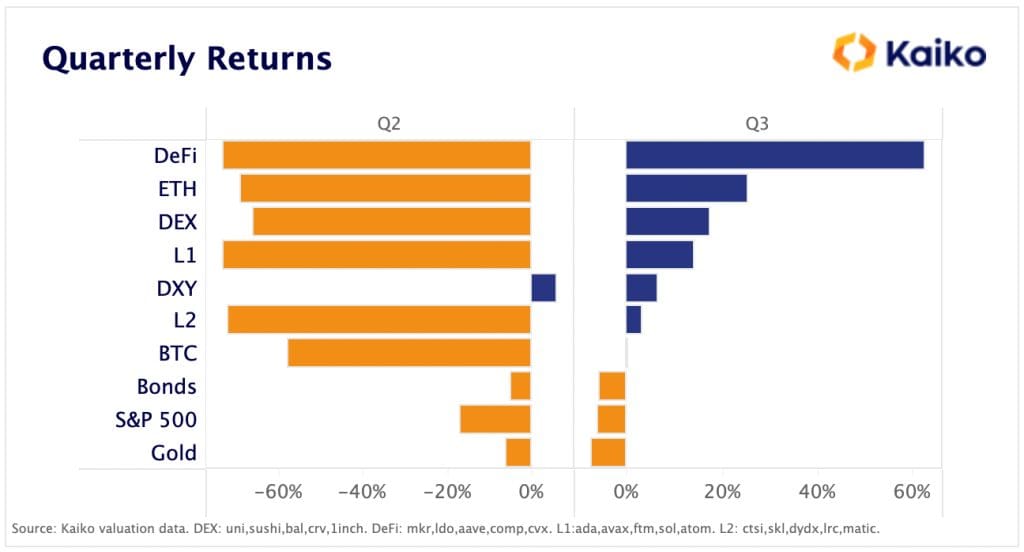

Despite the post-merge sell witnessed in September, Crypto prices performed relatively better than traditional assets in Quarter 3 (Q3/2022). This could indicate a favorable October as cryptocurrencies had historically performed well during this month, particularly last year when it earned the nickname “Uptober.”

Crypto Assets Performed Better Than Traditional Assets In Q3

It has been another three months of heavy volatility in the macro environment, particularly concerning fiat currencies. The U.S. dollar continues to rise against major world currencies at its index. DXY soared to 114.7 all-time highs on September 28.

On September 5, the Euro sank to $0.99 for the first time in 20 years following the announcement that Russia would cut off gas deliveries to Germany via the Nord Stream pipeline, triggering an oil crisis in Europe. Similarly, the British pound plummeted to $$1.0327 against the dollar – the lowest in over 37 years. This followed a series of tax cuts and spending measures in finance minister Kwasi Kwarteng’s mini-budget that threatened to undermine confidence in the U.K.

Bitcoin closed yet another September in the red after dropping from highs above $25,000 in mid-August. Despite the heavy volatility experienced in Q3/2022, a report by Digital Assets Market Data provider Kaiko reveals that most cryptocurrencies performed better than other traditional assets. Cryptos recovered from double-digit losses recorded between April and June.

To put this into context, Kaiko analysts “constructed several equally-weighted baskets of assets” to calculate returns in each sector. They found that the DeFi token basket gained over 60% throughout Q3/2022, a performance that was primarily attributed to the LIDO token. ETH managed to pull out the post-Merge sell-off to close the quarter more than 20% higher, outperforming other tokens in Layer 1 and Layer 2 baskets.

Regarding Bitcoin’s performance, Kaiko reports that the big crypto lost most of its gains in September, ending Q3/2022 “slightly down following a drop in global risk.” Bitcoin started trading on July 1 at $19,820 and ended on September 30 at $19,431. According to Kaiko:

“Safe-haven demand and real yield differentials continued fueling the U.S. Dollar (DXY), which was the only asset to register positive returns in both Q2 and Q3.”

Ether, the second-largest cryptocurrency, closed the quarter in the red, far below its high levels of the previous three months.

The report by Kaiko also showed that as crypto prices recovered somehow from their Q1/2022 and Q2/2022 lows, their performances were above other asset classes, such as equities, bonds, and commodities, in quarter 3. For example, the S&P 500 index closed Q3/2022 1.7% below the previous quarter’s. The gold index also finished the last quarter in the negative.

The Morningstar, US Market Index fell by 4.6% during Q3/2022. On the last day of the quarter, stocks fell to a new low in the bear market, bringing the yearly losses to 24.9%. This was the worst start to the fiscal year in two decades.

The dismal performance of equities and stocks can be attributed to decades of inflation, aggressive interest-rate increases by the Federal Reserve and other major central banks, rising recession risks, and aftershocks from Russia’s invasion of Ukraine, which continued to drive stock and bond market performance.

By the end of Q3, most equities were firmly in the bear-market zone, and bond rates, which move inversely to prices, were at multi-year highs.

Conclusion

Crypto advocates and Bitcoin maximalists are holding onto the hope that “Uptober” will play out again this year after two straight months of a sell-off. According to historical data from TradingView, Bitcoin has performed well in October in eight out of the last twelve years, with an average return of almost 30%. This means that October had a 66% positive return percentage. Will history repeat itself? It’s a matter of waiting and seeing.