- Low-income households in crypto-heavy areas saw mortgage balances rise by 150% since 2020, fueled by crypto sales.

- Higher debt-to-income ratios in high-crypto regions suggest vulnerabilities to future financial instability during economic downturns.

- Despite high leverage, delinquency rates in these areas remain low, according to Treasury research findings.

A report from the U.S. Treasury’s Office of Financial Research highlights how lower-income households are increasingly using profits from cryptocurrency investments to secure larger mortgages. The study, authored by Treasury researchers, observed a 250% increase in mortgage originations among these households in areas with high crypto exposure between 2020 and 2024.

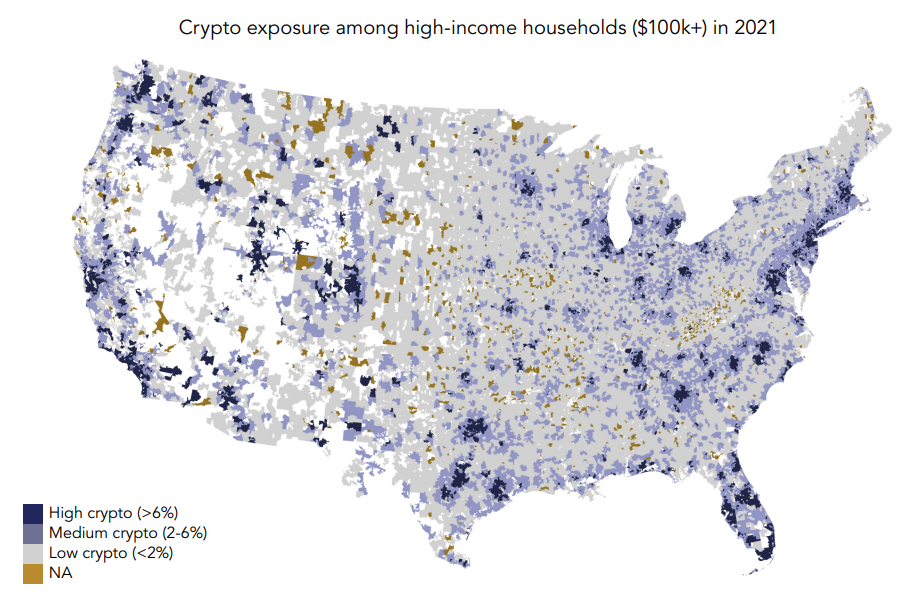

The research defines “high-crypto exposure” areas as zip codes where over 6% of households reported cryptocurrency tax events. In these regions, the average mortgage balance grew from $172,000 in 2020 to $443,000 by 2024. The findings suggest that gains from crypto sales have contributed to larger down payments, enabling access to higher borrowing limits.

However, the study also noted a significant rise in debt-to-income ratios among mortgage holders in these areas. The researchers cautioned that while delinquency rates remain low for now, elevated leverage could become problematic if economic conditions worsen or cryptocurrency markets face a downturn.

Debt Risks and Broader Economic Implications

The report underscores that increased mortgage debt in high-crypto areas is part of a broader trend of rising household leverage. The Federal Reserve Bank of New York recently reported U.S. household debt reached a record $17.9 trillion in the third quarter, driven by mortgages, auto loans, credit cards, and student debt.

While the study did not find immediate financial distress among low-income households in high-crypto exposure areas, it flagged the potential for systemic risks. Researchers expressed concern about the concentration of high-risk borrowers within financially vulnerable institutions.

The report’s findings emphasize the need for continued monitoring, particularly as the financial stability of these households may depend on both the volatility of crypto markets and broader economic conditions. High debt levels combined with exposure to crypto assets could amplify financial stress in adverse scenarios, posing challenges for both individual households and the broader economy.