- Fidelity expects Bitcoin to hit a new all-time high before the end of the current cycle, citing strong bullish momentum.

- Global Bitcoin adoption is fueling the surge, with markets in Asia, the Middle East, and Europe driving demand.

- Despite optimism, Fidelity warns that unexpected global events could still disrupt Bitcoin’s upward trajectory.

Fidelity Investments, managing $5 trillion in assets, believes Bitcoin could hit a new all-time high before the end of the current cycle. The firm pointed to the ongoing “Acceleration Phase” of Bitcoin’s price movement as evidence, suggesting that the cryptocurrency is poised for another record.

Bullish Momentum Driven by Global Adoption

Fidelity’s analysis highlights a bullish pattern that began in June 2023, indicating that Bitcoin’s prolonged period of high volatility may be settling into a more stable uptrend. They noted that global factors, including the adoption surge in Asia, the Middle East, and Europe, are pushing Bitcoin toward the $110,000 mark this summer.

Caution Amid Optimism

While optimistic, Fidelity cautioned that unexpected global events could still impact Bitcoin’s price trajectory. They recalled how the COVID-19 pandemic disrupted previous cycles, suggesting that the current bullish trend could be either cut short or prolonged depending on unforeseen factors.

Bitcoin’s Recent Surge

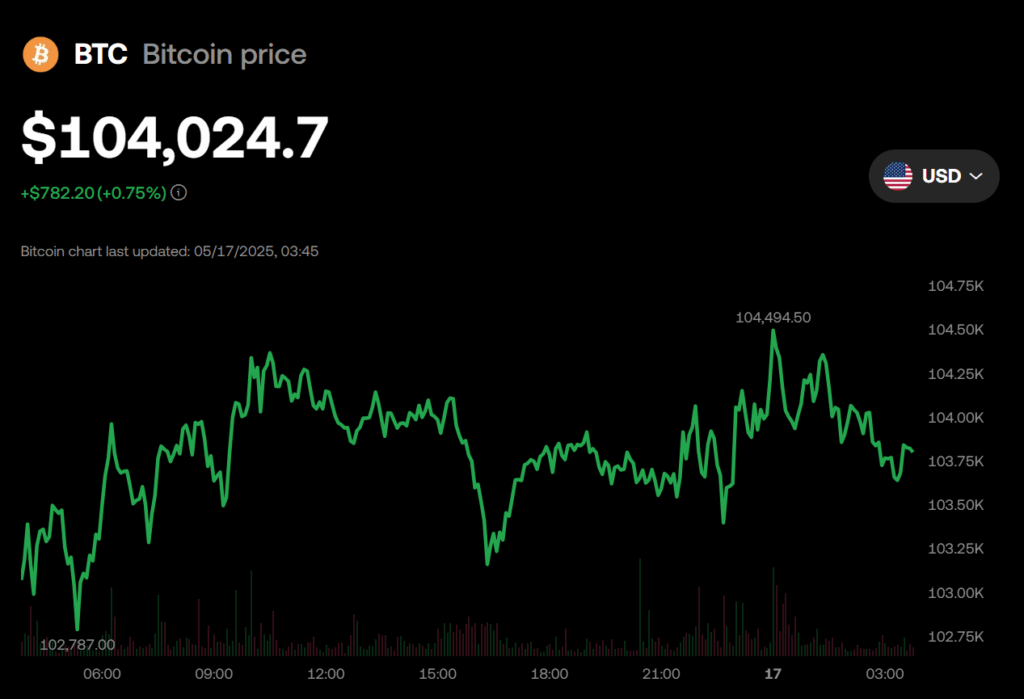

Over the past month, Bitcoin’s value has risen by more than 22%, reclaiming the $104,000 level.

Fidelity sees this upward momentum as a sign of its growing acceptance as a global investment asset, bolstered by the return of a pro-crypto U.S. administration under President Trump.