- ETH down 14.6% weekly, trading near $4,004 with slowing momentum.

- Bitmine buys 40,980 ETH ($157M) — a strong sign of institutional confidence.

- Analysts eye $8K–$10K targets for Ethereum by early 2026 as liquidity expands.

Ethereum’s price has been under pressure lately, but behind the red candles, some key players are quietly making moves. Over the last 24 hours, ETH slipped by 3.9%, and in the past week, it’s down about 14.6%. At the moment, it’s sitting around $4,004, giving it a market cap of $481.7 billion, with trading volume cooling to $50.6 billion — about 13.9% lower than the previous day.

Despite the dip, analysts suggest this could be the kind of setup that often precedes a strong recovery. And that view might just have some solid backing.

Bitmine’s $157M Ethereum Buy Sparks Institutional Buzz

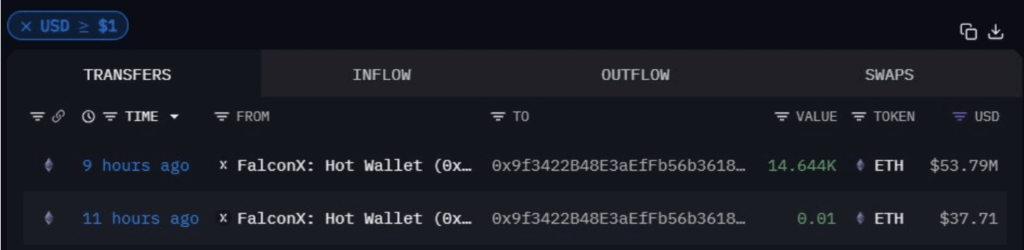

Crypto analyst Max Crypto highlighted something that grabbed everyone’s attention: Bitmine just scooped up 40,980 ETH, worth roughly $157 million, right in the middle of this price decline. That’s not the move of a company expecting more pain — it’s a bet on Ethereum’s long-term strength.

Ethereum remains the heartbeat of decentralized finance, NFTs, and Web3 infrastructure. Moves like Bitmine’s usually spark confidence among retail traders because, well, institutions tend to buy when everyone else panics. It’s a classic case of smart money accumulating while sentiment is weak.

Analysts Set Bold Targets: $8K–$10K Possible by 2026

Market watcher Hailey LUNC believes Ethereum could be gearing up for a massive breakout cycle — with fair value targets ranging from $8,000 to $10,000 by Q1 2026. Her reasoning? Liquidity. Specifically, Ethereum’s price trend has often followed the M2 global money supply, which is expected to expand again later this year.

More liquidity usually means more capital chasing assets like ETH. Combine that with potential institutional staking approvals and increasing inflows, and the case for a sustained rally strengthens. As Hailey put it, this could mark the start of one of Ethereum’s strongest market cycles yet.

Technical Setup Still Shows Weak Momentum

On the charts, Ethereum’s near-term picture remains shaky. The price is hovering close to the lower Bollinger Band at $3,723, with resistance zones at $4,240 and $4,758. A bounce from here isn’t impossible — ETH already showed a small recovery off $3,800 — but momentum still feels fragile.

The RSI sits around 43.38, below the neutral mark, signaling limited buying power. Meanwhile, the MACD remains in bearish territory, with deepening red bars showing sustained selling pressure. Unless ETH closes decisively above the $4,240 level soon, risks of sliding below $3,723 remain high.

For now, Ethereum looks weak on the surface, but under the hood, accumulation from whales and institutions tells a different story. If history’s any guide, that’s usually when the next leg of the rally begins.