- BMNR is up 4.3% today after a -21% slide in five days, with earnings on Nov. 21 and signs it may be front-running an Ethereum bottom like it did before its July explosion.

- Hidden bullish RSI divergence, rising OBV into earnings, and CMF breaking its downtrend all hint that buyers are quietly returning as long as the $30 support zone holds.

- If ETH rebounds and OBV breaks out, BMNR could target $39, then $52–$65, but losing $30 support risks a fast drop toward $25 as NAV compresses with any further Ethereum downside.

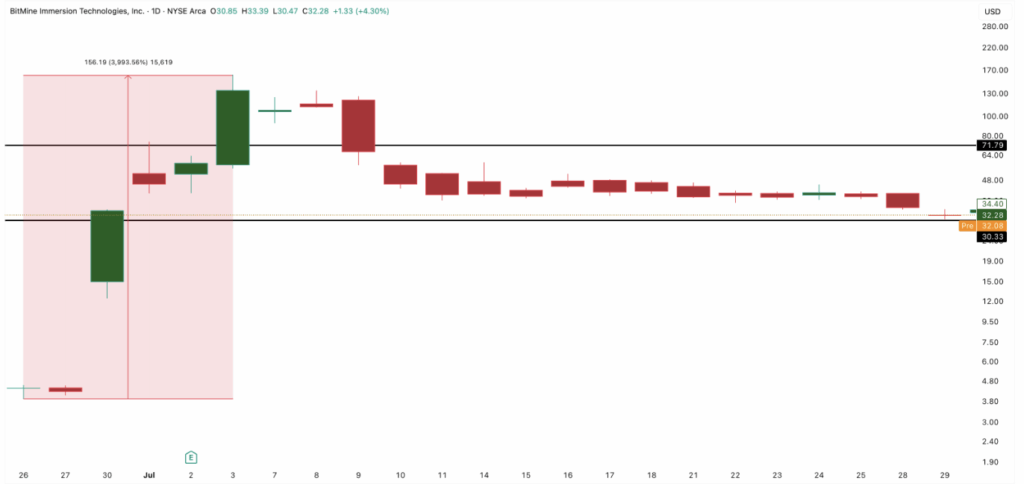

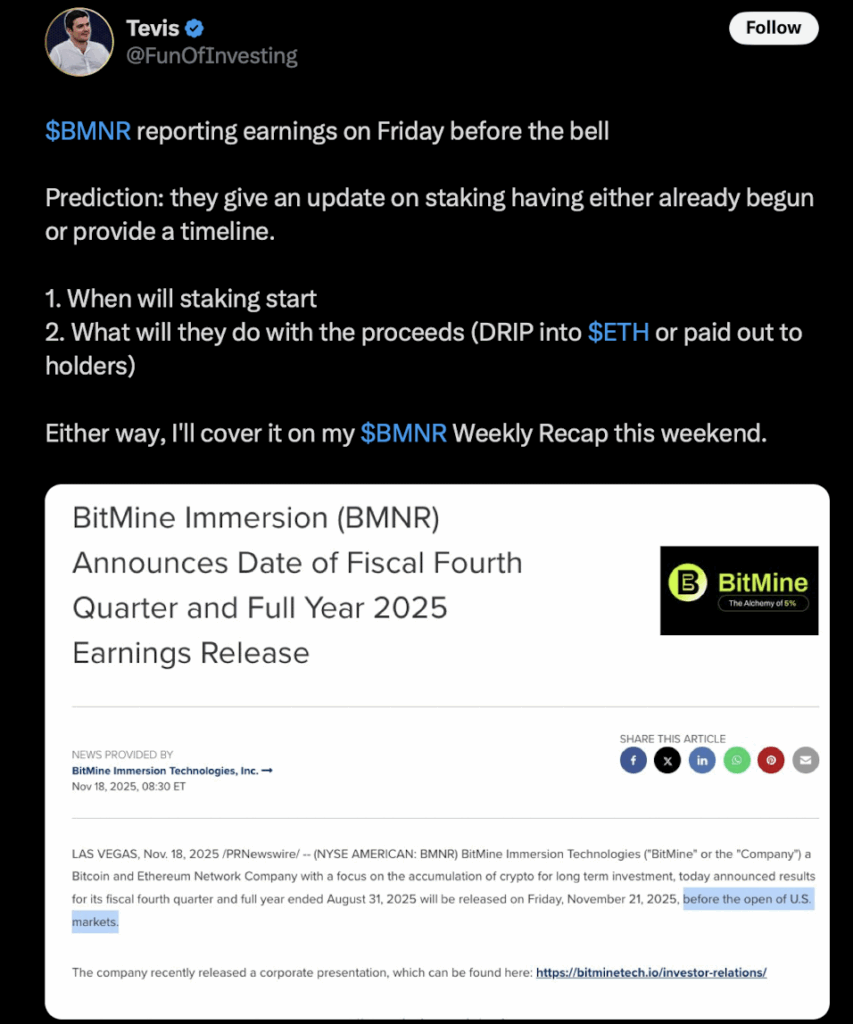

BMNR stock is up 4.3% today, even though it’s still down more than 21% over the past five days — most of that drop tracking Ethereum’s sharp 12% slide this week. With Q4 earnings coming on Nov. 21, this small jolt of strength has people wondering whether BMNR is positioning itself ahead of the market… again. The last time it behaved like this, BMNR moved long before Ethereum did, almost like it was sniffing out the next trend before everyone else noticed.

BMNR Has Front-Run ETH Before — and Conditions Are Starting to Look Familiar

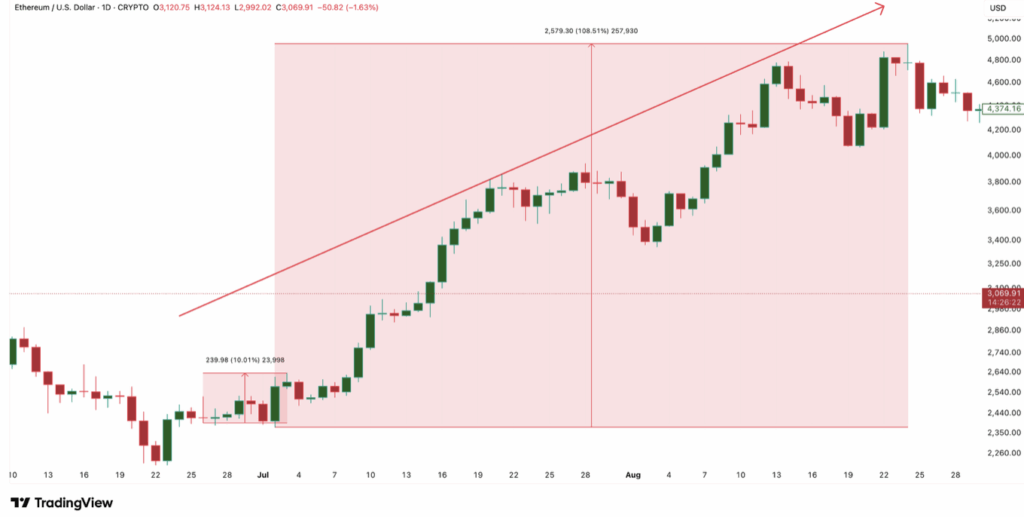

Between June 26 and July 3, Ethereum rose just 10%. Meanwhile BitMine (BMNR) absolutely exploded, flying 3,993% from $3.91 to $160.10 — literally in a single week. The Q3 earnings release came out on July 2, right in the middle of that move. Only after BMNR’s insane rally did Ethereum begin its own run, climbing more than 100% into late August. BMNR had clearly priced in the move early, reacting to expectations instead of waiting for ETH’s actual breakout.

Now the same conditions are starting to form. Crypto is flashing bottoming signals, BMNR is stabilizing right before earnings, and ETH is trying to build a base. It all feels… strangely familiar.

Hidden Bullish Divergence Says the Uptrend Isn’t Dead Yet

From a technical standpoint, BMNR still has some strength underneath the surface. Between June 27 and Nov. 17, BMNR printed a higher low while RSI printed a lower low — that’s hidden bullish divergence, the kind you usually see in assets that remain in long-term uptrends even during aggressive pullbacks. RSI has also bounced off oversold levels, giving BMNR a steadier footing heading into earnings.

But momentum alone isn’t enough. The real deciding factor comes from On-Balance Volume.

OBV Is the Trigger: A Breakout Could Start the Next Move

OBV has been stuck under a descending trendline for weeks. Every time BMNR tried to recover, this trendline stopped it. But now OBV is curling upward as earnings approach — and that’s usually the moment where BMNR launches its biggest moves.

Here’s what’s important right now:

- OBV is still below resistance, but close.

- OBV is rising ahead of the earnings release.

- A clean break above the OBV trendline usually precedes massive moves in BMNR.

There’s also long-term OBV divergence forming: between Sept. 5 and Nov. 17, the stock made a lower low while OBV made a higher low. That’s a sign sellers are losing control beneath the surface even if the price hasn’t responded yet.

Key Levels: $30 Support, $39–$65 Resistance

BMNR has defended the $30 level since early August. The stock is once again holding that zone, suggesting buyers are still active here.

If $30 holds:

- First target: $39

- Above $43: opens the path toward $52–$58

- Full extension: $65 if Ethereum sees even a modest rebound

But it cuts both ways. If Ethereum dumps again and BMNR loses $30, downside accelerates fast:

- $25 becomes the next support

- NAV compresses sharply under Dean’s valuation model

- BMNR returns to low-liquidity risk territory

CMF Shows Inflows Returning Ahead of Earnings

The Chaikin Money Flow (CMF) has broken above its descending trendline, meaning inflows are rising again — right before earnings. It’s not a breakout signal on its own, but it supports the idea that buyers are quietly stepping back in.

Donald Dean’s NAV model also adds weight: BMNR’s fair value scales directly with ETH’s percentage moves. If ETH rebounds even 10%, BMNR’s model-based valuation jumps toward the higher ranges — near $65. But if ETH drops? BMNR’s NAV contracts just as fast.

BMNR Could Front-Run Ethereum Again — If Two Conditions Align

The next big BMNR move depends entirely on:

- OBV breaking out, and

- Ethereum choosing its direction

If both flip bullish around the Nov. 21 earnings release, BMNR may once again outrun the crypto market the same way it did in July — pricing in the move long before ETH wakes up.