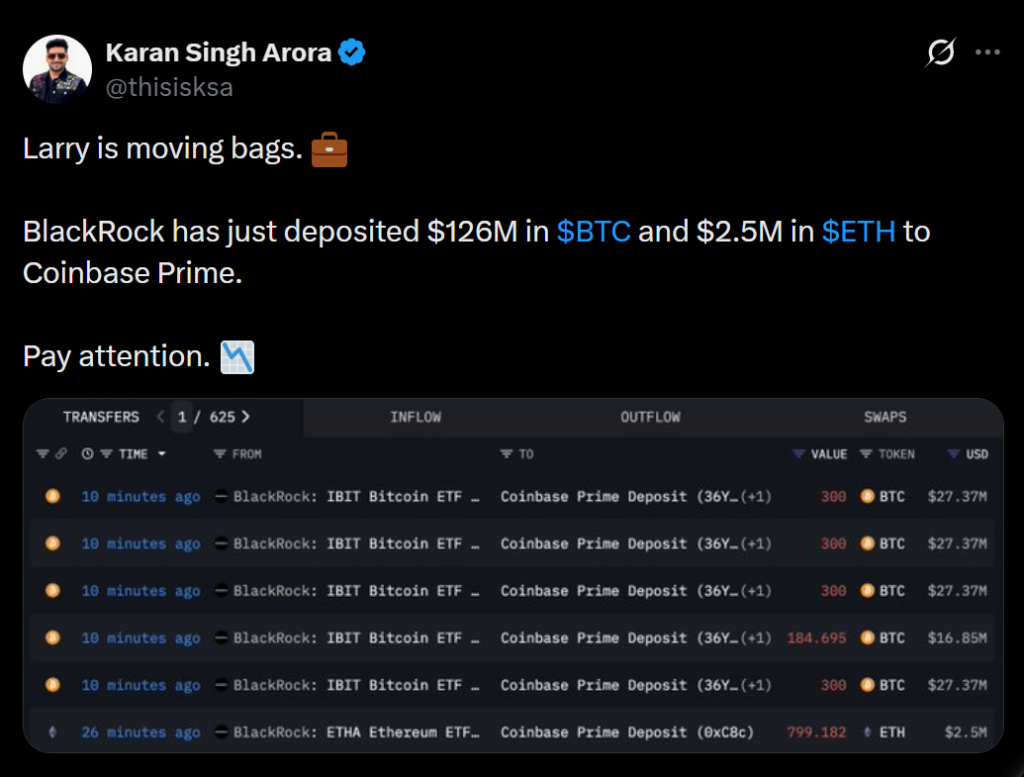

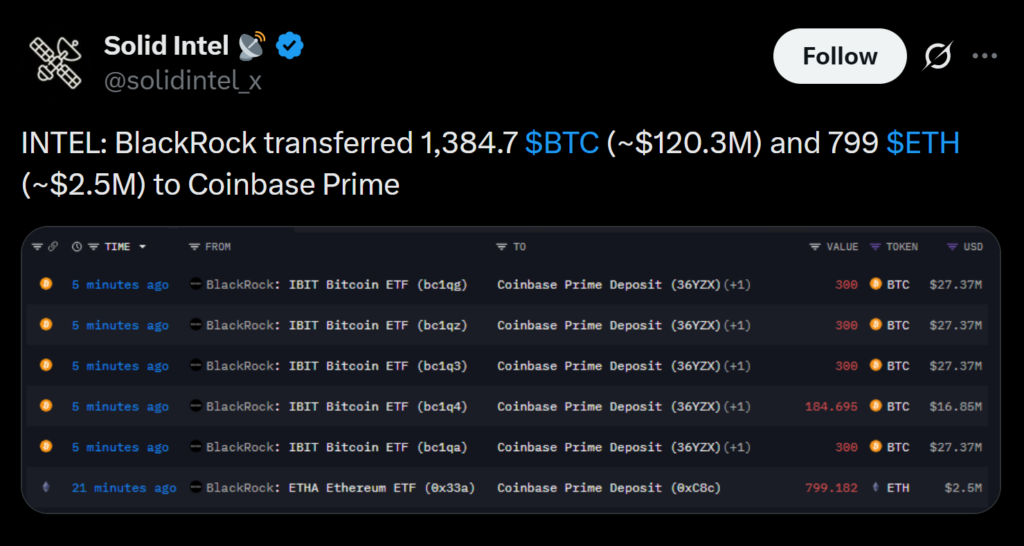

- BlackRock moved $120M in BTC and $2.5M in ETH to Coinbase Prime for ongoing ETF and portfolio adjustments.

- The firm’s BTC ETF saw $113M in outflows, while the ETH ETF posted $28M in inflows.

- Regular transfers signal continued institutional engagement despite market volatility.

BlackRock made another noticeable move today, sending roughly $120 million worth of Bitcoin and an additional $2.5 million in Ethereum to Coinbase Prime. These transfers are part of the firm’s ongoing portfolio adjustments as it manages an expanding set of digital-asset holdings. Although the market has been choppy, the activity shows that big institutions are still reshuffling positions rather than stepping back.

Coinbase Prime Remains a Key Hub for Institutional Activity

The transfers again flowed through Coinbase Prime, the institutional arm designed for high-volume crypto custody and execution. It’s become one of BlackRock’s preferred venues for ETF-related balancing, especially as the firm continues operating some of the largest spot Bitcoin and Ethereum ETFs in the U.S. Each rebalance or shift in demand typically requires fresh custodial moves — something Coinbase Prime handles with ease.

ETF Flows Offer a Closer Look at Demand

Portfolio changes appear to reflect shifting investor appetite as well. BlackRock’s Bitcoin ETF posted about $113 million in net outflows on Thursday, while the Ethereum ETF actually pulled in $28 million. That divergence may hint at a broader rotation forming, with some investors taking profit on BTC while positioning early around ETH ahead of the market’s next catalysts. Either way, BlackRock is adjusting quickly to match that flow.

A Steady Institutional Presence Despite Market Noise

Even with recent volatility, these regular transfers suggest BlackRock is still actively managing crypto exposure rather than scaling back. For the broader market, this kind of consistent institutional presence remains a quiet but important stabilizer — especially when smaller players are reacting emotionally. The long-term trend still leans toward deeper institutional involvement, even if week-to-week flows wobble.