- Avalanche DeFi TVL crosses $2B, doubling since spring.

- Price tests $36 resistance, with potential upside toward $44.

- Spot activity and exchange outflows confirm bullish accumulation.

Avalanche’s DeFi ecosystem has doubled in size since spring, pushing its total value locked (TVL) past $2 billion—the highest level in two years. This surge in capital highlights growing confidence in the network as AVAX shows signs of building upward momentum across trading markets.

Avalanche Price Analysis: Key Levels at $36 and $44

AVAX recently broke through $26.81, establishing higher support and reinforcing its uptrend since June. The token is now testing resistance at $36.12. A decisive close above this level could pave the way for a run toward $44, while failure to hold could lead to short-term retracements back toward $33–$34.

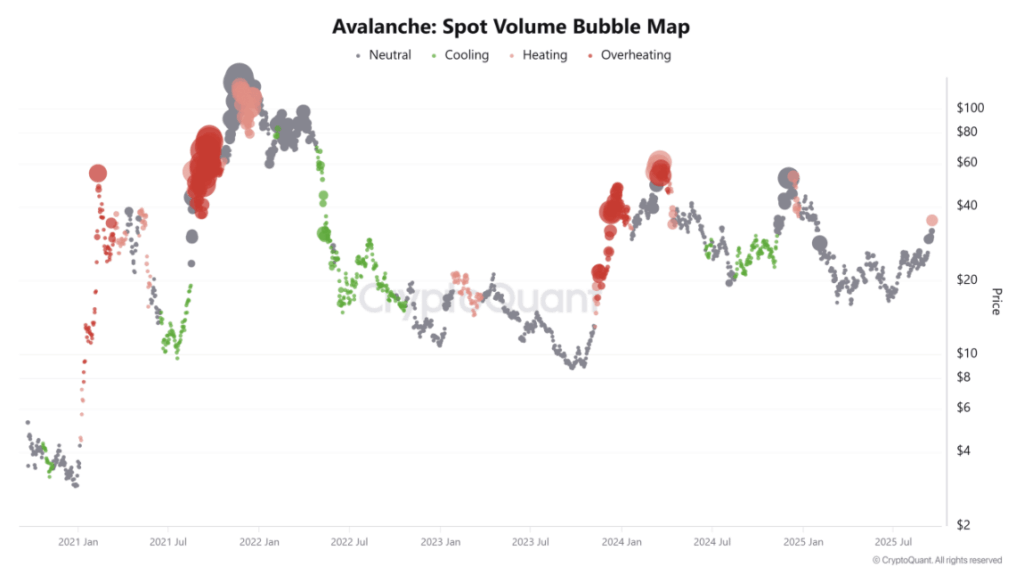

Spot Trading Volume Signals Rising Demand for AVAX

Spot trading volume has surged, with bubble map data showing larger clusters of activity. This indicates stronger engagement from both retail and institutional traders after months of consolidation. Sustained growth in spot demand adds weight to the bullish breakout structure.

Exchange Outflows Suggest Whale Accumulation

Exchange netflow data shows nearly $1 million in daily outflows, signaling accumulation as tokens leave exchanges. This reduces immediate selling pressure and aligns with the sharp rise in TVL, suggesting investors are locking up AVAX for long-term exposure rather than keeping it liquid.

Avalanche Price Forecast: Can AVAX Break Out Toward $44?

With surging DeFi TVL, bullish technicals, rising spot activity, and consistent exchange outflows, Avalanche looks well-positioned for further upside. If bulls defend $36 and momentum holds, AVAX could climb toward $44 in the near term, keeping its breakout narrative intact.