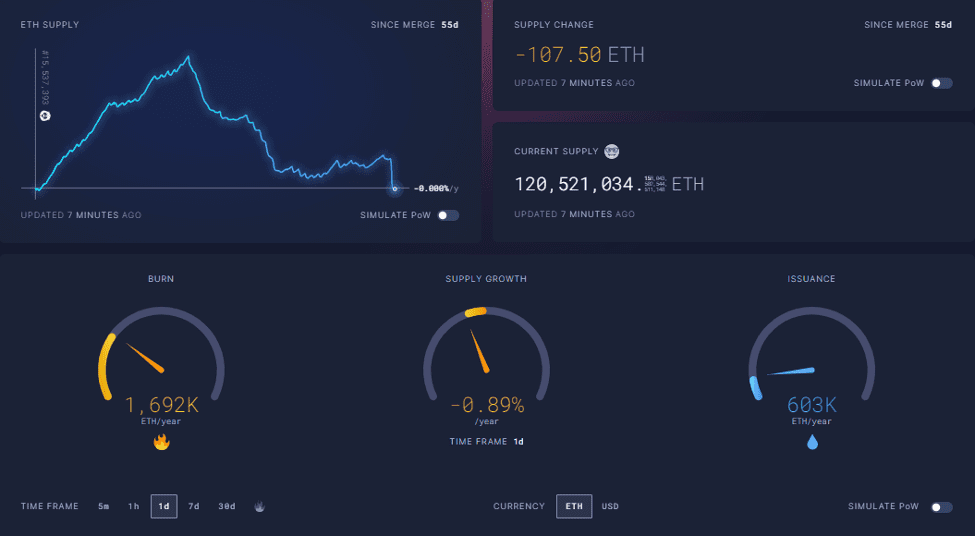

Ethereum has become deflationary for the first time since the Merge, meaning that more Ether (ETH) has been burnt than issued since September 15, according to tracking by Ultrasound Money.

Fifty-five days had passed since Ethereum’s Merge, when the network successfully transitioned from Proof-of-Work (PoW) to Proof-of-State (PoS), a move that drastically changed the dynamics of its supply.

A combination of the Merge event and the network’s move to introduce EIP1559, wherein transaction fees are burnt, equates to the possibility of a deflationary ETH. The test of deflationary evaluates an asset’s current issuance and burn rate to assess its future. Following the much-anticipated Merge, Ethereum 2.0 was expected to deliver several long-awaited upgrades to the Ether ecosystem.

Despite this expectation, whether the new version would mean Ethereum would become a deflationary asset remained. Fast forward to November 8, and Ethereum issuance has officially become a deflationary post Merge.

“JUST IN: #Ethereum has gone deflationary.”

Ethereum As A Deflationary Asset

An asset is considered deflationary when it records decreasing coin supply. It follows that the circulating supply of Ethereum has reduced over time, with each of the remaining ETH coins becoming more valuable because the scarcity of Ethereum continues to decrease.

Ethereum managed to keep inflation in check before the Merge thanks to its PoW consensus mechanism. The main factors leveraged by the network to control inflation included block time and block rewards.

However, with the roll-out of Ethereum 2.0, EIP-1559, and the Merge event, the network’s countdown to becoming deflationary started. Noteworthy, EIP-1559, launched in August 2021, determines the supply of Ethereum by introducing a deflationary mechanism by bringing down the base fee while introducing the ETH burning mechanism.

Ethereum’s current situation is different from most cryptocurrencies in the market today, as well as fiat currency, which is inflationary and has high supply caps and no cap on their supply, respectively. As more Ethereum is created, its value continues to decrease.

After the Merge, Ethereum 2.0 ushered in the PoS consensus mechanism, which reduced the issuance rate significantly. With the PoS mechanism, mining rewards due to the PoW mechanism became obsolete, an action that caused a sliding scale between the amount of ETH staked by the network validators and the amount of interest they would earn. As such, miners became more motivated to mine ETH than other coins like Litecoin, which uses the PoW mechanism.

The Supply of Ethereum

On April 1, 2018, Vitalik Buterin made a ‘Fools’ day joke suggesting that the total supply of ETH be capped at 120 million. According to the Ethereum co-founder, this would guarantee a more stable and sustainable economy for the network. While this was just a joke, it sparked the inflationary-deflationary discussion surrounding the supply of cryptocurrencies.

During the 2014 Ethereum ICO, Ether’s (ETH) total supply was approximately 72 million. In June 2022, Ethereum’s total supply was a little over 121 million. While Ethereum does not have a supply cap, this does not mean the second largest crypto in the market cap will be circulating in the billions. The number of ETH issued has been steadily declining.

Ethereum used to be an inflationary crypto. However, it became deflationary following a series of upgrades- Ethereum 2.0, EIP-1559, and the Merge. The EIP-1559 update marked one of the most crucial transformations for the Ethereum network, introducing a deflationary mechanism by destroying the base fee.

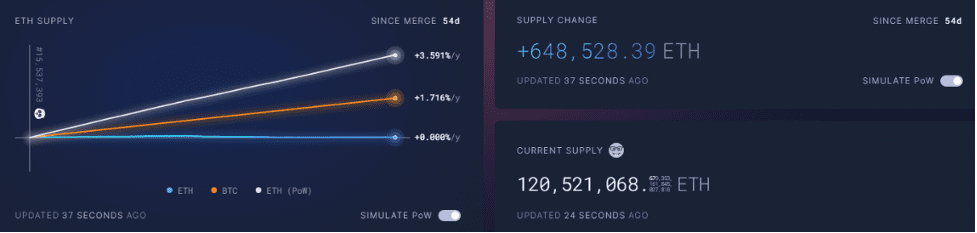

Post-Merge, the Ethereum issuance rate reduces below 1%. If ETH were still Proof of work, its supply would have increased by around 650,000 ETH. Instead, it has decreased.

Nonetheless, watching how this plays out will be fun as demand for Ethereum grows into the next cycle and thus drives even more ETH to burn.