- BNB saw a modest 2% price increase, backed by a spike in on-chain activity, including a 17% jump in transaction fees and 13 million transactions processed in 24 hours.

- Retail investors remain cautious, selling nearly $2.9 million worth of BNB, which may limit further gains despite strong network usage.

- Futures and options markets show bullish signals, with high long-to-short ratios on Binance and OKX, and a 43% rise in options volume, pointing to potential upside if retail sentiment shifts.

BNB managed to notch a modest 2.02% gain recently, closely tracking the broader crypto market’s 2.70% uptick. Not bad, but when you peek under the hood, there’s more going on than the price action suggests. According to CoinMarketCap, the altcoin index has climbed to 29%, setting a decent backdrop. Still, BNB’s current growth feels kinda underwhelming given what’s happening on-chain.

Transaction Surge Fuels Hopes – But It’s Not So Simple

Over the last 24 hours, BNB usage has popped off a bit. Network activity? Through the roof.

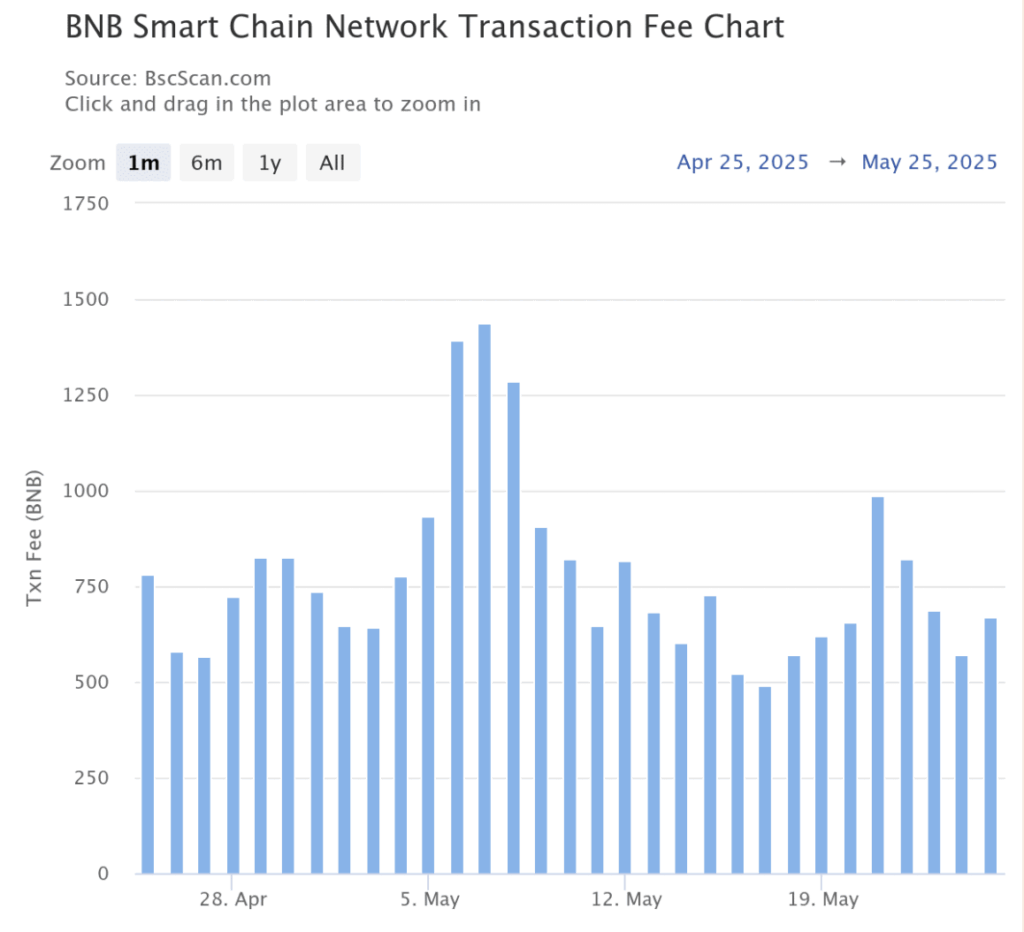

Transaction fees? Up 17%—about 671 BNB burned, worth nearly $451K at the time. Not too shabby. That spike in fees mostly came from an uptick in finalized transactions. In fact, over 13 million of them were wrapped up in a single day. That’s wild.

Now, if this trend keeps up, more BNB could be put into circulation for transactional use. That’s usually a recipe for price appreciation… but there’s a catch.

Retail’s Not Playing Along – At Least Not Yet

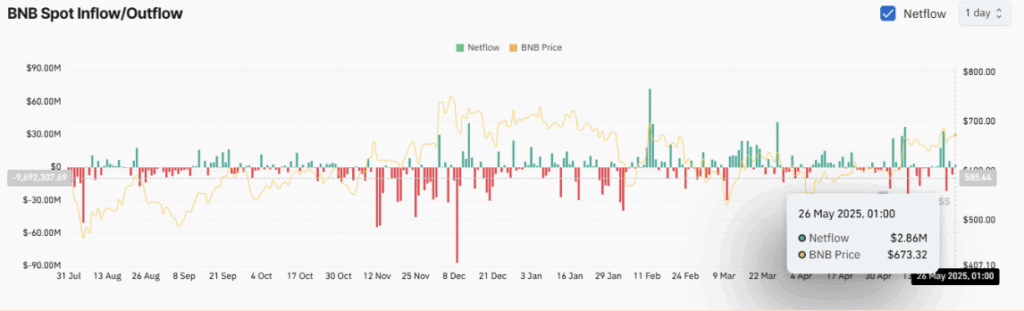

Despite all this network activity, retail traders don’t seem too convinced. AMBCrypto’s review of Coinglass data showed spot investors are leaning bearish. Like, $2.87 million worth of BNB just got dumped. That kind of offloading doesn’t exactly help upward momentum.

Retail players move markets more than people think, and if they keep pulling back, BNB’s rally might hit a ceiling sooner than bulls would like.

Derivatives Say “Buy,” Especially On Binance and OKX

Meanwhile, futures traders are showing a bit more optimism—especially on platforms like Binance and OKX. Their long-to-short ratios tell the story: 1.83 on Binance, 1.29 on OKX. Anything above 1 = more buyers stepping in.

Top traders on Binance, in particular, have kept things bullish, holding a steady 1.09 buy volume ratio. So, even with the broader derivatives market staying kinda flat, those signals show bullish pressure is still in play.

Options Market Starting to Buzz

Now here’s where it gets a little more interesting—options. In the last 24 hours, volume jumped 43.57% to $721K. Open interest? Pushed past the $10 million mark. That kind of movement usually signals growing confidence. If this continues, it could help push BNB out of its current hesitation zone.

Final Take

So yeah, BNB is climbing, but the price is just part of the story. On-chain activity is heating up, futures and options traders are getting bold—but unless retail joins in, that rally might stall out. If they do hop back in though… things could move fast.