- Bold Predictions for 2025: Analysts forecast Bitcoin could reach $180K–$250K by 2025, fueled by ETF inflows, institutional interest, and rising global liquidity concerns.

- Changing Market Dynamics: Traditional 4-year cycles may be fading. Experts suggest Bitcoin is now driven more by macroeconomic shifts than by internal crypto events like halvings.

- Massive Long-Term Potential: With fiat instability and growing debt, some analysts see Bitcoin eventually hitting $500K to over $1 million by 2030 as capital seeks scarce assets.

Bitcoin’s latest surge has reignited the age-old debate—how far can this thing really fly? While cracking the code on market tops isn’t exactly easy (some might say it’s pure luck), analysts and investors alike are tossing out bold predictions, especially now that BTC has danced well above $100K. At this stage, some folks are eyeing six-figure targets with a surprising amount of conviction, leaning on past bull cycles and new waves of adoption to make their case.

What’s tricky is timing. If BTC tops sometime in 2025, does that mean it’s time to cash out and brace for another icy crypto winter? Or are we looking at a new kind of cycle—less predictable, more… global? There’s chatter that this time, things really might be different.

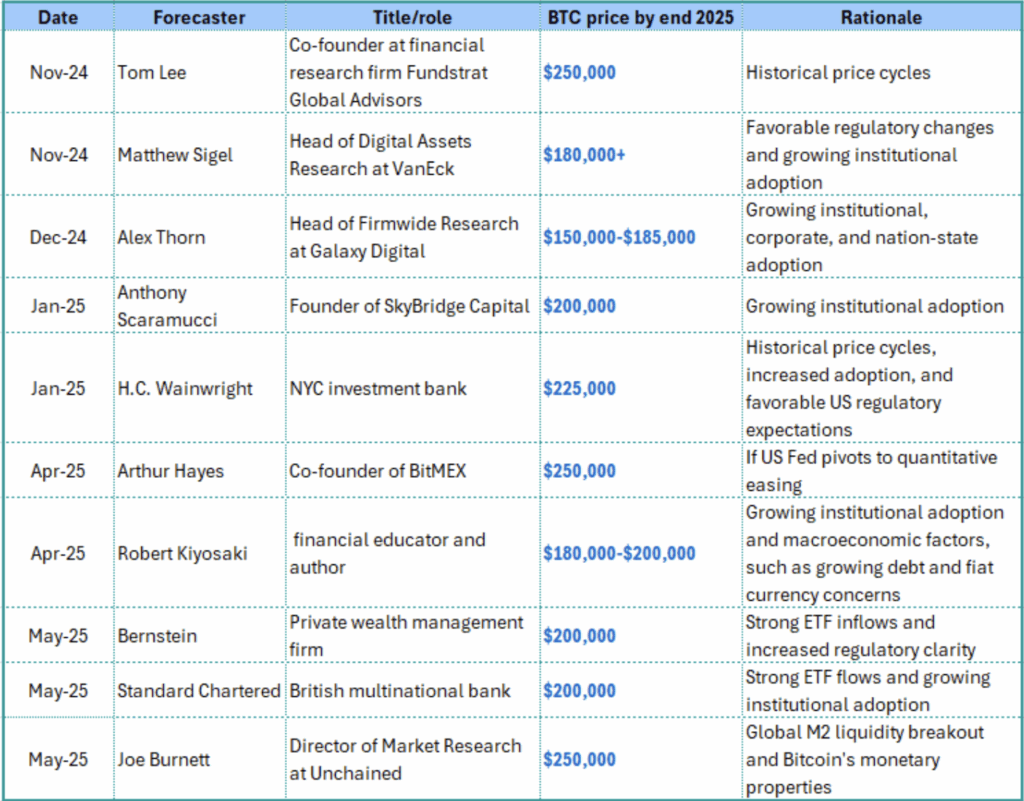

The 2025 Forecasts: From Bullish to Bonkers

After BTC ripped past $90K in late 2024, the price projections came in fast. Names like Galaxy Digital and Fundstrat tossed around targets from $180K to $250K, mostly on the back of ETF inflows and major institutions joining the party. BitMEX co-founder Arthur Hayes chimed in too, saying Bitcoin doesn’t really care about much—just the future of fiat, and right now that future looks pretty messy.

Interestingly, many of those late-2024 predictions are still holding up in mid-2025. Why? Because the assumptions behind them haven’t really changed. Liquidity is the buzzword of the year, with global debt climbing and the macro backdrop getting weirder by the day. According to Nik Bhatia, this isn’t a rally fueled by optimism. It’s more like capital trying to escape a broken system.

Could 2026 Bring the Next Crypto Crash?

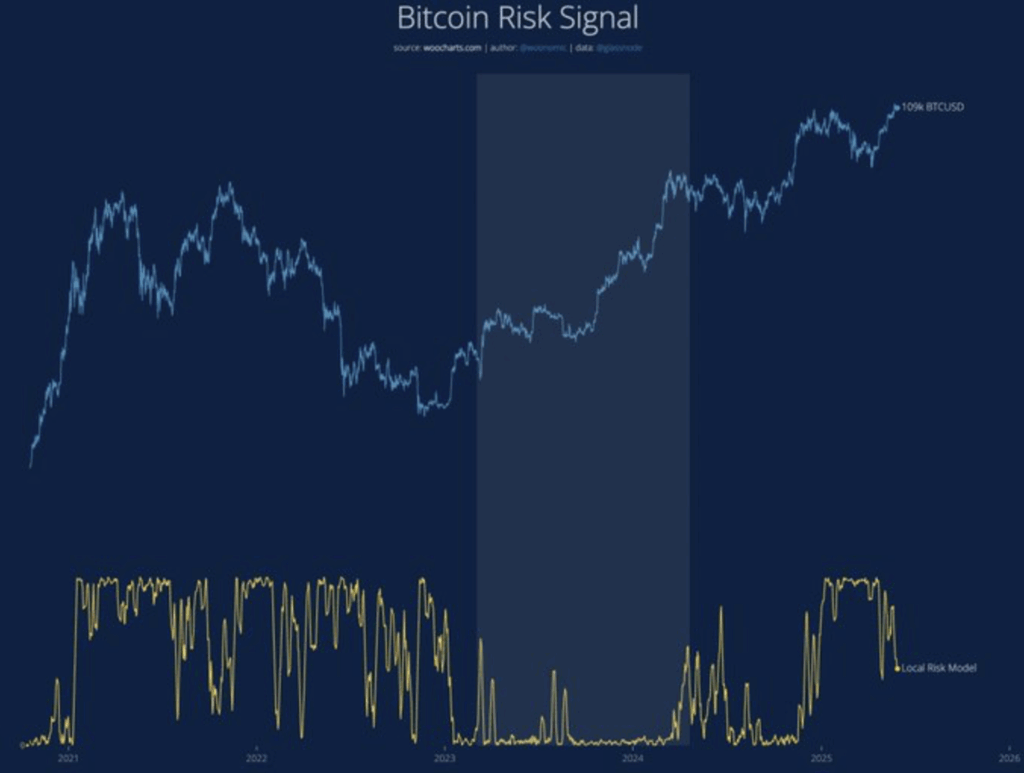

Right now, most signs say Bitcoin is still very much in a bull run. On-chain analyst Willy Woo highlighted a declining “Risk Signal,” which usually points to a dominant buyer environment. That same signal flashed before BTC’s last big surge, so optimism’s still in the air.

But… 2026? That’s where things get murky. Some cycle-based models are bracing for a reset next year. However, Woo suggests ditching those neat four-year patterns. He thinks Bitcoin is turning into a global macro asset—a kind of early-warning system for everything else. Halvings are losing their power, and it’s liquidity that’s steering the ship now.

From Fiat Drain to Bitcoin Tidal Wave?

On the macro side, things look… tense. Stack Hodler says the U.S. government’s attempts at financial discipline have pretty much flopped. The deficit’s ballooning again, and with over $7 trillion sitting idle in money markets, there’s a looming question: where does all that cash go next?

If history repeats itself, capital will seek out what can’t be printed. Bitcoin fits that bill. Joe Burnett’s talking about a full-on “sovereign race” for BTC, with a potential price tag of $1 million by 2030. ARK Invest goes even further, tossing out numbers like $2.4 million.

Sound wild? Maybe. But with fiat systems wobbling and Bitcoin’s fundamentals staying rock solid, these lofty predictions aren’t so far-fetched anymore. We might still be early—just before the real fireworks begin.