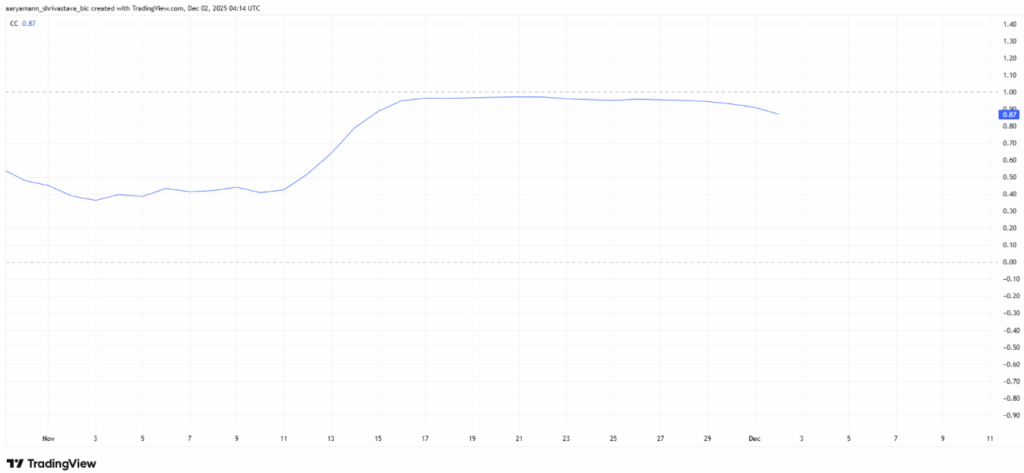

- HBAR struggles as its 0.87 correlation with Bitcoin pulls price downward.

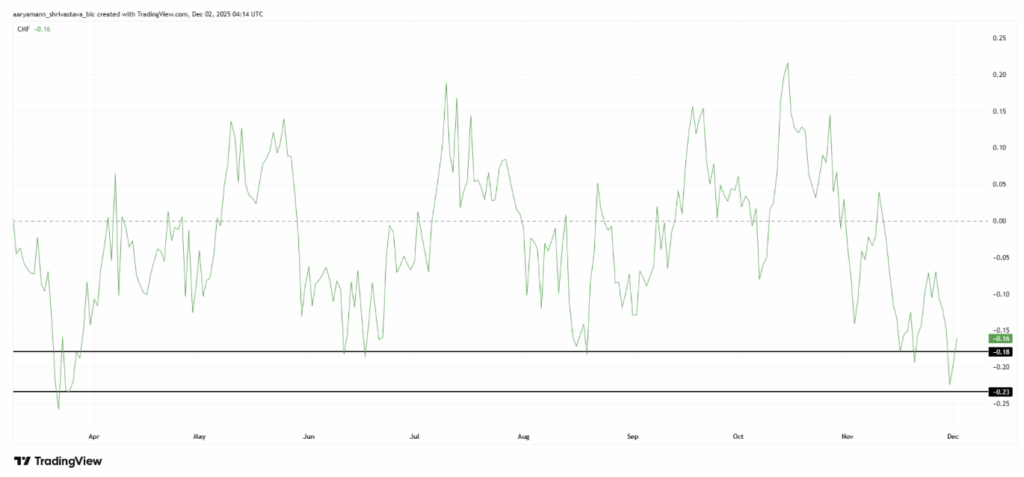

- CMF weakness shows continued capital outflow despite typical reversal levels.

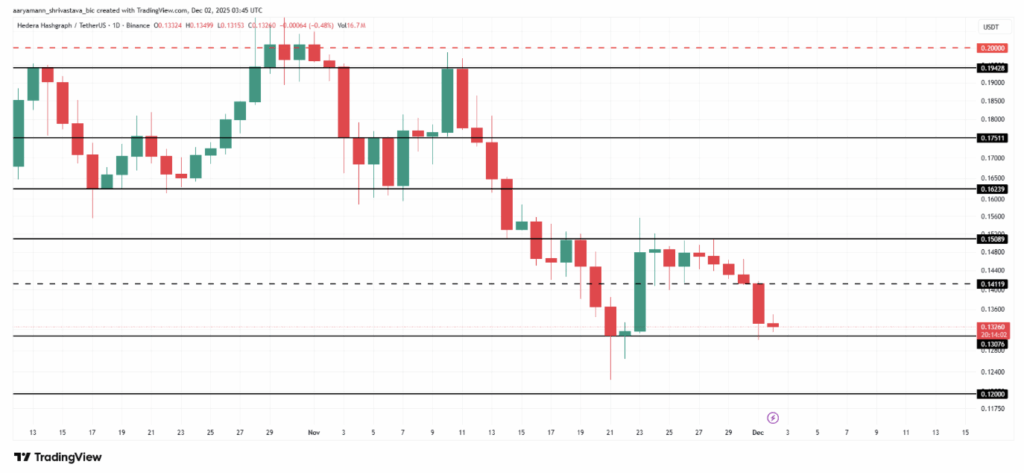

- Holding $0.130 is critical; losing it could send HBAR toward $0.120.

Hedera has been struggling to catch its breath this past week, even though the broader market had a brief moment of relief before everything turned bearish again. HBAR tried — really tried — to climb back toward its recent highs, but the entire market’s downturn pulled it right back. What it revealed is something most traders already suspected: Hedera still moves almost entirely at the mercy of Bitcoin.

Hedera’s Biggest Problem Right Now? Bitcoin.

HBAR’s correlation with BTC is sitting at a pretty uncomfortable 0.87, only slightly lower than last week’s peak. That means almost every move Bitcoin makes, Hedera copies. And that’s not exactly great timing, since Bitcoin is stuck wobbling around the $86,000 range with zero momentum.

Because BTC can’t reclaim strength, Hedera can’t either. Every attempt at a rebound stalls out before it even begins. The lack of independent momentum makes HBAR extra fragile — one Bitcoin dip is enough to drag it underwater again.

Capital Flows Show Weakness Despite Usual Reversal Levels

The macro picture isn’t offering much relief either. Hedera’s Chaikin Money Flow (CMF) recently dipped to a seven-month low. Normally, when the CMF moves into the 0.18–0.23 range, it signals that outflows are slowing and inflows are beginning to show up — often a sweet spot for altcoins to stabilize.

But this time, the pattern didn’t hold. CMF fell below 0.18 before barely nudging upward again. That tiny recovery doesn’t reflect strength — it shows hesitation. Investors are still pulling liquidity from HBAR even though, historically, this kind of setup often triggers a bounce. The market’s broader bearish tone is overriding the usual signals.

HBAR Price Stuck at Support, Waiting for a Catalyst

At the time of writing, HBAR trades at $0.132, sitting just above the must-hold $0.130 support level. This price floor has saved Hedera multiple times before, and losing it would open the door to deeper lows.

If the market stays weak — especially if Bitcoin dips again — HBAR will likely continue drifting in a tight range between $0.130 and $0.150. A clean breakdown below $0.130 could send price toward $0.120, extending the bearish trend.

However… if Bitcoin catches even a modest recovery, HBAR could follow suit. A bounce from $0.130 might push the price back to $0.150, and breaking that level would flip resistance into support. That would open the path toward $0.162, which would finally break the bearish pattern and give HBAR some room to breathe.

Outlook

HBAR is stuck in the same bind as many altcoins — trapped under Bitcoin’s shadow, unable to break free until BTC decides what it wants to do. Capital flows remain weak, momentum indicators show hesitation, and traders are cautious. But if Bitcoin recovers, even slightly, Hedera has a shot at reclaiming short-term strength.