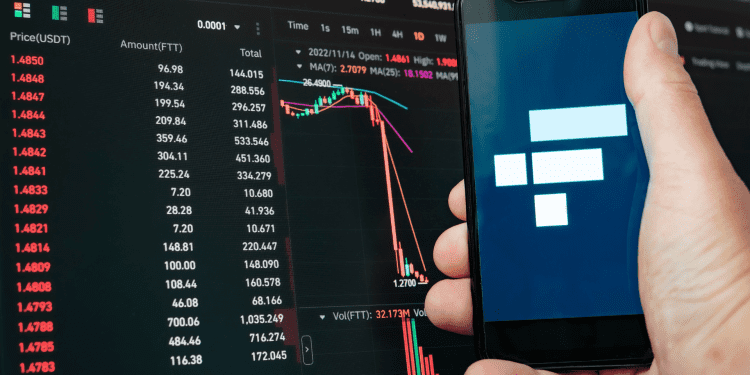

The spectacular collapse of FTX, once one of the largest and most respected cryptocurrency exchanges, sent shockwaves through the crypto industry in 2022. Its founder Sam Bankman-Fried went from being hailed as a savior to being charged with fraud and money laundering. The FTX saga serves as a sobering reminder of the risks inherent in the unregulated crypto space.

Former FTX Executives Launch New Exchange in Dubai

In the aftermath of FTX’s failure, several former executives have banded together to build a new exchange called Backpack Exchange. Based in Dubai and led by ex-FTX lawyer Can Sun, Backpack aims to learn from FTX’s mistakes and prioritize security of customer funds. It will use advanced cryptography techniques to self-custody assets and enable users to verify holdings. Backpack is currently in beta testing and plans to officially launch later this month.

The Downfall of Sam Bankman-Fried

The man at the center of FTX’s collapse, Sam Bankman-Fried (SBF), was indicted on charges of fraud and conspiracy in December 2022. SBF allegedly misused billions in customer funds, illegally transferring them to his hedge fund Alameda Research. His former legal counsel, Can Sun, quit after SBF revealed Alameda’s questionable use of client deposits. SBF ultimately failed to secure a bail package, with prosecutors citing his immense wealth and high risk of flight. He now awaits trial.

Industry Impact and Lessons Learned

The FTX debacle has fueled calls for greater oversight of cryptocurrency exchanges. It demonstrated the urgent need for transparency and accountability when handling customer assets. The case also highlighted the influence of conflicts of interest and lax corporate governance. As the industry works to rebuild trust, secure custody solutions and verifiable audits are more important than ever. The crypto community must take the difficult lessons from FTX to heart to avoid similar catastrophes in the future.

Conclusion

FTX’s spectacular collapse marked one of the darkest chapters in cryptocurrency’s short history. But this story is far from over. As former staff work to correct FTX’s wrongs with new exchanges, regulators chart stricter oversight, and the industry aims to learn from past mistakes, the next chapter for crypto remains unwritten. The enduring legacy of FTX will be determined by how much the sector grows through these trials.