- Bitcoin rebounds to $110K as gold drops 5.5% from record highs.

- Funding rates turn negative, signaling trader caution and hedging.

- BTC’s key battleground: $106K support vs. $116K resistance near 21-week EMA.

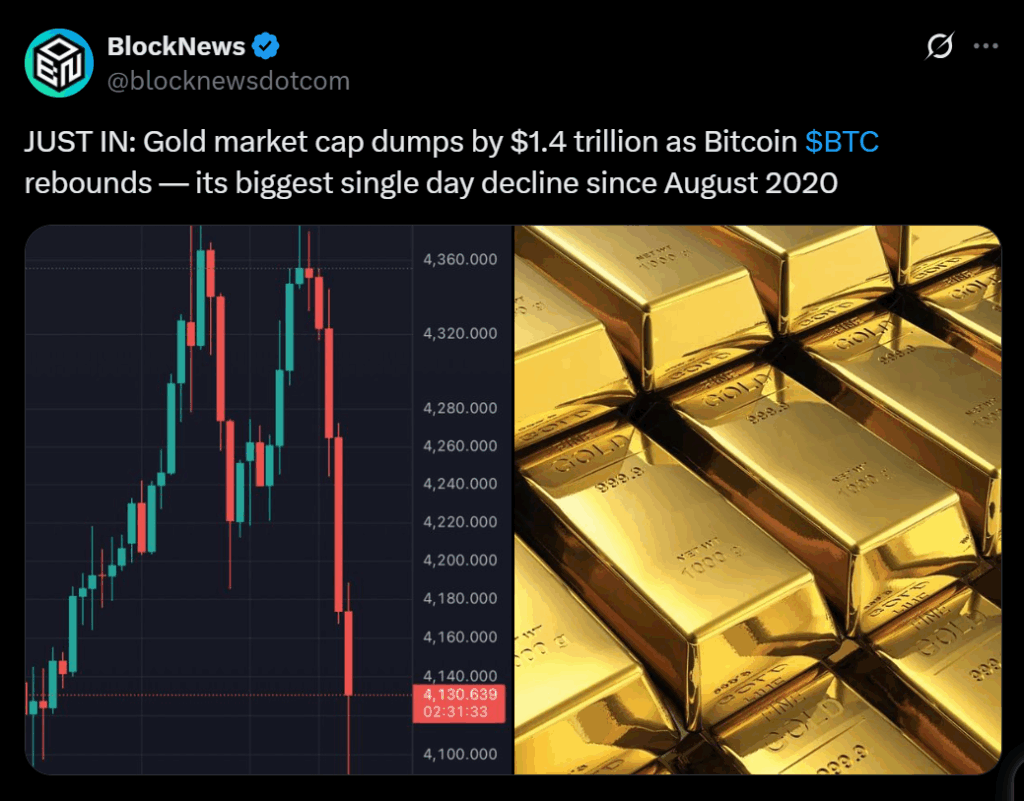

Bitcoin returned to the $110,000 zone on Tuesday as volatility picked up around the Wall Street open, marking a strong rebound while gold saw one of its sharpest single-day drops of the year. According to data from Cointelegraph Markets Pro and TradingView, BTC/USD reversed sharply after testing its weekend CME futures gap, holding firm above key short-term supports. Liquidity on exchanges thickened, suggesting both buyers and sellers were actively jockeying for position. Traders described the action as a “tug-of-war” around $110K — a crucial psychological and technical level heading into the week.

Derivatives Flash Risk-Off Signs

Monitoring resource CoinGlass showed heavy two-way flows across derivatives venues, with funding rates turning negative — a sign that traders expect further downside and are hedging accordingly. “It’s been a while since liquidations looked like this,” noted trader Luca, who highlighted the build-up of bids near current levels and a large cluster of sell orders (“price magnets”) stacked around $116,000. Analyst Rekt Capital also pointed to the 21-week EMA as the key line in the sand for bulls: “Bitcoin is finding resistance here. Holding this demand area is crucial if BTC wants to reclaim that EMA and confirm a higher low.”

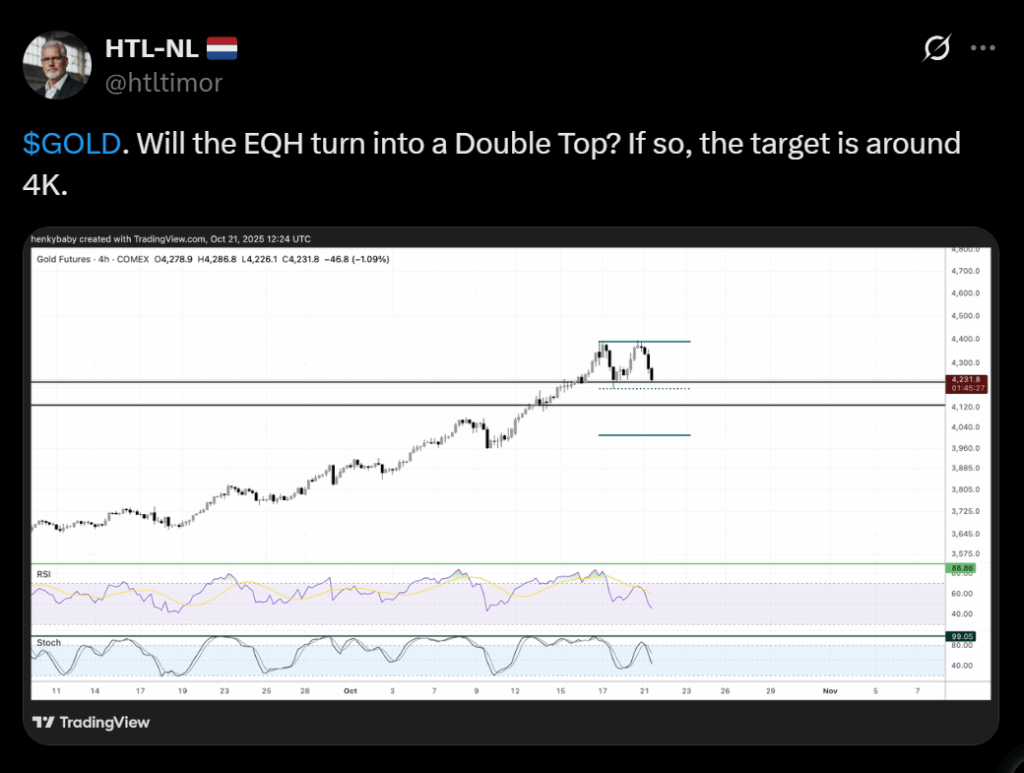

Gold’s 5% Drop Adds to the Contrast

The move in Bitcoin came as gold — which recently touched new all-time highs — suffered a 5.5% correction, sparking fears of a potential “double top” formation. Forex.com strategist James Stanley warned that a break below support could trigger a retest of $4,000 per ounce, a level tied to Fibonacci projections. The sharp reversal in gold has led some analysts, like Crypto Tony, to speculate that a pause in the metal’s bull run could free up capital for crypto: “Risk assets tend to outperform when gold cools off — if this pullback sticks, expect a crypto boom,” he said on X.

What Traders Are Watching Next

With liquidity building near both $106K and $116K, Bitcoin is set for an important range test heading into the week’s close. A reclaim of the 21-week EMA could strengthen bullish momentum toward $120K, while losing current support would risk sliding back toward $104K–$105K. For now, the divergence between Bitcoin and gold is drawing fresh attention — and suggesting that risk appetite may be quietly rotating back into crypto.