Bitcoin’s (BTC) price cruised past the $21,000 mark as it entered the weekend, rising above the descending trendline that had suppressed the big crypto since mid-August. Meanwhile, the total crypto market capitalization was back above the $1 trillion mark. BTC’s dominance is currently 39.14%, a 0.02% increase over the past 24 hours, according to data from CoinMarketCap.

Bitcoin Leads Crypto Market Recovery

According to data from CoinMarketCap and TradingView, the flagship cryptocurrency has risen 16% over the last four days and is up 8% over the past week. It was exchanging hands at $21,624 at the time of writing this article after shuttering the $20,000 resistance level on Friday. Bitcoin had been trapped below this psychological level since the start of the week.

Similarly, Ethereum (ETH) blasted through the 50-day simple moving average (SMA) after climbing more than 12% over the past four days to trade above $1,700. Other top cryptocurrencies were also flashing green, with Binance Coin (BNB) trading at $294 and Cardano (ADA) going for $0.51 after raising 1.3% and 3.37%, respectively, on the day.

Although there is no clear catalyst behind the uptick in the crypto market, a weakening dollar and a rise in global stock markets may be responsible.

The U.S. dollar index (DXY) reached a local high of 110.7 mid-week, though it began weakening on Thursday. Demand for the dollar declined throughout the second half of the week following the European Central Bank’s (ECB) decision to raise interest rates by a 75 basis, the highest since 2011. The drawdown in the greenback’s value has relieved risk-on assets like Bitcoin and other cryptocurrencies, which may explain the market’s sudden surge.

Bitcoin Sends A Recovery Signal

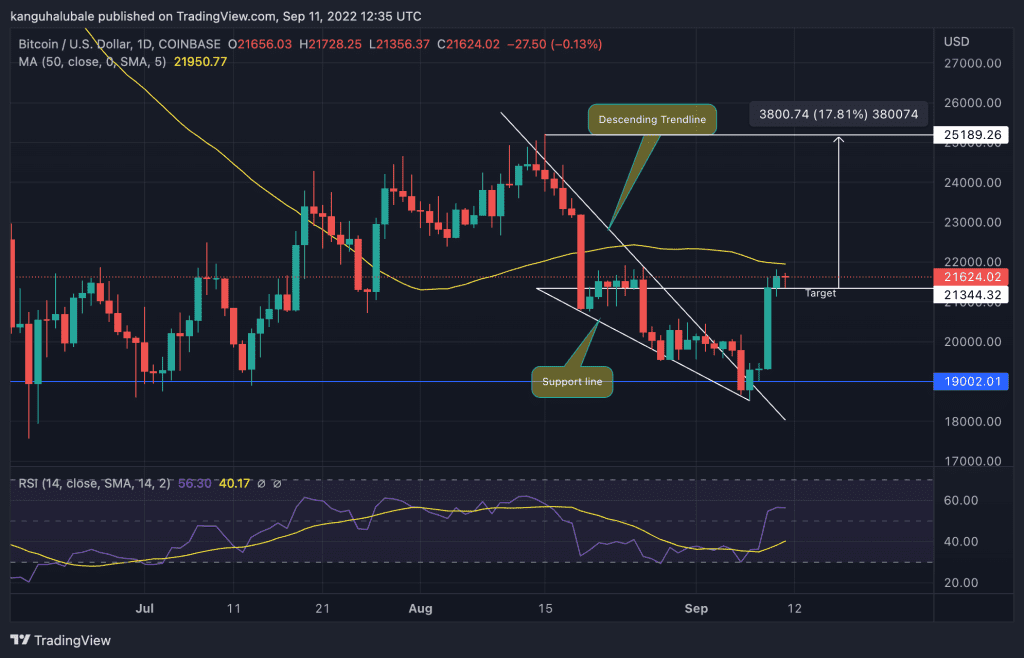

Bitcoin has set a new multi-week high of $21,654 following a brief period of consolidation. It now faces resistance from the $22,000 mark, a support level it lost on August 19.

From a technical outlook, however, the latest move by the pioneer cryptocurrency has already proved decisive and should favor bulls even on longer timeframes.

BTC displayed strength on the daily chart after escaping the bullish falling wedge, surpassing the technical pattern’s target at $21,344. Buyers may push Bitcoin higher to confront resistance from the $22,000, which appears to coincide with the 50-day SMA.

If they succeed, they will be bolstered to push the price beyond the liquidity zone, stretching from $22,000 to $24,000. Above that, the next logical move would be the $25,000 psychological level or the $25,189 range high. Such a move would represent a 17.8% climb ascent from the current price.

The relative strength index (RSI) position in the positive region supported Bitcoin’s optimistic outlook. The price strength at 56 suggests that the bulls have started returning to the scene and are taking control of the price.

IOMAP

Also supporting BTC’s positive outlook was data from IntoTheBlock, an on-chain data and insights firm. Its In/Out of the Money Around Price (IOMAP) model revealed that Bitcoin was on relatively robust support.

The IOMAP chart showed strong support around the $21,250 mark, where 1.01 million investors previously bought approximately 464,750 BTC.

As such, any attempts to push the price below this level would be met by aggressive buying from this cohort of investors who wish to increase their profits.

On the downside, if Bitcoin turned down from the current price, it would drop toward the $20,000 psychological level. Below that, a move to $19,000 or $18,500 would be the next logical move.