- Ethereum faces heavy losses but remains above key moving averages.

- Market sentiment sits in Extreme Fear with mostly bearish indicators.

- Short-term prediction shows a 10% rebound, though uncertainty remains high.

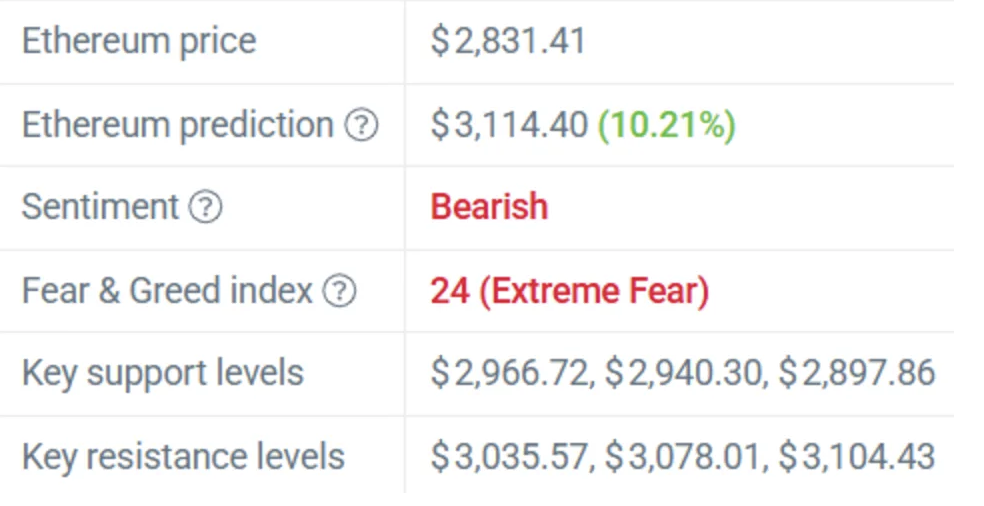

Ethereum has been trading like a bruised and tired bull lately, stumbling harder than most of the market. ETH is sitting around $2,831.41, dropping 5.42% in a single day — a deeper cut than the wider crypto market’s 6.15% slump. Even in its usual rivalry with Bitcoin, ETH slipped another 0.29%. It’s not a pretty picture right now. Still, strangely enough, predictions show Ethereum could climb back to roughly $3,114.40 by December 6, 2025 — about a 10.21% rise over the next five days. A quick bounce after a heavy fall isn’t impossible… but the road isn’t exactly smooth.

Ethereum’s Bleeding Stretch Continues, but Flickers of Life Remain

Zooming out doesn’t help the mood much. ETH lost 26.71% over the past month. Over three months the decline extends to 35.30%. And over the last year? Down 23.40%. Last December, ETH traded at $3,696.43 — a far cry from today, and even further from its record high of $4,946.50 hit on August 24, 2025. The current cycle paints a blunt picture: a high at $3,093.87, a low at $2,631.93, and monthly volatility of just 9.48, which isn’t much for a coin known for explosive swings. Even so, Ethereum managed to squeeze out 14 green days in the past thirty — tiny breaths of relief in the middle of a storm.

Fear Dominates the Market as ETH Tests Support

The broader market today is moving with the same emotional tone: fear. The Fear & Greed Index sits at 24 — full-on Extreme Fear. Traders look cautious, nervous, waiting for that “right” moment that rarely ever comes. Ironically, fear often creates the best opportunities, the kind where coins slip into low-value zones before the next big revival.

Key support zones lie at $2,966.72, $2,940.30, and $2,897.86. On the upside, ETH faces resistance at $3,035.57, $3,078.01, and $3,104.43. Breaking above these levels could give Ethereum a much-needed new lease on life… but the indicators aren’t exactly cheering. Four indicators show bullish undertones, while twenty-six flash bearish signals — a heavy 87% leaning toward the downside.

Signals Are Mixed, but ETH Avoids a Full Collapse

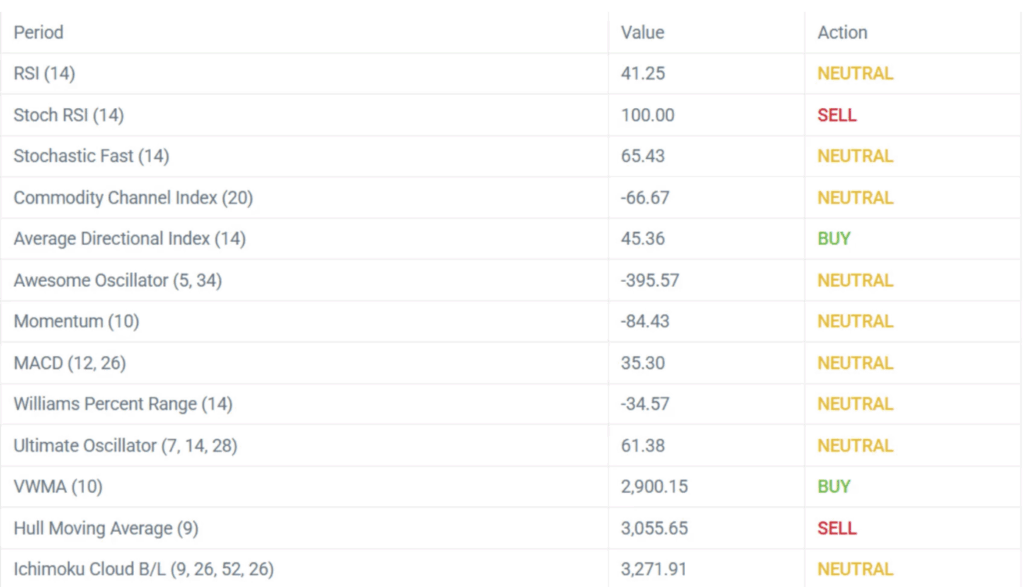

Despite the bearish flood, a few technical details clash with the doom. The RSI at 41.25 sits in neutral territory, not oversold and not overheated. ETH is also trading above its 50-day and 200-day simple moving averages, which typically signals strength. These contradictions make the current mood a bit confusing — the market feels weak, but not broken.

What’s Next for Ethereum?

The forecast still expects a rise over the coming days, but overall sentiment leans toward caution. Ethereum needs that 10.21% push to reclaim its short-term target, yet the path ahead depends on more than numbers: fear levels, support zones, and a market that changes direction faster than anyone likes to admit.

Crypto never stands still — not hope, not fear, not Ethereum. Here is where patience becomes strategy, and strategy becomes survival.