- Ethereum’s burn rate has plummeted due to lower user activity on the mainnet, leading to a 95% drop in daily ETH burned and pushing ETH’s circulating supply higher—creating inflationary pressure and making it harder to stay above $2,000.

- Users are migrating to cheaper, faster alternatives like Optimism and Solana, contributing to Ethereum’s decline in transaction volume, though experts still argue that ETH’s strong fundamentals and decentralization give it a long-term edge.

- ETH’s price is hovering around $1,834 with its RSI climbing to 57.68, suggesting growing bullish momentum; a breakout past $2,027 is possible if buying pressure holds, but a dip to $1,733 could occur if it weakens.

Ethereum’s been feeling kinda sluggish lately. User activity on the mainnet? Yeah, it’s taken a dive. And that’s not just some abstract issue—it’s got real impact. Fewer users means fewer transactions, and fewer transactions mean less ETH is getting burned. And when less ETH gets burned… you guessed it: more ETH floats around.

So now we’ve got inflationary pressure creeping back in. ETH’s been struggling to stay above that $2K line—like it just keeps slipping off the ledge.

More ETH, Less Burn, More Problems?

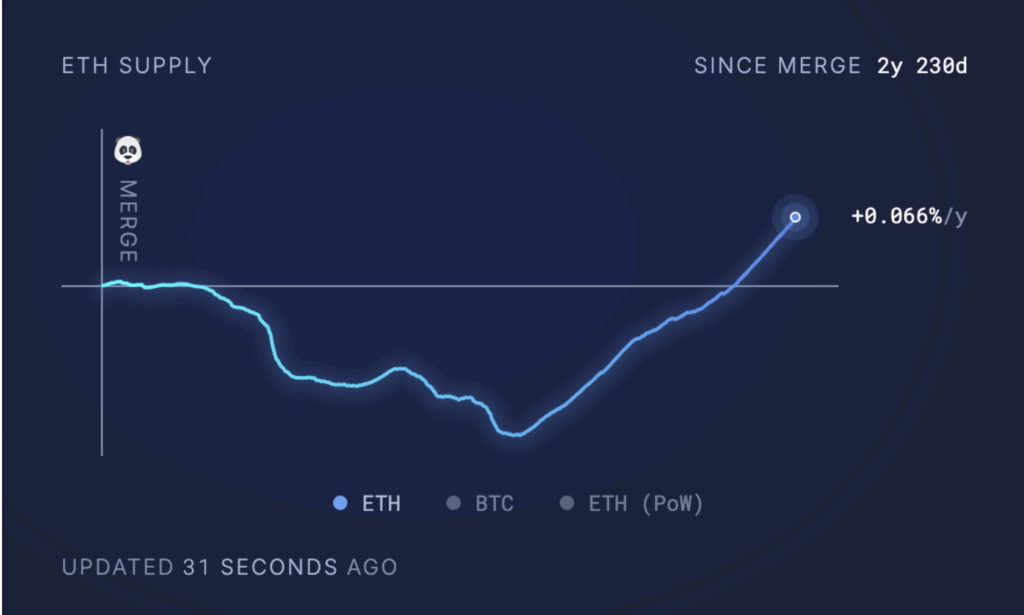

According to Ultrasoundmoney, the past month added around 72,927 ETH (roughly $134 million) to the total supply. That puts the current supply at over 120.7 million ETH—yep, higher than where we were pre-merge.

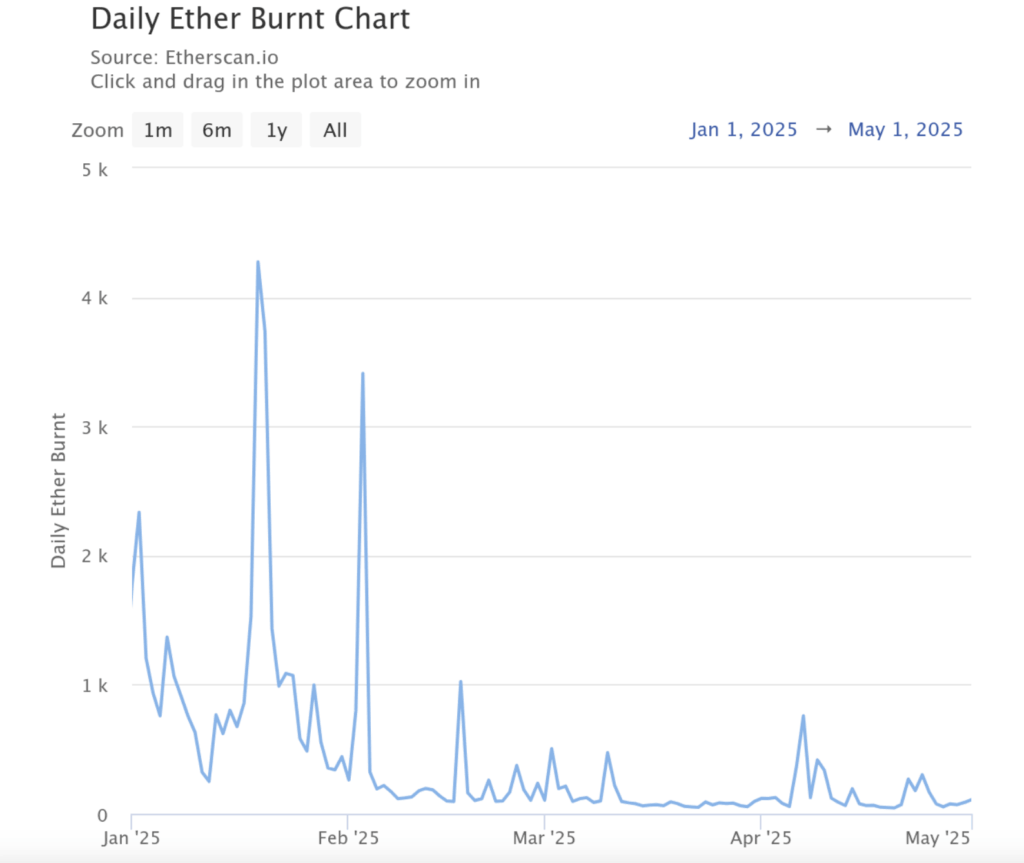

And here’s the kicker: Etherscan shows daily ETH burns have dropped 95% since the start of the year. On April 20, we hit rock bottom with the lowest burn day yet. Ouch.

Why’s Everyone Ditching Ethereum?

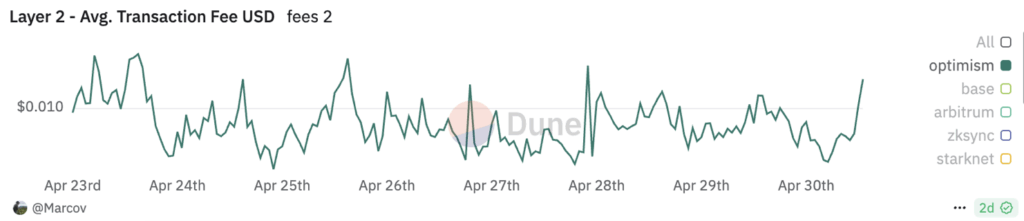

Honestly, it’s not just about Ethereum being “slow” or “expensive” anymore—it’s about options. People are hopping over to Layer-2 networks like Optimism and Arbitrum. Why? Way cheaper fees and lightning-fast speed.

Just for comparison: on April 30, Optimism had average fees around $0.024. Ethereum? A much steeper $0.18. Doesn’t take a genius to figure out why folks are switching.

Add in the rise of meme coin crazes over on Solana and other “ETH killers,” and Ethereum’s been left kind of… out of the party.

Fundamentals Still Strong… Right?

Despite all the chatter, some experts still believe in ETH’s long-term muscle. Vincent Liu from Kronos Research says Ethereum is still crushing it when you look at total value locked—almost $369 billion worth. That’s no joke.

Sure, it ranks 5th in 24-hour fees behind other chains like Solana, Bitcoin, and BNB, but Liu thinks Ethereum still shows solid usage and staying power.

Temujin Louie from Wanchain chimed in too, saying Ethereum’s structure—post-merge—is still an edge. Unlike a bunch of Layer-1s that are printing tokens like there’s no tomorrow, ETH can potentially go deflationary. But… only if there’s enough network activity to justify the burn.

And yeah, even with Solana and other L1s stealing some thunder, Ethereum’s decentralization and history still make it a heavyweight in the room.

So, What’s Up With ETH’s Price?

Well, ETH’s been wobbling. It’s trading around $1,834 right now, down about 1% in the last 24 hours. But not all is doom and gloom—its RSI is climbing, sitting at 57.68. That’s a good sign that momentum’s quietly building.

If buying pressure kicks in, we could see a push past $2,027. But if bulls lose steam? It might sink back to $1,733 territory.

Bottom Line

Ethereum’s in a bit of a weird spot. Fundamentals? Still solid. Burn rate? Not so much. User activity? Yeah, that needs work. But if things shift—if we get more on-chain action and demand picks up—ETH could rebound hard. Until then, it’s all about watching that $2K level like a hawk.