- Grayscale Research updated its list of the top 20 crypto assets for Q1 2025, adding six new assets: Hyperliquid (HYPE), Ethena (ENA), Virtuals Protocol (VIRTUAL), Jupiter (JUP), Jito (JTO), and Grass (GRASS).

- The additions highlight the growth of DeFi, decentralized AI, and the Solana ecosystem, as the overall crypto market cap surged to $3 trillion.

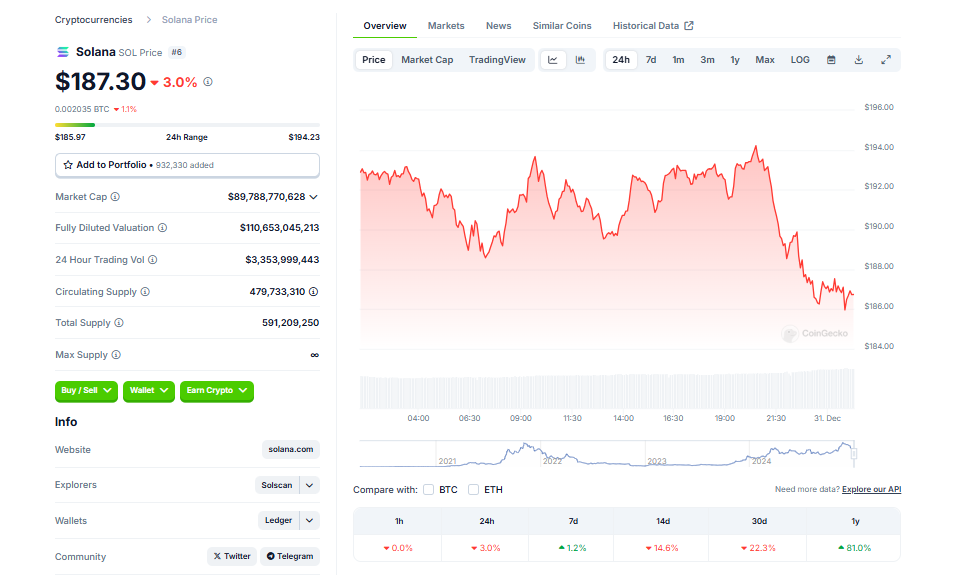

- Established assets like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Chainlink (LINK), and Sui (SUI) remained on the top 20 list.

Grayscale Research, a leading name in the crypto world, has recently updated its list of the top 20 crypto assets for Q1 2025. This upgraded list reflects the continued evolution of market trends and the key factors shaping the digital asset landscape. Six new additions have been made to the list, including Hyperliquid, Ethena, and Virtuals Protocol, amongst others.

Emerging Trends in the Crypto Market – Q4 2024 Analysis

The crypto market saw a remarkable upswing in Q4 2024, largely due to a positive response to the US election results. Grayscale’s report indicates that the total industry market cap tripled during the quarter, escalating from $1 trillion to a staggering $3 trillion. The Smart Contract Platforms sector witnessed the most significant growth, with Solana outperforming Ethereum, the category leader. Investors are increasingly turning their attention to alternative layer 1 networks such as Sui and The Open Network (TON), indicating an intensification of competition in this space.

Grayscale’s Expanded Crypto Sector Framework

In response to the surge in market valuations, Grayscale’s quarterly rebalancing added 63 new assets to its Crypto Sectors index, bringing the total to 283 tokens. The Consumer & Culture sector saw the most growth, driven by strong returns for memecoins and appreciation in gaming and social media-related assets. Grayscale Research’s updated list of top 20 crypto assets indicates that the digital asset industry’s market cap is now on par with the global inflation-linked bond market.

Noteworthy Additions to Grayscale’s Q1 2025 List

Among the new additions, Hyperliquid stands out as a layer-1 blockchain designed to support on-chain financial applications. Ethena, another addition, introduced a novel stablecoin backed by hedged positions in Bitcoin and Ether. Virtuals Protocol, a platform on the Ethereum layer-2 network Base, facilitates the creation of tokenized AI agents. Jupiter, the leading decentralized exchange aggregator on Solana, and Jito, a Solana-based asset, also made the list. Lastly, Grayscale shed light on Grass, a decentralized data network that compensates users for sharing unused internet bandwidth.

Crypto Industry Trends and Outlook for 2025

Grayscale retained several well-established assets on its top 20 list, including Bitcoin, Ethereum, Solana, Chainlink, and Sui. The firm’s strategy incorporates factors such as network growth, upcoming catalysts, token valuation, and potential risks to select assets with high potential for the quarter. Grayscale is the largest institutional holder of Ethereum, managing ETH worth $6.62 billion. The company also holds 249,029 BTC, valued at $23.33 billion at current valuations.

Conclusion

With the crypto market cap surging to $3 trillion and new assets making their way to the top 20 list, the Q1 2025 outlook is promising. Investors and market players should keep a keen eye on these emerging trends and the evolving digital asset landscape to make informed decisions. As Grayscale continues to update its crypto assets list, it reaffirms the dynamic nature of the crypto market and the vast potential it holds.