- Ethereum is consolidating near $2,560, with a breakout pattern forming and bullish signs building beneath the surface.

- ETF inflows, institutional adoption, and Ethereum’s expanding Layer 2 ecosystem are pushing long-term growth potential.

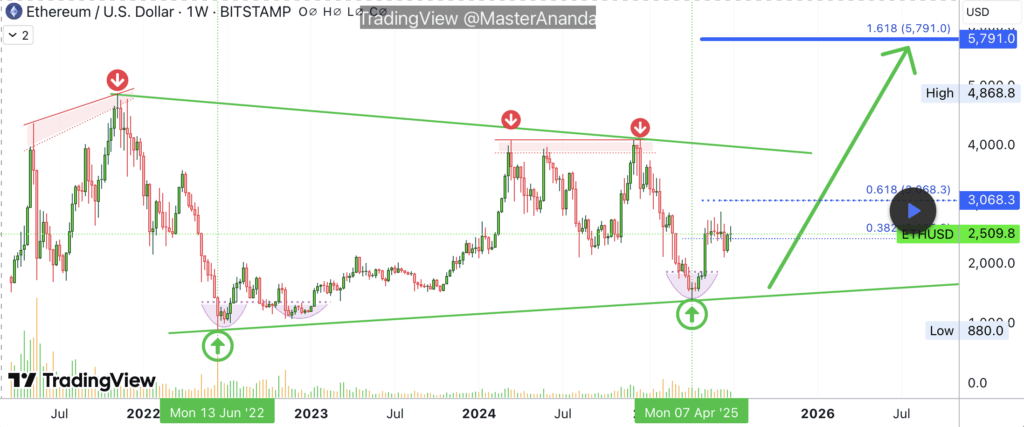

- Analysts see $5,791 as the next major stop—and possibly $8,500 if momentum continues into late 2025.

Ethereum’s holding its ground around $2,560, but beneath that calm exterior, there’s something brewing. With ETFs pulling in serious money and long-term investors showing no signs of letting up, ETH could be gearing up for one of its biggest moves yet—maybe even toward $8,500 by the end of 2025.

ETH Coiling Up Inside a Symmetrical Triangle

Right now, Ethereum’s just kinda chilling—hovering around $2,559 as of July 7. It dipped a little earlier this week but quickly bounced off $2,450 and climbed right back over its key moving averages. Nothing flashy yet, but that’s often how big moves start.

On the 4-hour chart, ETH is boxed inside a tight symmetrical triangle, with resistance near $2,560 and support at $2,478. All the major EMAs (20, 50, 100, 200) are jammed together between $2,486 and $2,525, which usually means something’s about to give.

The RSI’s sitting around 49—neither too hot nor too cold. A break above $2,560 with solid volume could open doors to $2,639, even $2,723. But if ETH slips below $2,478, well, $2,388 or worse—$2,320—might be next.

Ethereum ETFs: Not Just Hype—Big Money’s Coming

Here’s where it gets spicy. Matt Hougan from Bitwise thinks ETH ETFs could bring in $10 billion by year’s end. That’s not a typo. We’re talking serious institutional firepower. Just in June alone, ETFs pulled $1.17 billion into Ethereum.

Why the rush? Ethereum’s moving into the driver’s seat for tokenizing real-world stuff—stocks, bonds, stablecoins, you name it. Hougan says TradFi’s waking up to Ethereum as the settlement layer of the future. Makes sense.

And get this: the SEC recently made a move that pretty much greenlights staking without calling it a security. That could lead to staking-enabled ETFs, which would be another huge draw for investors chasing passive yield.

Big Picture: $8,500 Isn’t That Crazy

Zooming out, Ethereum’s been stuck in consolidation mode for a while, holding tight above $2,425 since April. But there’s a rounded bottom forming—classic bottoming pattern if you’re into that stuff.

One technical model pegs $5,791 as the next big resistance. After that? A stretch to $8,500 doesn’t seem so far-fetched. Higher lows keep stacking up, and no new highs since March 2024? That smells like pressure building for a breakout, not a breakdown.

Don’t Forget Layer 2 and Staking

Sure, ETFs are sexy, but there’s more under the hood. Ethereum’s Layer 2s—like Arbitrum, Optimism, zkSync—are buzzing. Transactions are up. TVL’s growing. Fees? Still manageable.

More importantly, staking’s paying off. Rewards are rising. And more staked ETH means less circulating supply—which, as we know, usually means prices head north. That deflationary push could be what really lights the fire.

So… Can ETH Really Hit $8.5K?

With so many stars lining up—ETF inflows, staking gains, L2 growth, bullish chart setups—it’s hard to ignore what Ethereum’s building toward. It needs to bust through $2,560 first, but once that happens? $5,791 is the first major checkpoint. And if the momentum holds, don’t be shocked if $8,500 comes into play before this cycle’s out.