issue to ensure precise regulation of this asset class.

In April, India introduced a tax on all crypto income at a flat rate of 30% and a 1% Tax Deducted at Source (TDS) on transactions above $125 (10,000 Indian rupees) and taxation of such gifts in the hands of recipients. The move was proposed in February during the Union Budget. These taxes were effected on July 1.