- BNB hit a new all-time high of $1,370, rebounding after a $19B crypto liquidation event.

- Binance compensated users with $283 million after system lags during the crash.

- Despite controversy, BNB’s trading volume surged 75%, pushing it back to the market’s top tier.

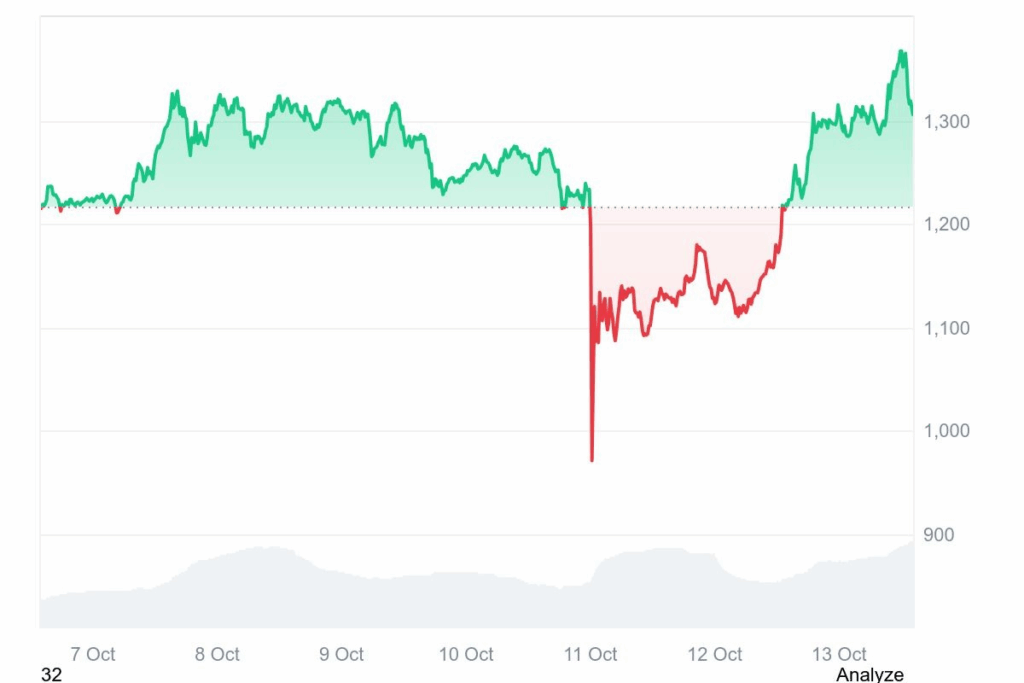

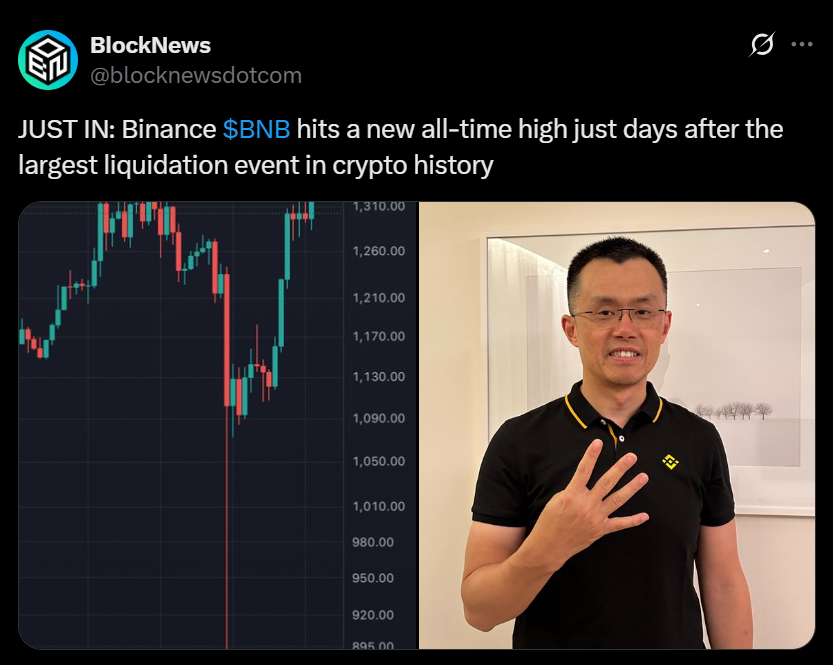

BNB has once again proven its resilience, breaking through to a new all-time high of $1,370 even as the broader crypto market reels from a weekend collapse that wiped out over $19 billion in positions. According to CoinMarketCap, the surge came just days after a historic liquidation cascade, showing how fast sentiment can flip when liquidity and confidence return.

The weekend crash left thousands of traders nursing losses, with some accusing Binance of system outages during peak volatility. Yet despite the uproar, BNB rallied nearly 11%, fueled by renewed accumulation and the exchange’s move to compensate users with $283 million in restitution.

Binance Faces Backlash, Responds With Compensation

The chaos began when multiple tokens, including stablecoin USDe, suffered flash crashes amid thin liquidity. Some traders claimed they couldn’t close futures positions during the drop, sparking anger across social platforms.

Binance co-founder Yi He pushed back against the criticism, explaining that while certain “modules” faced temporary lags, the platform’s core contracts, spot engines, and API systems remained stable. In a follow-up statement, Binance said its liquidation ratio “remained at historically low levels” relative to trading volume, attributing the chaos to wider macro pressure rather than exchange malfunction.

In a rare gesture, Binance pledged $283 million in user compensation. The announcement not only calmed tensions but likely contributed to the BNB rebound, signaling confidence in the platform’s willingness to support its traders during turbulent times.

Hidden Liquidations and Market Maker Moves

Not everyone was convinced the damage was fully visible. Jeff Yan, co-founder of Hyperliquid, claimed that some centralized exchanges may be “underreporting liquidations”, potentially masking the true scale of trader losses. According to Yan, Binance’s system often records only one liquidation per second — even when “hundreds occur simultaneously.”

Adding to the intrigue, market maker Wintermute reportedly moved $700 million in Bitcoin to Binance just hours before the crash. Analysts like Merlijn The Trader suggested the move could have contributed to downward pressure, noting that liquidation velocity “hit max speed” shortly after the transfer.

BNB Turns Crisis Into Catalyst

Despite the chaos, BNB’s performance flipped the market narrative. The token’s price recovery — and subsequent breakout to $1,370 — reflects renewed investor confidence in the Binance ecosystem. Trading volume spiked 75% to $13.2 billion, suggesting that traders quickly rotated back into BNB as the dust settled.

With compensation distributed and trading systems stabilizing, BNB appears to have turned a market-wide disaster into a show of strength. Its ability to rally amid systemic stress could reinforce its role as the third-largest crypto by market cap, following Bitcoin and Ethereum.