- Ethereum fell 6.6% to around $1,947, but Coinbase data shows retail investors increasing BTC and ETH holdings.

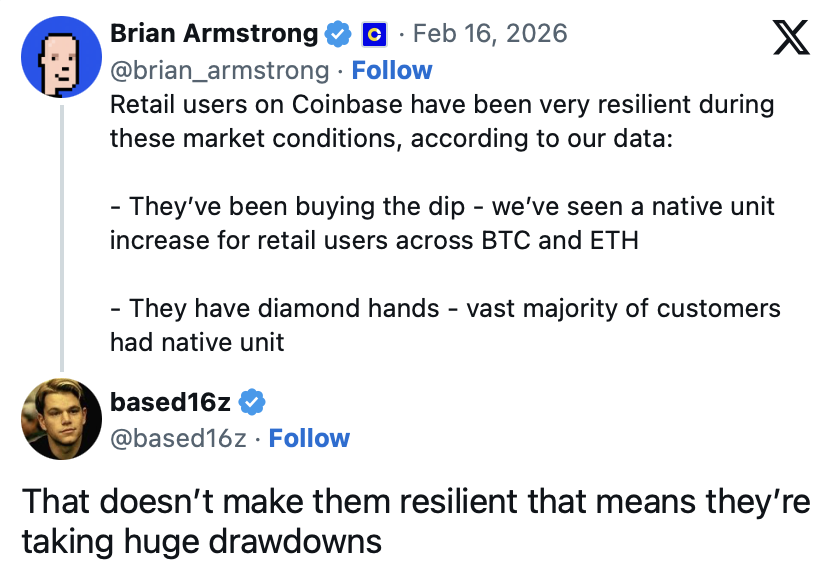

- CEO Brian Armstrong highlighted “diamond hands” behavior, with most users holding equal or higher balances than in December.

- Despite mixed views and declining trading volumes, steady retail accumulation may provide a stabilizing base for future recovery.

Ethereum has slipped again, down roughly 6.6% over the past 24 hours and hovering near $1,947. The broader crypto market isn’t exactly calm either, with macro pressure and general risk-off sentiment still hanging in the air. It’s the kind of environment where traders get jumpy fast. And yet, in the middle of that turbulence, Coinbase CEO Brian Armstrong is pointing to something unexpected: retail investors aren’t running.

Retail “Diamond Hands” Are Still Buying

According to Armstrong, Coinbase’s retail users have shown notable resilience during this recent downturn. Instead of panic-selling into weakness, many have actually been buying the dip, leading to net increases in native unit balances for both Bitcoin and Ethereum on the platform.

“Retail users on Coinbase have been very resilient during these market conditions,” Armstrong shared, adding that users have continued accumulating BTC and ETH despite the drawdowns. In fact, he noted that most customers held equal or greater native unit balances in February compared to December. That’s not the behavior of a crowd in full retreat.

The phrase “diamond hands” gets thrown around a lot in crypto, sometimes jokingly, but here it carries weight. Bitcoin pulling back toward the $68,000–$69,000 range and Ethereum slipping below $2,000 would normally shake out weaker holders. Instead, Coinbase’s retail base appears to be leaning in, not out. That suggests conviction, or at the very least, a shift in mindset compared to previous cycles.

A Maturing Retail Base… Or Just Deep Drawdowns?

Not everyone is convinced this is purely bullish. Some critics argue that holding through sharp declines doesn’t automatically equal strength. It could just mean investors are already sitting on sizable unrealized losses and have little incentive to sell at depressed prices. That’s not resilience, they’d say, it’s inertia.

Still, the data shows accumulation. And historically, sustained retail buying during periods of fear has often preceded stronger recoveries later on. When institutions pull back and retail absorbs volatility, the market can quietly build a base. It doesn’t always feel dramatic in the moment, but those slow accumulation phases matter.

There’s also a broader policy conversation happening in the background. Commentators like Wendy O have argued that retail investors deserve greater access to yield on stablecoins and reforms around accredited investor laws. The idea is simple: expand participation, expand opportunity. If retail has more tools to earn yield and manage capital efficiently, confidence may deepen further.

Coinbase’s Tough Quarter, But Steady Inflows

The timing of Armstrong’s remarks is interesting. They come shortly after Coinbase’s Q4 2025 earnings report, which revealed declining trading volumes amid an 11% drop in overall crypto market capitalization. It wasn’t exactly a blowout quarter. Volatility tends to compress activity, and exchanges feel that directly.

Yet even as volumes softened, Coinbase reported continued inflows of native crypto units from retail users. That’s a subtle but important distinction. Trading may slow during uncertain periods, but accumulation can still rise. It hints at a floor forming beneath the market, supported by smaller investors who are thinking longer term.

If that dynamic continues, retail could increasingly act as a stabilizing force rather than a source of volatility. In earlier cycles, retail was often blamed for euphoric spikes and panicked crashes. Now, the behavior appears more measured, more patient, maybe even strategic.

What This Means for Ethereum and the Market

For Ethereum specifically, the drop below $2,000 isn’t insignificant. It’s a psychological level, and losing it tends to amplify short-term bearish sentiment. But if retail accumulation continues underneath that price, it could soften the impact of broader macro pressure.

Bitcoin and Ethereum remain tied to larger economic currents, from interest rate expectations to global liquidity shifts. Price action may stay choppy in the near term, and there’s no guarantee that resilience alone can reverse a downtrend overnight.

Still, the pattern is worth noting. Retail investors appear less reactive than in past downturns, more willing to hold and even add during weakness. If that shift holds, it may quietly change the foundation of future rallies. Sometimes the real story isn’t the price drop, it’s who keeps buying anyway.