- Crypto prices consolidate as price volatility decreases across the board.

- Ethereum price coils up in a symmetrical triangle as bulls fight to hold above $1,800.

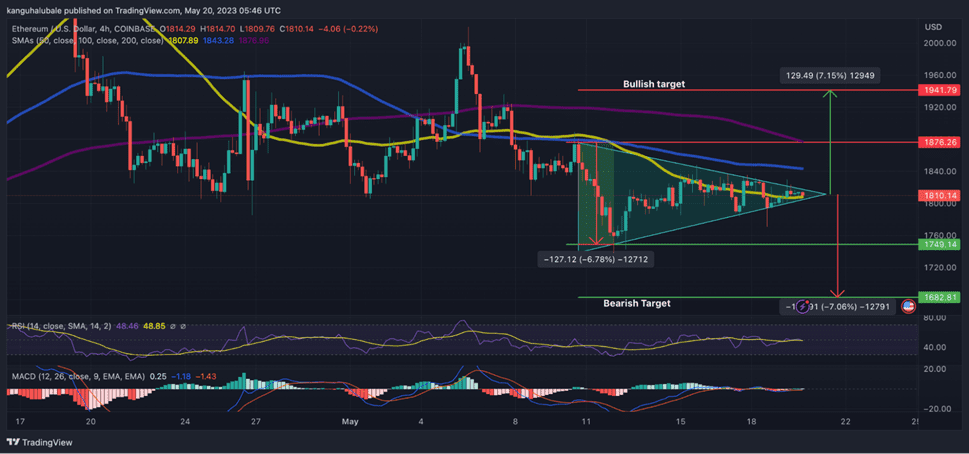

- A breakout of the triangle is imminent, triggering a 7% move in either direction.

The crypto market remains drab with very low price volatility, especially among the top-cap assets, which show no clear directional bias. For example, Ethereum (ETH) remains unpredictable as it coils above a critical support line.

Ether is up a mere 0.24% on Saturday to trade at $1,810. If the second largest crypto does not hold above the 50 SMA, it is possible to see the price drop toward $1,680 in the short term.

Ethereum Price Consolidates In A Symmetrical Triangle

After being rejected by the 50-period SMA around $1,880 on May 10, the now proof-of-stake (PoS) cryptocurrency went on a downward spiral that saw ETH retreat to $1,750. Since then, the Ethereum price has recorded a series of lower highs and higher lows.

This price action has led to the appearance of a symmetrical triangle on the four-hour chart, justifying reducing volatility.

The consolidation is also supported by the position of the Relative Strength Index (RSI) close to the midline. The price strength at 48 suggests that the number of sellers is almost similar to buyers.

Moreover, the SMAs and Moving Average Convergence Divergence (MACD) indicator were leveling out. The position of the MACD close to the zero line indicated that the buying and the selling pressure were balancing out.

If the technical setup works correctly, traders could see a 7% move for the largest altcoin. However, the movement could be in either direction.

ETH/USD Four-hour Chart

Therefore, if Ethereum price moves to favor the upside and produces a four-hour candlestick close above the 50 SMA at $1,807, bulls could be bolstered to push for a breakout above the upper trendline of the triangle at $1,811.

If this happens, Ether’s price would be poised to rise above the 100 SMA and later the 200 SMA at $1,876 before reaching the optimistic target of the prevailing chart pattern at $1,940. This would represent a 7.15% uptick from the current price.

Though this would be a significant move in the lower timeframe, it will fall short of the $2,000 mark many bulls would wish to see ETH reclaim.

Note that the buy signal from the MACD sent on Friday, May 19, when the 12-period Exponential Moving Average (EMA) crossed above the 26 EMA, was still in play. This showed that the market sentiment was still positive.

On the downside, the RSI was moving below the midline at 48. This, coupled with the appearance of a red candlestick on the chart, attested to the possibility of a downward breakout.

Therefore, a drop below the lower trendline at $1,800 may occur before the trend lines meet. Such a move may pull ETH 7.06% lower, bringing regions below $1,700 into the picture.