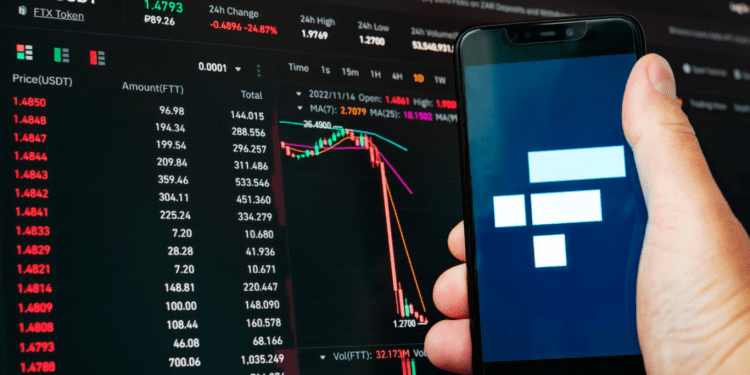

- FTX files for return of $460 million investment funds made to venture capital firm by Sam Bankman-Fried through Alameda Research.

- When he invested, Sam Bankman-Fried was allegedly in a romantic relationship with Ms. Zhang.

- Modulo Capital requests FTX’s release of claim to its 20% shares upon request of its funds.

A venture capital firm known as Modulo Capital is being requested to pay back FTX funds, which were invested under the rulership of Sam Bankman-Fried, the ex-CEO, and co-founder of FTX and Alameda Research.

FTX, a once-prosperous crypto exchange, has filed for the return of its funds on Modulo Capital which Alameda Research, a sister company of FTX, invested.

According to the filing, under the rule of SBF in 2022, Alameda Research began investing in the VC firm in May 2022. It accumulated to $475 million by the time of FTX’s petition date on November 11, 2022. Modulo Capital is expected to pay back $404 million in cash to FTC, while the digital assets worth $56 million held on the FTX crypto exchange will be relinquished.

On June 16, 2022, Alameda Research entered an exclusive partnership agreement with venture capital. This resulted in the FTX affiliate company transferring the funds in exchange for a claim to 20% of Modulo’s non-voting Class A shares.

However, the $460 million return means FTX will no longer own rights to any of Modulo Capital’s shares as the agreement terms of clawback between Modulo and FTX will represent 97% of the latter’s initial investment.

In bankruptcy proceedings, payments made to entities before filing for bankruptcy could be eligible for return and redistribution to creditors. The return timeframe is initially fixed at 90 days for unsecured creditors. However, it takes a year for insiders.

It is alleged that Alameda Research only entered into an investment agreement under the command of Sam Bankman-Fried because he was dating the co-founder of Modulo Capital, Xiaoyun “Lily” Zhang.

The court filing states that the request for its funds by FTX is in the best interest of its creditors and without the need to commence litigation following negotiations with the principals of Modulo Capital.

“The Debtors’ entry into the agreement is in the best interests of their stakeholders, estates, and creditors and should be swiftly consummated,” the filing reads.

Although the US Bankruptcy Judge, John Dorsey, is yet to confirm the agreement deal, the motion for a hearing has been fixed for April 12, 2023.

Additionally, the parties involved in negotiating claims (Modulo Capital co-founders Ms. Zhang and Mr. Rheingans-Yoo and FTX) have been on cordial terms.

Conclusion

Since it filed for bankruptcy and shook the crypto industry to its core late last year, FTX, the once-famous crypto exchange, has been recovering all unchecked funds dispersed under the rule of its ex-CEO. The agreement to recover $460 million from Modulo Capital is one of its moves toward restructuring and paying back its creditors.