The crypto market has lost nearly $2 trillion since its peak towards the end of 2021. Top cryptos are trading more than 70% below their all-time highs, average prices of NFT collections have dropped tremendously as the 2021 frenzy seems to disappear, and several lenders and hedge funds have collapsed in what are seen as signs of an extended “crypto winter.”

As devastating as this has been to cryptocurrency investors, analysts opine that the recent plunge is not a traditional market deterioration.

Understanding The Numbers

To put this into context, there is no doubt that the 2022 bear market is the worst the crypto industry has ever seen when analyzed in dollars. For example, Bitcoin’s value plummeted by a whopping $52,000 from its November 10, 2021, all-time high when it dropped to $17,000 on June 18. On the same day, Ethereum slipped below the $1,000 mark for the first time since January 13, 2021, to trade at $883. This was $4,008 below its $4,891 peak on November 16, according to data from CoinMarketCap. This makes the scale and the magnitude of the impact of this year’s market downturn the largest ever.

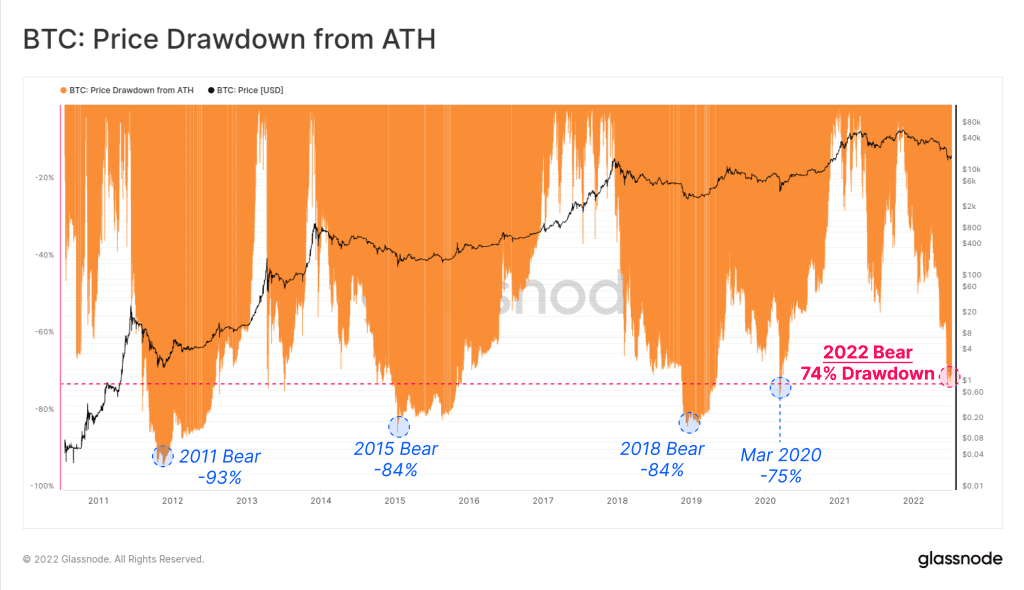

However, the same story about percentages paints a different picture. A joint report by CoinMarketCap and Glassnode released on July 29 found the 2022 crypto market downturn to be the least severe in Bitcoin’s history. BTC price has fallen 74% from the $69,000 all-time high to the lows reached on June 18. This drop is 79% for ETH.

Compared to falls during the past bear markets: “93% in 2011 and 84% in 2015 and 2018” for Bitcoin; and 94% in 2018 for ETH, the one being experienced appears less grievous.

It has also been interesting to see the performance of some of the most widely recognized on-chain metrics on Glassnode – Realized Price and Market Value Realized Value (MVRV) ratio. During all the past Bitcoin bear markets, the BTC price plunged below the Realized price for an average period of 180 days: 116 days in 2011, 292 days in 2015, and 134 days in 2018. This lasted only seven days in March 2022, and Bitcoin has continued to trade above the Realized Price since then.

When the price falls below the Realized Price, the MVRV moves below 1. The same data from Glassnode shows that most Bitcoin investors are still holding their BTCs above their on-chain cost basis in 2022 and thus are still in profit. This indicates a less severe market condition in 2022 than the other bear markets.

Crypto Adoption On The Rise Despite The Bear Market

Actual crypto adoption is not measured by the number of people who own crypto (mainly for speculative purposes) but by how many use cryptocurrencies to pay for goods and services. That is the trustless and decentralized financial system envisioned by Satoshi Nakamoto when he wrote the Bitcoin whitepaper in 2008.

At the moment, data from CoinsPaid – a bitcoin payment processing gateway and business wallet, revealed that adoption is moving in the right direction. The payment gateway has processed more than €13 billion in crypto and continues to grow at a rate of 7% per month despite the bear market conditions.

CoinPaid reports processing over 10 million transactions with approximately €6 billion in the first half of the year alone. This is a tremendous increase from the 3.7 million transactions worth over €2 billion processed during the same period last year.

This data from CoinsPaid shows that cryptocurrencies continue to gain mainstream adoption as more users transact in Bitcoin, and more businesses accept crypto in exchange for the goods and services they offer.