- ETH struggles to maintain stability after recent fluctuations, signaling uncertain sentiment.

- Current price action hovers around a key support level that could determine the next move.

- Recovery attempts remain weak, but buyers may step in if a stronger catalyst emerges.

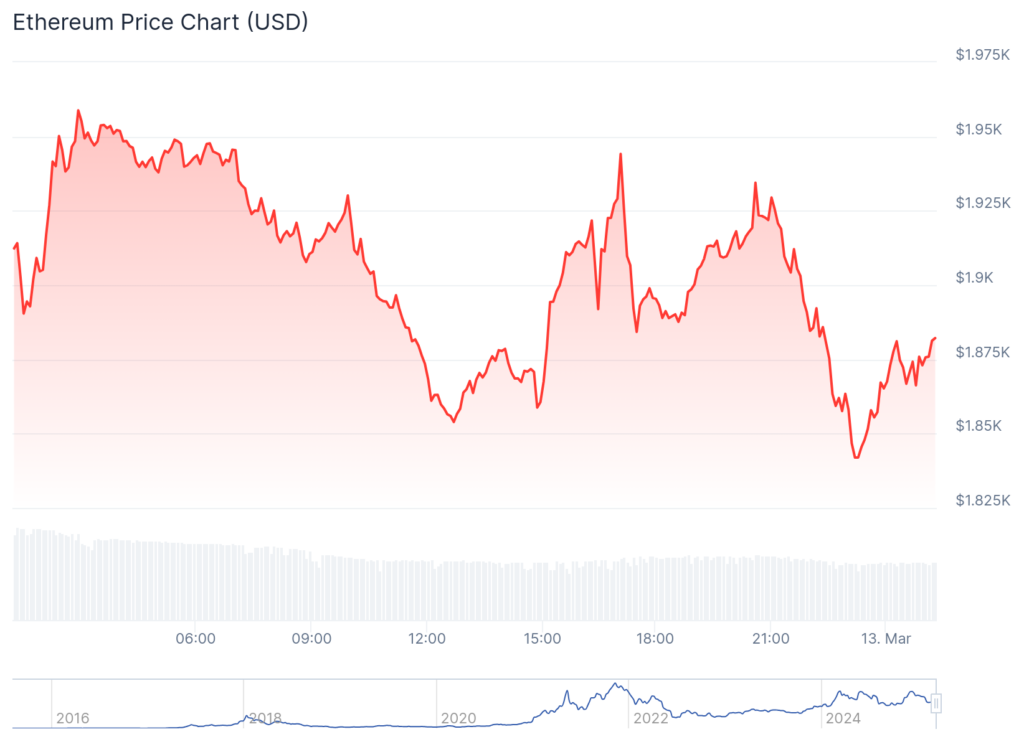

Ethereum’s price has been on a rollercoaster ride, making traders unsure about its next direction. The CoinGecko chart reflects a pattern where ETH tested resistance, dipped lower, and is now trying to stabilize. The recent downward movement shows sellers are still in control, but it’s not entirely doom and gloom yet.

Price movements have been choppy, with rapid spikes followed by immediate pullbacks. This kind of action suggests a lack of strong momentum from either side, making it difficult to predict a clear breakout. A decisive move above the recent highs would indicate that buyers are gaining confidence, but if ETH keeps struggling at resistance, sellers might take over once again.

For now, Ethereum is sitting on an important level, and how it reacts here could determine whether it makes a stronger push upward or breaks lower for a deeper correction. The market remains cautious, waiting for a stronger catalyst to shake things up.

Bouncing Back or Just a Pause?

One of the most critical areas on the chart is the support level ETH is currently hovering around. This zone has historically acted as a strong buying area, and if traders defend it again, we could see a short-term bounce. However, the problem is that recent rallies have been weak, lacking the momentum needed for a full-blown recovery.

If ETH starts closing above previous highs, that would be a good sign that demand is picking up. On the flip side, a clean break below this support could trigger another wave of selling, which might push Ethereum toward even lower levels.

Buyers have stepped in at this level before, but this time, they’ll need to show more strength to flip market sentiment. Otherwise, Ethereum could remain stuck in a downward trajectory, with traders hesitant to take on new positions.

Looking at the Bigger Picture

Zooming out, Ethereum’s overall trend has been weaker compared to its previous bullish runs. This doesn’t mean a complete breakdown is inevitable, but it does suggest that ETH needs a strong fundamental driver to shift momentum in its favor.

The broader market sentiment will play a big role in what happens next. If Bitcoin finds stability, it could lift Ethereum alongside it. But if uncertainty remains high, Ethereum’s price might struggle to find solid footing. Watching for signs of renewed buying pressure or a clean break below key levels will be essential for determining Ethereum’s next major move.

Ethereum, originally introduced in 2015 by Vitalik Buterin, was designed as a decentralized platform for smart contracts and decentralized applications (dApps). Unlike Bitcoin, which primarily serves as a store of value, Ethereum’s flexibility in creating and executing smart contracts has positioned it as a backbone for many blockchain-based projects. Its long-term potential remains strong, but short-term price movements will be heavily influenced by market trends and investor confidence.