- HYPE token gained ~4%, hovering near $46.

- Hayes projects a 126x rally fueled by stablecoin growth.

- Hyperliquid now controls 75% of the perps DEX market and rivals Binance in volume.

Hyperliquid’s native token, HYPE, was one of the few green spots in the crypto market over the last 24 hours, climbing almost 4% to $45.64 after briefly touching $47 earlier in the day. The move came right after BitMEX co-founder Arthur Hayes dropped a bold prediction at the WebX 2025 conference in Tokyo, saying he expects HYPE to climb 126x within the next three years.

Hayes argued that the explosion of stablecoins would be the driving force behind this surge. According to him, Hyperliquid’s annualized fee revenue could balloon from today’s $1.2 billion to a staggering $258 billion, thanks to growing demand for decentralized derivatives. For context, Hyperliquid specializes in perpetual futures—derivative contracts without an expiry date—allowing traders to go long or short with leverage, no asset ownership required.

Hyperliquid Activity Hits New Records

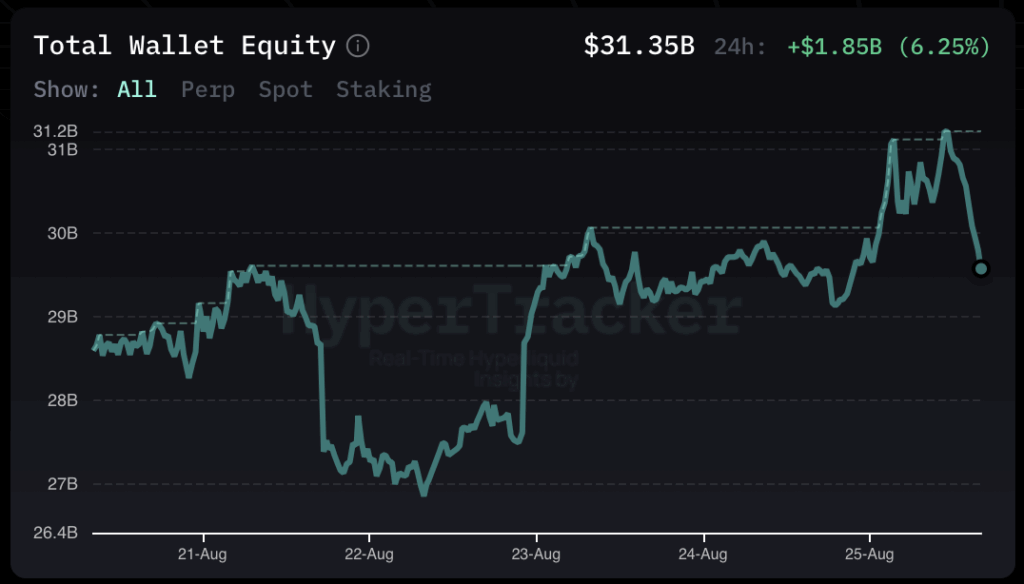

Fresh stats show momentum is building across the board. Hypertracker data reported that total open positions hit an all-time high of 198,397 contracts on Monday, with open interest climbing past $15 billion. Wallet equity on the exchange also peaked at $31 billion, signaling that traders are stacking serious capital into the platform.

DEX trading volume told the same story. Over the weekend, Hyperliquid cleared a record $1.56 billion in daily volume, with transaction fees already hitting $93 million so far in August—matching July’s record pace, according to DefiLlama. On top of that, the exchange’s total value locked (TVL) sits at $685 million, just a hair below its February peak.

Hyperliquid Dominates the Perps Market

It’s not just hype—Hyperliquid is literally eating its competitors alive. Data provider Redstone released a report last week showing that in less than two years, the DEX has grabbed more than 75% of the decentralized perpetual exchange market, overtaking dYdX’s long-held dominance.

Today, the exchange regularly processes $30 billion in daily trading volume and, on certain pairs, has begun to rival Binance itself. For perspective, HYPE hit its all-time high of just under $50 on July 14, and at press time it was only about 7% away from reclaiming that level.

Outlook

With record-breaking volumes, surging fees, and Arthur Hayes throwing a 126x forecast into the mix, Hyperliquid is firmly on traders’ radar. The question isn’t just whether HYPE can take out its $50 all-time high, but how far this new derivatives powerhouse can run if stablecoin adoption keeps scaling the way Hayes envisions.