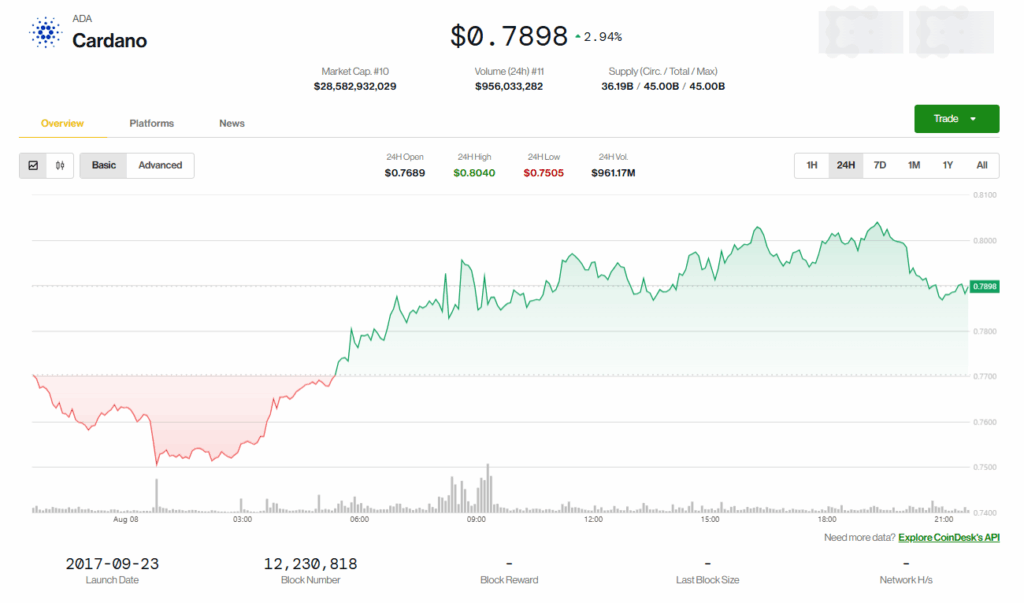

- Cardano forms a golden cross on the hourly chart, signaling fading selling pressure and potential bullish momentum.

- ADA trades at $0.80, with key resistance at $0.86 and $0.94 before retesting the $1 level.

- A $71M treasury allocation for upgrades like Hydra and Project Acropolis adds strong fundamental support.

Cardano has formed its first golden cross pattern for August, a bullish technical signal that occurs when a short-term moving average — in this case, the 50-hour SMA — crosses above a long-term moving average, typically the 200-hour SMA. This crossover on the hourly chart suggests that short-term selling pressure is fading, and bullish momentum may be building. The move comes after ADA began the month on a weaker note, dropping to $0.684 on Aug. 2, which also coincided with a bearish death cross on the four-hour chart earlier in the week.

Price Action and Market Outlook

At the time of writing, ADA has surged 5.73% in the last 24 hours to $0.80, aided by a broader crypto market rally fueled by optimism over potential 401(k) retirement plan crypto integrations. With the daily 200 SMA now at $0.7245 — a key gauge for momentum — ADA has managed to break and hold above it. Resistance levels at $0.86 and $0.94 stand as the next hurdles before ADA can attempt to retest the $1 mark, a level last reached in early March when it spiked to $1.19 following a crypto strategic reserve announcement.

Key Fundamentals Supporting Bullish Sentiment

Fundamentally, ADA’s rally is being underpinned by network growth. Input Output (IO), Cardano’s core development team, recently secured a $71 million treasury allocation to fund network upgrades over the next year. Major projects like Hydra and Project Acropolis aim to improve scalability, developer activity, and real-world use cases for Cardano, potentially boosting long-term demand for ADA.

Path Toward $1 and Risks

With bullish momentum in both the technical and fundamental landscape, the path toward $1 appears viable if resistance levels are breached. However, short-term pullbacks remain possible, especially if the market rally loses steam or if ADA fails to maintain levels above the $0.80 mark. Traders will be watching closely for follow-through buying and volume confirmation in the coming sessions.