- Bankrupt crypto firm Celsius strikes a deal to be acquired by NovaWulf.

- The plan proposes that NovaWulf contributes $45 to $55 million and creates a new company that will continue with Celsius business while compensating creditors

- Celsius plans to begin returning assets to customers in June if the plan is approved by the bankruptcy court

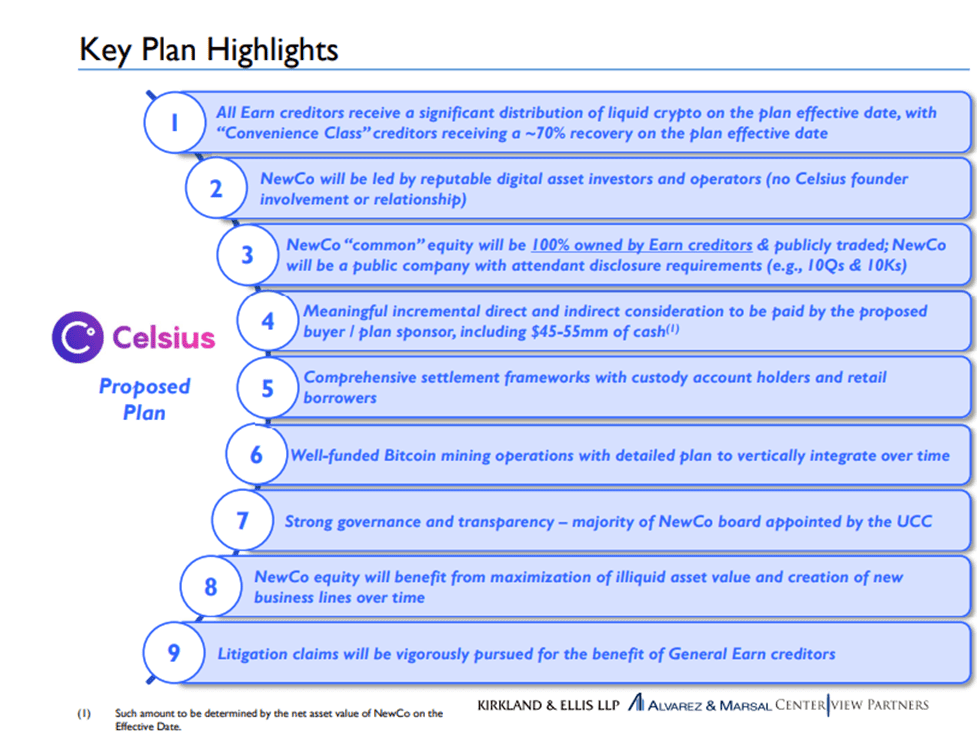

The bankrupt crypto lender has chosen to be bought by investment firm NovaWulf Digital Management which will take over its lending operations in hopes of assisting in the resolution of its bankruptcy case. NovaWulf is expected to finance Celsius’ Chapter 11 restructuring plan, potentially seeing customers recover up to 70% of their funds.

The proposed plan, backed by The Celsius Official Committee of Unsecured Creditors (UCC), which represents Celsius customers’ interests, was presented in a filing to the United States Bankruptcy Court for the Southern District of New York.

According to the filing, the Debtors selected NovaWulf because they believed that the NovaWulf plan is the ideal way to distribute the Debtors’ liquid crypto assets while maximizing the value of the Debtors’ illiquid assets via a new company, NewCo.

The plan proposes the creation of NewCo, a public platform wholly owned by Earn Creditors, whose board will majorly be appointed by the UCC. The plan stipulates that the new board will have no “Celsius founder involvement or relationship.”

As part of the plan, NovaWulf is expected to contribute $45 to $55 million to NewCo, which will be under its management. The filing reads:

“NovaWulf will make a direct cash contribution of $45-55mm to NewCo(1), furnish additional consideration to customers transacting on the NewCo platform to offset anticipated gas fees, and assume significant liquidation and winddown costs that the Debtors would otherwise incur in a controlled liquidation of the Debtors’ business.”

The purpose of NewCo will be to manage and facilitate Celsius’ illiquid assets and mining business along with developing crypto-oriented operating businesses and services.

Also stipulated in the plan is a “Convenience Class,” which entails creditors having claims worth $5,000 or less who, on the petition date, will receive a “one-time distribution of liquid crypto” paid in Bitcoin, Ether, or USDC. This Convenience Class is estimated to comprise at least 85% of Celsius creditors. Creditors with higher claims will be offered shares in the new firm, NewCo, from which they will earn dividends.

In addition, holders of Celsius tokens will receive recovery at the initial coin offering (ICO) price of $0.20 per token against the current price of around $0.50.

If approved by the bankruptcy court under Judge Martin Glenn and supported by most Celsius clients, the plan proposes a contract with NovaWulf to allow the crypto lender to begin repaying crypto assets to customers in June.

The Litigation Trust

The UCC filed a motion seeking claims from Celsius’ former executives led by CEO Alex Mashinsky, who the Committee claims steered the company to bankruptcy. The Committee alleged that:

“They made negligent, reckless (and sometimes self-interested) investments that caused Celsius to lose more than $1 billion in a single year. Their mismanagement (or worse) caused Celsius to lose nearly a quarter of a billion dollars because they could not adequately account for the company’s assets and liabilities.”

As such, the restructuring plan also entails a litigation trust which will facilitate the prosecution of claims against CEO Alex Mashinsky and Daniel Leon, among other claims which will be decided upon.