- Bitcoin rose 1.52% after the Supreme Court ruled Trump’s tariffs illegal, but failed to break the key $70K resistance level.

- Hotter-than-expected PCE inflation data and weak 1.4% GDP growth quickly shifted sentiment, limiting bullish momentum.

- A $335M Bitcoin whale transfer just before the GDP release suggests rising caution and potential market stress.

Macro events and crypto have always had this strange relationship. It’s rarely about the event alone, it’s about when it lands and how the market is positioned when it does. Short-term reactions tend to be sharp and emotional, money rushes in or spills out almost instantly. The broader impact, though, usually takes shape more slowly, after traders have had time to think, reassess, maybe second guess themselves.

February 20 Delivers a Double Shock

That’s pretty much how this current cycle is unfolding. February 20 delivered a heavy macro jolt, with two major developments colliding on the same day and forcing investors to react in real time. Bitcoin closed up 1.52%, a clean short-term bounce that signaled bullish intent. And yet, despite that strength, it still couldn’t crack the stubborn $70k resistance level, which continues to act like a ceiling no one can quite punch through.

Tariff Relief Meets Inflation Reality

The first catalyst was the U.S. Supreme Court ruling that President Donald Trump’s tariffs were illegal. Almost simultaneously, the PCE inflation report came in hotter than expected, reminding everyone that inflation isn’t quietly fading into the background. Bitcoin’s initial surge made sense. Relief over tariff uncertainty sparked buying, but that optimism faded as traders absorbed the inflation data and recalibrated expectations.

Whale Timing Raises Eyebrows

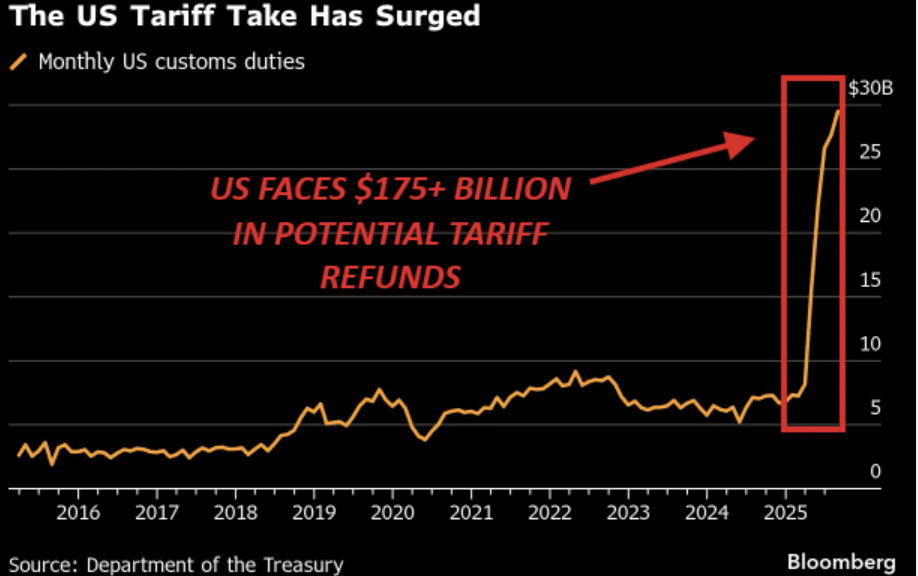

Still, one development ended up stealing the spotlight and reinforcing the idea that timing is everything in this macro-driven environment. Just before the U.S. Q4 GDP data was released, an insider whale wallet moved $335 million worth of Bitcoin, roughly ten minutes ahead of the announcement. GDP came in at 1.4%, the weakest quarterly reading since Q1 2025, adding to an already uneasy mood. Layer on top the potential $175 billion in tariff refunds and talk of a “backup plan” from President Trump, and the tension in the market felt almost thick.

Fragile Support, Lingering Caution

Put it all together, and that whale transfer doesn’t look random. Even with bullish news around the court ruling, Bitcoin couldn’t break $70k, which hints at deeper caution beneath the surface. Inflation risks and the fiscal uncertainty tied to tariff refunds likely played into the decision to move such a large position. If anything, the timing may serve as an early signal of stress building under the hood, especially with Bitcoin’s support levels once again starting to look fragile, maybe even a bit shaky.