- Binance ETH reserves are shrinking, but Ethereum’s price is still falling due to stronger downside forces.

- Derivatives positioning, open interest, and short pressure can overwhelm spot supply signals in the short term.

- If selling continues, ETH may retest deeper support near $1,700 before any recovery attempt.

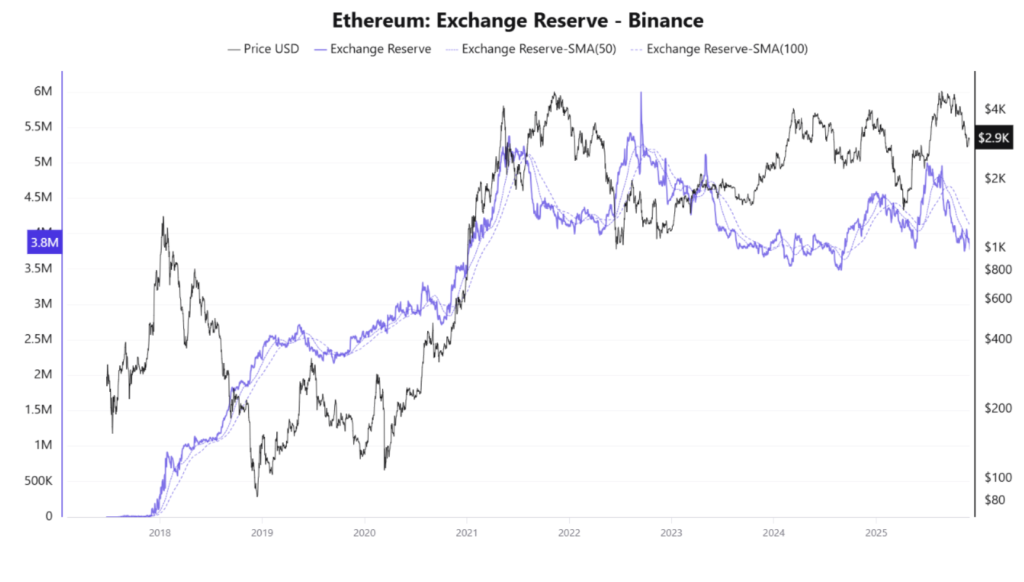

Ethereum keeps sliding, even though Binance’s ETH supply is shrinking. And normally, that would be the kind of signal traders love. Falling exchange reserves are supposed to be bullish. Coins leave exchanges, sell pressure drops, supply tightens, and price eventually pops. That’s the neat, clean textbook version.

But markets don’t really care about neat and clean. Crypto especially doesn’t. And ETH refusing to rally while reserves fall is basically proof that the old “supply shock” narrative doesn’t always work anymore, at least not on a short timeframe.

Right now, Ethereum is hovering around $1,908 with momentum fading. The moving averages are weakening too, and bearish crossovers are showing up across both short-term and longer-term spans. Downside pressure just keeps leaning on the chart. So if supply on Binance is dropping, what’s overpowering it?

Why Shrinking Binance Reserves Usually Looks Bullish

Binance’s ETH exchange reserves have been trending down again, meaning users are withdrawing Ethereum. Under normal spot-driven conditions, that’s constructive. Less ETH sitting on an exchange typically means fewer coins readily available for instant selling, which should reduce sell pressure.

In a pure spot market, this would often set the stage for a rally. The logic is simple and it’s not wrong. The problem is that it assumes spot activity is still the main driver of price, and that assumption is starting to break down.

Derivatives Are Running the Show Right Now

Here’s the catch: spot dynamics don’t dominate short-term price action anymore. Derivatives do. Futures, perpetual swaps, leverage, funding, open interest… that’s where most of the short-term battle happens now, and it can easily drown out on-chain signals.

Exchange reserve data mostly reflects spot supply. But ETH’s price chart, at least in this phase, is reacting far more to futures positioning than it is to withdrawals. That’s the key difference.

If open interest stays elevated, funding rates flip negative, and traders pile into shorts, then aggressive derivatives selling can drag ETH/USD lower even while spot supply is shrinking. In that scenario, futures pressure overwhelms spot optimism. And honestly, that’s what this looks like.

Withdrawals Don’t Automatically Mean Long-Term Holding

Even if we accept that futures are dominating, there’s another uncomfortable truth here. Withdrawals are not automatically bullish anymore. They don’t always mean “accumulation,” and they definitely don’t guarantee coins are being locked away for months.

ETH can leave Binance for a bunch of reasons that aren’t strictly bullish. It could be moving into DeFi to be used as collateral, heading into staking, being bridged to Layer-2 networks, going through OTC flows, or even being transferred to other exchanges entirely. So a drop in Binance reserves doesn’t mean ETH has vanished from the sell-side forever.

It just means it moved. And in crypto, “moved” can still mean “about to be sold somewhere else.”

Weak Demand and Macro Pressure Still Matter

This is the part that a lot of traders forget. Supply signals don’t mean much without demand. You can shrink exchange reserves all you want, but if buyers aren’t stepping in with real conviction, price won’t respond.

In crypto, one of the clearest demand indicators is stablecoin inflows. If those inflows are weak, risk appetite is low, and broader sentiment is negative, then ETH isn’t going to catch a bid just because Binance reserves are falling. Add macro correlation into the mix, like risk markets being soft, and the outlook gets even more complicated.

Reserve signals can get completely overridden when the market is in a risk-off mood. It happens all the time.

Some Whales May Be Hedging Both Sides

There’s also a more strategic possibility that’s easy to overlook. Large players can withdraw spot ETH while simultaneously opening short positions in derivatives. That’s not irrational, it’s hedging. Or positioning for lower levels while still controlling the asset.

So you end up with a market where on-chain data looks bullish, but price action stays bearish. Because under the hood, whales are playing both sides, and leverage is doing the heavy lifting.

What Comes Next for Ethereum Price

If derivatives pressure continues and liquidity keeps getting cleared to the downside, Ethereum price models increasingly point toward a deeper support retest. The $1,700 region is the level many traders keep circling, and if ETH gets dragged there, it wouldn’t necessarily break the long-term structure. But it would mean more pain first, and probably more forced selling before any real recovery.

For now, ETH remains under pressure despite shrinking Binance reserves. And it’s another reminder that in modern crypto, supply signals alone don’t move charts the way they used to. Positioning does. Leverage does. And when the futures market decides to lean hard in one direction, spot narratives tend to get flattened, at least in the short run.