- The SEC has officially closed its investigation into CyberKongz with no charges, marking a win for the Web3 gaming project.

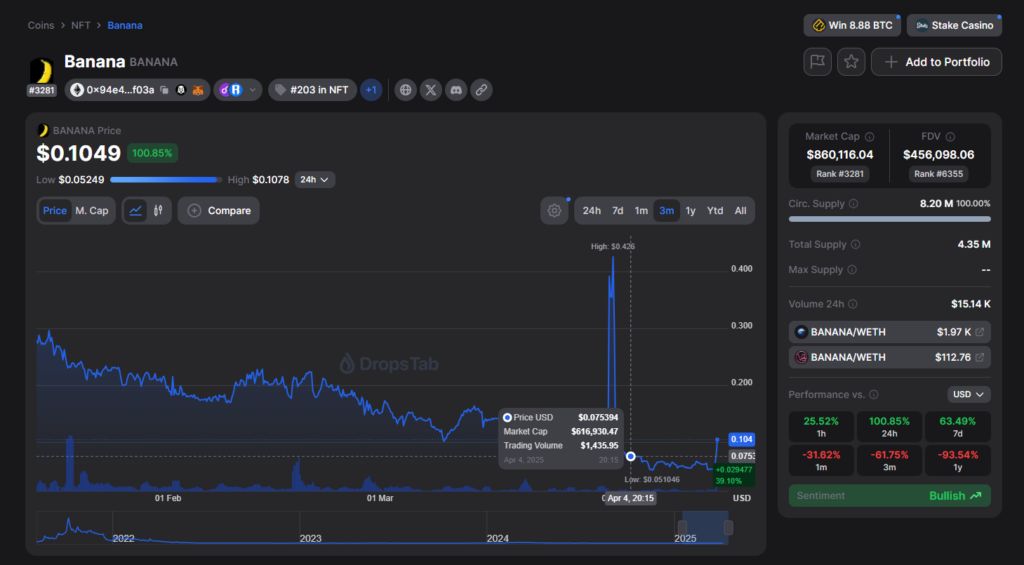

- The case centered around CyberKongz’s use of its BANANA token, which the SEC had reportedly viewed as a potential securities violation.

- This decision follows a recent trend of the SEC dropping cases against NFT projects like Yuga Labs and OpenSea under a more crypto-friendly administration.

After years of back-and-forth with the U.S. Securities and Exchange Commission, Ethereum-based NFT and gaming project CyberKongz finally caught a break—the SEC has ended its investigation. The team had been under the regulator’s microscope for over two years, with things heating up in December when they received a Wells notice. That notice, usually a precursor to formal charges, turned out to be the end of the road. No findings. No enforcement. Just… over.

The SEC, as usual, stayed quiet. A spokesperson declined to comment when contacted, which has kinda become the norm lately as the agency shifts under the Trump administration. Since the White House turned a bit more crypto-friendly, the SEC’s stance has noticeably softened, especially with Commissioner Hester Peirce—known in the community as “Crypto Mom”—now leading the agency’s new crypto task force.

A Fight for Web3’s Future

For CyberKongz, the journey hasn’t been easy. Legal bills piled up, uncertainty loomed, and the team says they fought not just for themselves, but for Web3 as a whole. “After years of litigation, unjust allegations, crippling legal fees… we are free,” they posted on X. According to the team, the SEC took issue with their 2021 game, their Genesis Kongz contract migration, and especially the use of their in-game BANANA token, which the regulator allegedly viewed as a security offering.

CyberKongz called the SEC’s logic “concerning rhetoric” and warned that classifying in-game tokens as securities could wreck innovation in the entire Web3 gaming space. Still, the result of this investigation—no action taken—might give hope and breathing room to others building in that lane.

The Bigger Picture: A Shift in SEC Tactics?

CyberKongz isn’t alone. Yuga Labs (creators of Bored Ape Yacht Club) also had their SEC case dropped recently, calling it a “huge win for NFTs.” Same with OpenSea, which saw its probe shut down back in February, although they’re still seeking clarity on what’s legal and what’s not when it comes to NFT marketplaces.

CyberKongz launched back in 2021 with a mint on Ethereum and later expanded to sidechain Ronin with their “Play & Kollect” game. Their NFTs once went for over $300K a pop—now, the floor price has come down to around $5,447 worth of ETH, according to NFT Price Floor.

Creator Myoo summed it up best in a post: “We’ve taken hits… but came out the other side. Stronger. Focused. And we’re going back to doing what Kongz does best.” And for the Web3 crowd, that’s a big sigh of relief.