- CoinShares and NYSE filed for Litecoin and XRP ETFs, signaling growing interest in expanding crypto investment options.

- The SEC’s new crypto task force, led by Hester Peirce, aims to simplify regulations and improve transparency for the crypto industry.

- Trump’s administration is expected to take a pro-crypto stance, potentially paving the way for more diverse spot ETFs.

A wave of crypto ETF filings hit regulators on Friday, marking a new push to expand the range of tradable digital assets. CoinShares submitted registration papers for two new ETFs: the “CoinShares Litecoin ETF” and the “CoinShares XRP ETF.” Meanwhile, the NYSE followed suit, filing a 19b-4 for the “Grayscale Litecoin Trust,” sparking excitement among market watchers.

But that wasn’t all. The NYSE also filed for a “Grayscale Solana Trust,” and both Grayscale filings hinted at plans to eventually convert these trusts into spot ETFs. This flurry of activity comes just days after Donald Trump officially kicked off his second presidential term, replacing Gary Gensler as SEC chair with crypto-friendly Paul Atkins—a move signaling a potential pivot in crypto regulation.

A Shift in SEC Dynamics?

Under Trump’s administration, the SEC appears poised for a friendlier approach toward crypto. The agency recently launched a new crypto task force, helmed by Commissioner Hester Peirce (often called “Crypto Mom”). According to the SEC’s statement, this team will focus on creating clearer registration pathways, improving disclosure, and using enforcement resources more strategically.

Over the past year, the SEC has approved spot Bitcoin and Ethereum ETFs, but filings are now pouring in for a broader array of cryptocurrencies, including DOGE, LTC, and XRP. It seems the industry is bracing for a regulatory shift, with firms rushing to position themselves ahead of any new rules.

Market Impacts and Ripple Effects

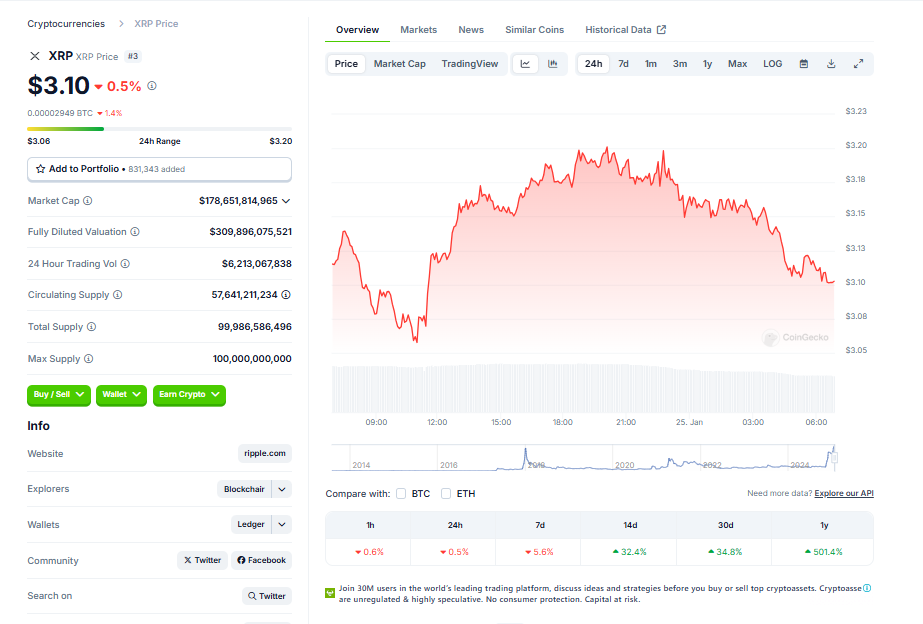

The filings arrive against a backdrop of optimism surrounding the new administration’s crypto stance. Litecoin (LTC) rose 2.49% following the news, while XRP saw a slight dip of 0.42%. These ETFs could significantly boost the market profile of Litecoin and XRP, offering institutional investors easier access to these assets.

The crypto community is now speculating on what’s next. Will the SEC deliver on expectations of streamlined regulation? And how might these changes reshape the competitive landscape for major tokens like XRP and LTC?