- Chainlink price drops 5% to $17.70 as selling pressure and weak momentum persist.

- Exchange outflows and failed EMA retests point to short-term bearish bias.

- Long-term confidence remains strong thanks to Fed visibility and infrastructure reliability.

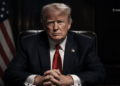

Chainlink (LINK) has been on shaky ground lately, falling over 5% in the past 24 hours to trade around $17.70. The pullback has traders eyeing the $17–$16.50 zone — a key support area that lines up neatly with the Fibonacci retracement and prior demand zones. For now, the bulls are hanging on, but barely.

Momentum Fades Below Key Resistance Levels

LINK’s price action paints a clear picture of exhaustion. The token got rejected hard from the 50-day EMA near $20.20, and after failing to stay above the 0.382 Fibonacci level at $18.62, sellers quickly took charge again. It’s now drifting closer to the $17 region where buyers are trying to catch their breath.

The 20-, 50-, and 200-day EMAs—clustering between $18.90 and $19.20—have all flipped into resistance. That’s a bad sign in the short term since price sitting below every major moving average usually means sellers are still in control. The RSI sits at about 41, which shows weak momentum but not yet oversold territory. Translation: there’s still room for one more dip before the next bounce.

Exchange Outflows Reflect Bearish Sentiment

On-chain data backs up the story. Chainlink saw more than $14 million in net outflows on October 21, extending a consistent streak of red since mid-September. Normally, outflows can hint at accumulation—but not this time. The price keeps dropping, which suggests the market hasn’t fully absorbed the selling pressure yet.

The imbalance between flows and price points to fading demand. Volatility’s also rising, making it tough for LINK to find stability above $18. Unless these metrics settle soon, LINK’s short-term bias stays tilted to the downside.

Chainlink’s Fed Appearance Draws Eyes, But No Price Impact

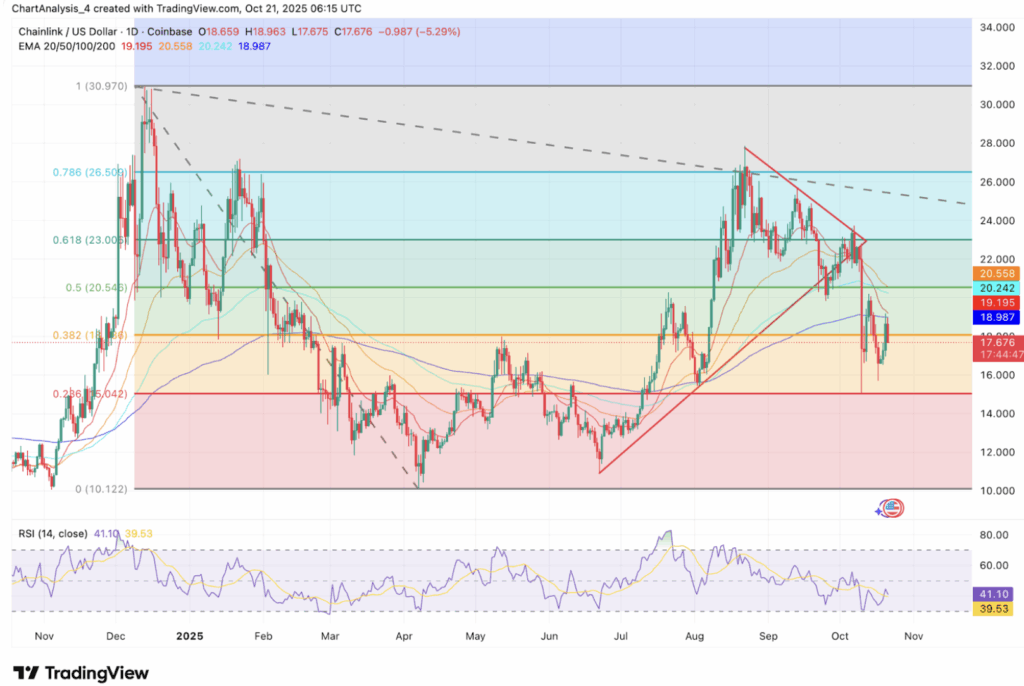

Interestingly, Chainlink managed to grab some spotlight during the Federal Reserve’s Payments Innovation Conference on October 21. Co-founder Sergey Nazarov joined a panel alongside execs from Coinbase, Circle, Paxos, and major banks. The discussion focused on bridging traditional finance with blockchain infrastructure—exactly where Chainlink thrives.

Still, the market didn’t flinch. Despite the positive exposure, LINK’s price action stayed sluggish. It’s another reminder that recognition and fundamentals don’t always translate into immediate price movement—especially in bearish conditions.

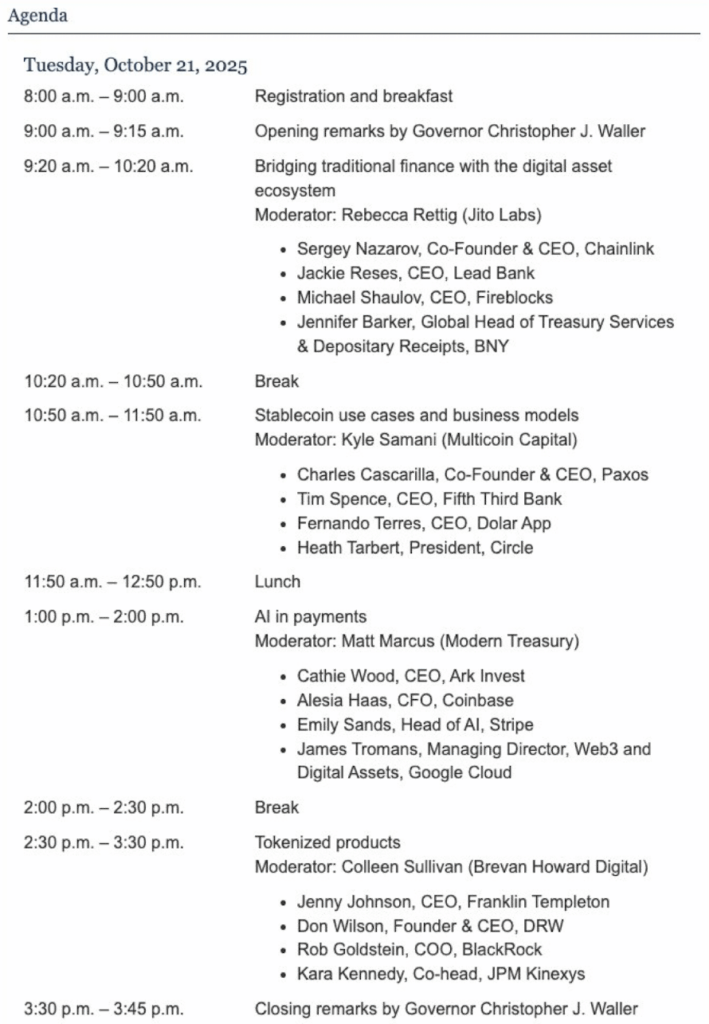

Chainlink Survives Cloud Outage Without a Scratch

While parts of the internet struggled through a major cloud outage, Chainlink reported zero downtime. Its oracle services remained fully functional, securing billions in DeFi and keeping data feeds live when centralized providers faltered.

That reliability reinforces Chainlink’s position as the backbone of decentralized oracle networks. But even strong fundamentals can’t always fight technical weakness—at least not in the short run.

Technical Outlook: Can Bulls Defend $17?

Right now, $17.00 is the line in the sand. Losing it could drag LINK toward $15.00, where the 0.236 Fibonacci level and summer consolidation zone align. If bears push harder, the next floor might be $13.50.

On the other hand, reclaiming $18.62 could flip momentum back to neutral. A clean breakout above $20.50 might even set the stage for a retest of $23.00—the September highs. But that’s a big “if” for now.

The Bottom Line

Chainlink’s short-term setup remains bearish. Failed EMA retests, weak volume, and persistent outflows keep sellers in charge. Still, long-term fundamentals—like its Fed recognition and flawless uptime—continue to give investors a reason to stay patient.

If buyers manage to hold the $17 support and push above $19, LINK could steady itself soon. If not, a deeper dip toward $15 might be next before any real recovery kicks in.