- Ethereum’s December 3 Fusaka upgrade introduces PeerDAS, higher data capacity, new gas limits, and wallet security improvements across the ecosystem.

- Analysts say the technical shift could strengthen reliability, reduce fees, and push Ethereum into a long-awaited bullish phase heading into 2026.

- ETH has broken major resistance near $3,000, with charts showing rising demand and structure favoring a potential breakout toward new all-time highs.

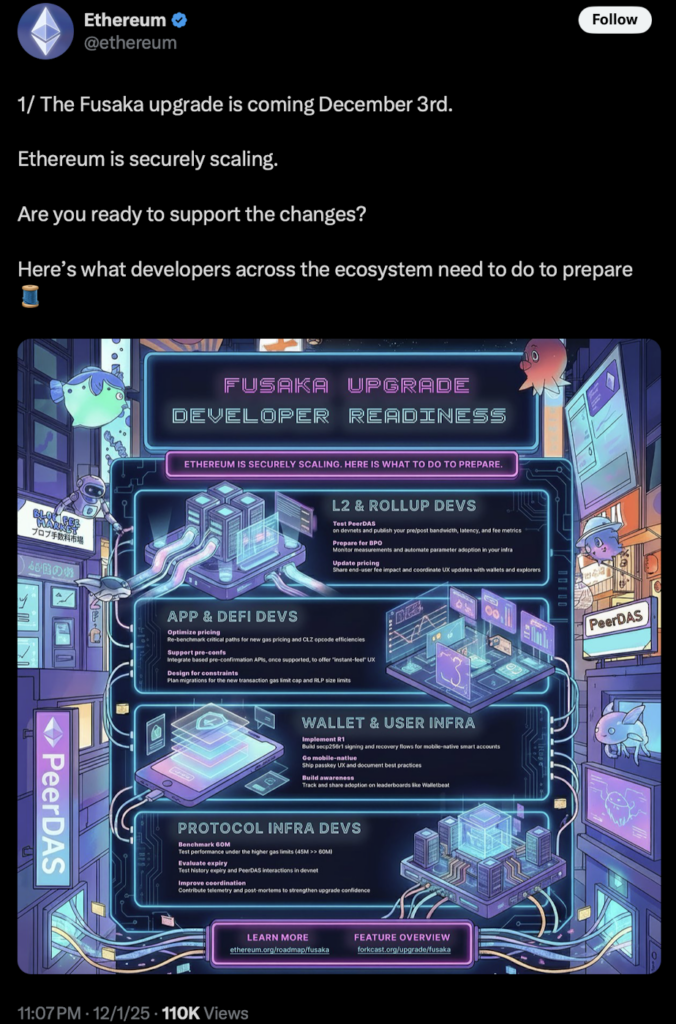

Ethereum is gearing up for its Fusaka upgrade on December 3, and even though the name sounds kinda low-key, the impact could be much bigger than it looks on the surface. Developers say this update is another step toward tightening up the network’s performance, stability, and, honestly, its long-term vibe when it comes to price and user confidence. The whole point is to make Ethereum run smoother for wallets, apps, and those Layer-2 systems that basically shovel activity off the main chain to keep things moving.

How PeerDAS Supercharges Ethereum’s Data Capacity

A big part of the upgrade is something called PeerDAS, which probably sounds like a random acronym, but it matters more than people realize. It’s meant to boost Ethereum’s data capacity—by a lot. Rollups and other scaling tools depend on Ethereum to publish chunks of data on-chain, and PeerDAS lets the network handle way more of it without slowing blocks or stuffing the chain with congestion. Developers say the system can push up to eight times more data through the pipeline at once, which, over time, should ease fee pressure and help transactions settle faster. Basically, less waiting around, less frustration.

Teams building on Ethereum have already been told to update their software and poke around on the test networks so nothing catches fire once Fusaka officially lands. The switch flips on December 3, but the rollout won’t magically fix everything overnight. There’s another set of changes landing on December 9, and then more again on January 7, so the full effect is kinda staggered.

EIP-7825: Why Transactions Now Have a 16.8M Gas Cap

One of the more specific tweaks is EIP-7825. It caps each transaction at around 16.8 million gas, which sounds oddly precise, but the idea is simple: stop any single transaction from stuffing an entire block. When traffic spikes, this helps keep the whole system from spiraling into chaos. Regular users probably won’t feel a thing, but developers running big, heavy smart contracts might have to do a little cleanup to stay within the new limitations.

Wallet Security, R1 Curves, and Higher Gas Targets

Wallet teams are also adding support for R1 curve cryptography and EIP-7951. The goal here is smoother passkey logins—especially on mobile—and just better security overall. Meanwhile, node operators are prepping for a higher block gas target of 60 million, which increases the network’s overall capacity and should leave more breathing room during busy periods.

Fusaka is mostly a technical upgrade, sure, but the impact goes beyond developer talk. It sets the groundwork for cheaper scaling, stronger reliability, and a healthier ecosystem that sends better signals to the market. And those things still shape how traders think about Ethereum’s long-term price narrative, whether they admit it or not.

Why One Analyst Thinks Fusaka Could Push ETH to New All-Time Highs

A crypto analyst recently went full-on bullish ahead of this upgrade, calling for a massive rally that could stretch into early 2026. In a post shared this week, he said the current setup might push ETH more than 100% higher once Fusaka settles in. He described it as “the biggest ETH outperformance this cycle has seen,” and claimed that this run could end with fresh all-time highs for the entire ecosystem. Looking ahead, he told followers that “Q1 2026 is our time,” basically urging traders to position themselves across the Ethereum landscape before the breakout becomes obvious.

Can Ethereum Rally Over 100% Into 2026 After Fusaka?

The chart he shared shows Ethereum breaking out of a long, stubborn descending channel that had trapped price action for weeks. ETH hit the bottom of that channel, bounced hard, and started carving higher lows along a rising trendline—a classic sign that buyers are waking back up. Price has now moved above the old resistance near $3,000, and that level has flipped into support, which is usually a good sign that the market’s settling into its new range instead of panicking.

As long as Ethereum stays above this area, there’s room for another move higher, especially if it pushes into the next resistance pocket. A clean breakout would likely speed things up, just like it usually does with ETH when momentum starts building. The analyst didn’t soften his stance at all, saying, “This cycle will top with new ETH all-time highs like I’ve been saying for two years now.” And honestly, the chart kind of backs him up.