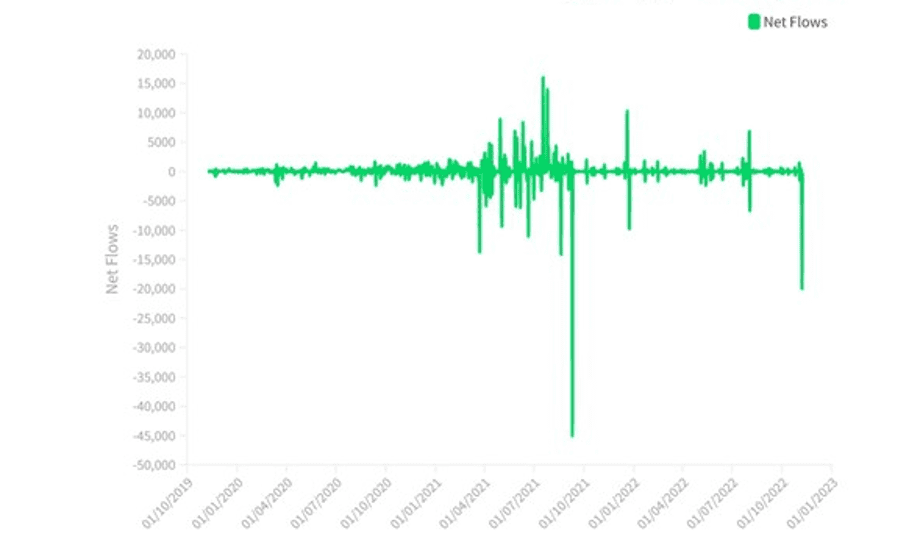

Cryptocurrency exchange FTX recorded massive outflows of up to 19,947 Bitcoin (BTC) worth $410 million as of November 7. This was the most prominent figure since September 10, 2021, when FTX recorded over 45,000 BTC outflows.

On Monday, FTX made history by recording the most significant number of withdrawal transactions the exchange has ever reached.

The outcome was a consequence of panic among users who were concerned about the current situation and the fate of their FTX-based assets and were moving them to other trading platforms.

Fears over FTX’s insolvency began circulating on Wednesday, November 2, after a leaked balance sheet of hedge fund Alameda Research that is associated with FTX – they are both Sam Bankman-Fried-founded companies.

Sam Bankman-Fried (SBF), the FTX CEO and founder, told investors earlier this week that Alameda owes the exchange $10 billion and that FTX left billions of dollars to his crypto hedge fund company. It has since been revealed that the funds are FTX’s customer deposits and that SBF made the transfer without the knowledge of the other company executives.

Consequently, FTX plunged into a liquidity crisis, fueling a bank run- the sudden spike in withdrawal demands from FTX exchange users. This eventually led to the platform halting withdrawals. The tension subsided after Binance announced plans to acquire FTX and its underlying asset.

“This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to acquire http://FTX.com and help cover the liquidity crunch fully. We will be conducting a full DD in the coming days.”

Binance Statement Sparks Volatility

Before FTX’s liquidity crunch, there was declining volatility across the crypto market.

Binance native token BNB and Solana’s SOL token hit their 30-day all-time-low volatility on October 22, recording 26.4% and 48.7% drops, respectively. However, following Binance’s announcement that the exchange would liquidate its holdings in FTX’s native FTT token, the volatility began to surge to record new highs.

Changpeng Zhao (CZ), Binance CEO’s Twitter statement on November 6 read:

“As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion equivalent in cash (BUSD and FTT). Due to recent revelations that have come to light, we have decided to liquidate any remaining FTT on our books.”

FTT’s volatility jumped from 53.3% on November 7 to 492% on November 8 after the token lost over 74% of its value over the same period. FTX’s troubling situation is the latest build on the file that records crypto events, keeping industry regulators ready to pounce heavily on the industry.

Markets Continue Reacting To The Latest News Surrounding FTX

The crypto market is still reacting to the latest news surrounding the FTX exchange. As SBF’s crypto empire faces potential collapse if they fail to secure cash injection, Binance pulled away from the acquisition deal, attributing the change of mind to due diligence concerns:

“As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com.”

Industry sources report that Alameda appears to have an $8 billion hole in its balance sheet. Also, Tron DAO founder Justin Sun stood up as a potential candidate to rescue FTX with the announcement that plans were underway to restore normalcy to users. Tether also started freezing FTX’s USDT following a request by law enforcement as investigations commenced.

“Tether freezes $46 million $USDT linked to an FTX address at the request of law enforcement, CoinDesk reports.”

Regardless of how this plays out, the week beginning November 7 has been characterized by numerous industry setbacks. These delayed the potential onboarding of users who may otherwise have benefited from the unique value proposition of self-custody and transparency characteristic of digital assets, according to co-founder and CEO of Kraken Jesse Powell in a Twitter thread.

Many crypto projects and companies will be affected shortly after the past few days’ events. For one, Alameda Research may be forced to liquidate its asset holdings, which will undoubtedly spark severe sell-side pressure on multiple assets. The whole digital asset space will certainly feel the long-lasting effect of these events.

A steady decline in volatility is one of the significant observations when evaluating the state of the digital asset markets over the last few months. As the crypto winter thickens and digital assets become more responsive to macroeconomic data, a catalyst’s absence will significantly reduce volatility.