- BNB hit new highs above $1,200 backed by 10–17M daily transactions.

- Chainlink’s integration brings official U.S. economic data on-chain, boosting DeFi use cases.

- Strong support at $1,240 and bullish sentiment suggest BNB could aim for $1,360 next.

BNB has been on fire lately, blasting to new highs and showing no signs of slowing down just yet. The coin’s push above $1,200 didn’t come out of nowhere either — it was powered by a surge of on-chain activity and a wave of fresh adoption across the Binance Smart Chain.

Daily transactions have been holding steady in the 10–17 million range, which is no small feat. That’s one of the longest stretches of consistent growth the network has ever seen, and it shows this rally is built on more than hype. People are actually using the chain, not just speculating.

Chainlink Integration Gives BNB Extra Utility

One of the big drivers behind this latest run is BNB Chain’s move to integrate Chainlink’s data standard. Now, official U.S. economic data like GDP and the PCE Price Index are available directly on-chain. That might sound dry, but in practice, it’s a game-changer.

This opens the door for DeFi projects, prediction markets, and risk tools that depend on real-world data. It’s the kind of step that makes blockchain more than just charts and candles — it makes it useful. For investors, that’s a big deal because it signals that BNB Chain is growing into a more serious player, not just another speculative playground.

Can BNB Stay Above Key Support Levels?

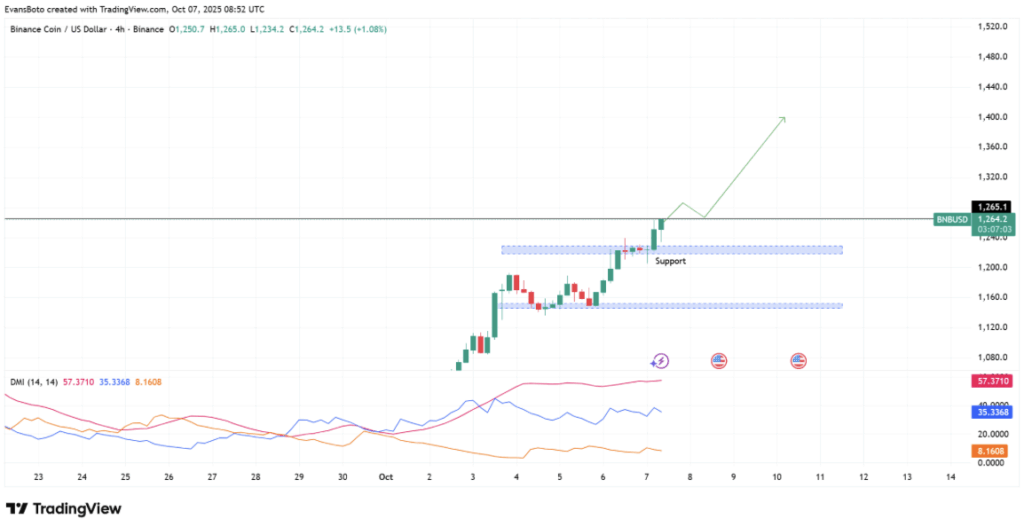

On the technical side, things still look very bullish. BNB is trading comfortably above the $1,240 support zone, and the charts show a strong ascending structure. Buyers have been stepping in consistently, keeping momentum intact.

The DMI indicator backs this up too: +DI remains well above –DI, and the ADX sits around 57, which basically screams strong trend. If buyers keep control, the next target is sitting up near $1,360 resistance. A clean break there could push BNB into another leg higher.

Sentiment and Social Buzz Back the Rally

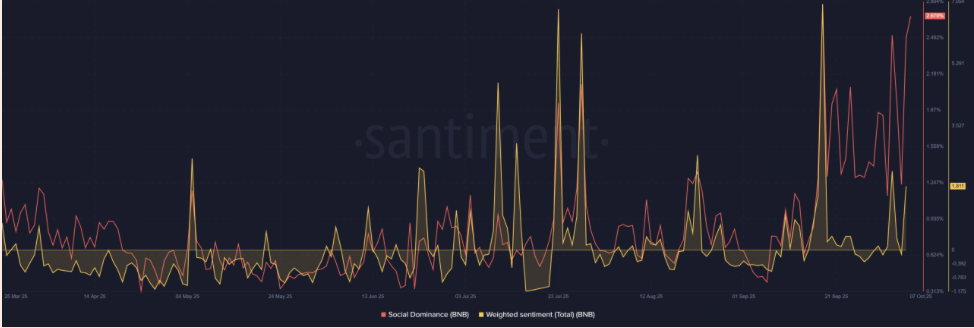

It’s not just charts either — the mood around BNB has clearly shifted. Santiment data shows its Social Dominance climbing to 2.67%, the highest it’s been in months. Weighted Sentiment hit 1.81, another solid sign that traders are feeling bullish again.

Whenever you see social chatter rise alongside strong fundamentals, it usually means the market is gearing up for more action. That’s exactly the setup BNB finds itself in now.

Utility Growth Could Make This Rally Different

At the end of the day, this BNB rally looks sturdier than some of the speculative spikes of the past. High transaction volumes, Chainlink’s integration of real-world data, and growing developer activity all point to genuine utility backing the move.

If the trend holds, BNB might not just be running hot in the short-term — it could be shifting into a new, utility-driven phase of demand that keeps momentum alive for the long haul.