A look at price trends over the past quarter shows that the macro environment continues to dictate short-term cryptocurrencies price movements. Since the Fed began indicating it would tighten monetary conditions back in November, crypto prices have been dropping with every rate increase.

The article analyzes how closely Bitcoin, the Nasdaq100, and S&P 500 trended throughout Q3.

Increasing Correlation Between Bitcoin and Equities

Bitcoin and most cryptocurrencies continued to perform like leveraged stock indices in Q3/2022. This continues to invalidate the thesis of Bitcoin as a hedge against inflation as the price of the big crypto declined as inflation remained high.

At the moment, nothing appears to be acting as an inflation hedge, with the gold index declining in 2022 and a vast majority of fiat currencies. On September 5, the Euro sank to $0.99 for the first time in 20 years following the announcement that Russia would cut off gas deliveries to Germany via the Nord Stream pipeline, triggering an oil crisis in Europe.

Last week, the British pound plummeted to $$1.0327, hitting all-time lows against the dollar. This is the first time the Sterling went to decimal since 1971 after a bonanza of tax cuts and spending measures in finance minister Kwasi Kwarteng’s mini-budget threatened to undermine confidence in the U.K.

Across the Atlantic, the U.S. dollar strengthened against major world currencies, with the USD index (DXY) reaching an all-time high of 114.7 on September 28. The relatively strong dollar has continued to pull down cryptocurrency prices over the last quarter as Bitcoin’s price was locked in overhead pressure since mid-August.

Bitcoin Long-Term Holders Unbothered By Market Volatilities

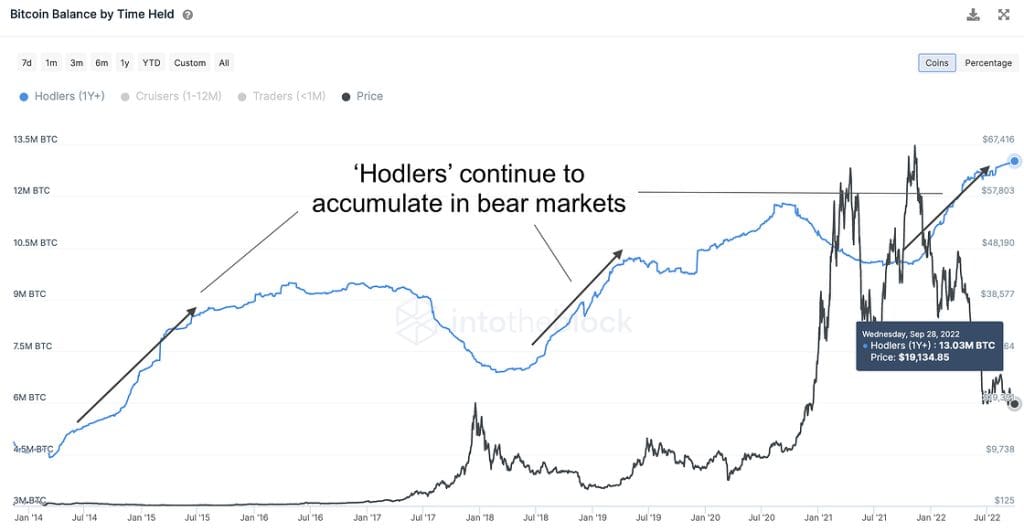

Despite the high volatility experienced in Q3/2022, long-term holders appear to be increasing their Bitcoin reserves, even as prices plummet.

Historically, long-term holders usually decrease their BTC holdings after the crypto breaks new record highs, a sign of profit taking. Then as prices crash, the long-term players buy back at discounted prices. Q3/2022 saw holders increase their Bitcoin holdings by 5% and 30% year-to-date, according to data from IntoTheBlock.

For example, MicroStrategy, the software and data intelligence firm led by a staunch Bitcoin bull Michael Saylor, purchased an additional 301 BTC for approximately $6.0 million at an average price of $19,851 per Bitcoin on September 20. This made MicroStrategy (MTSR) the most prominent corporate holder of Bitcoin, with a total of 130,000 BTC reserves, up from 129,699 BTC at the end of the second quarter.

This accumulation pattern by “holders” could suggest that the thesis of Bitcoin as a store of value could still be alive, as presumably the consensus among these long-term buyers is to expect more excellent prices or else they would not be buying more.

Conclusion

Undoubtedly, the macroeconomic conditions will be unfavorable to financial markets in 2022. It should be remembered that cryptocurrencies benefitted from loose monetary policies in 2021 as much as they are struggling now under tighter conditions and heightened uncertainties.

Despite the current risk environment, declining values of the world’s significant currencies vs. the U.S. dollar could increase Bitcoin as the most liquid asset not under the control of governments.

More and more people are turning to Bitcoin as a hedge against inflation. There has been a dramatic increase in BTC/GBP trading volume as British citizens turn to Bitcoin (BTC) and the Sterling pound (GBP) continues to weaken against a strengthening United States dollar (USD).

If long-term holders can continue believing in crypto, cryptocurrencies and Bitcoin may begin to disassociate with macro conditions and become a natural hedge against inflation.