- Aave Labs proposed directing 100% of product revenue to the DAO under a new framework.

- In return, it requested $50M and 75,000 AAVE tokens to fund development.

- DAO members raised concerns about transparency and potential extraction, signaling governance tensions remain unresolved.

The uneasy truce between Aave Labs and the Aave DAO is starting to feel… fragile again.

Back in January, both sides agreed to cool things off after a bruising governance fight. Now Aave Labs has introduced what it calls the “Aave will win” framework, a proposal that would direct 100% of product revenue from Aave-branded platforms straight to the DAO. On paper, that sounds like alignment. In practice, it’s stirring up tension all over again.

100% Revenue to the DAO — With Conditions

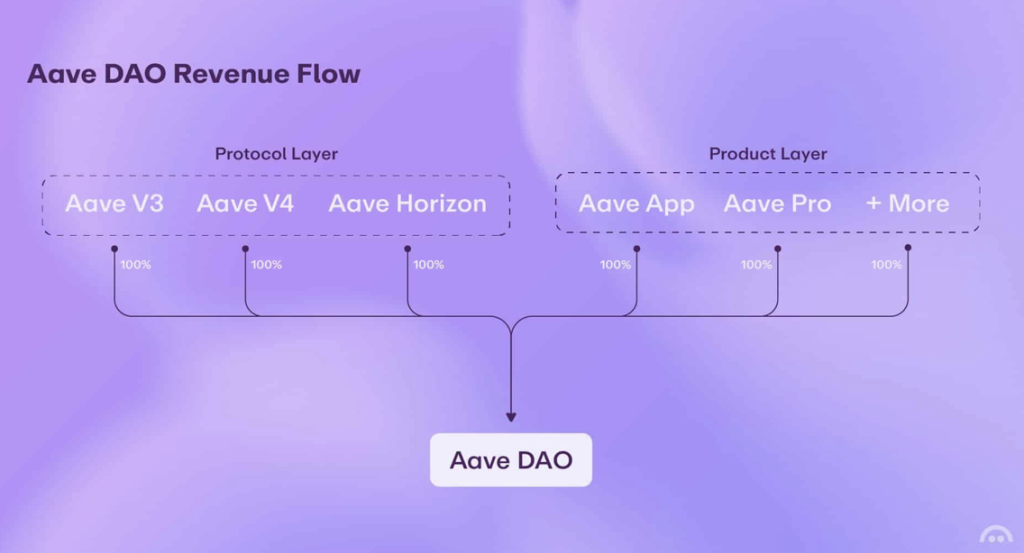

Under the proposal, every dollar generated from Aave-branded products — Aave.com, the Aave mobile app, Aave Card, Aave Horizon (the tokenization platform), and other initiatives — would flow directly to the DAO.

Stani Kulechov, Aave Labs CEO and founder, framed the move as a long-term structural shift. According to him, the framework formalizes Aave Labs’ role as a long-term contributor operating under a token-centric model, with all product revenue benefiting the DAO. As DeFi and TradFi increasingly blur together, he argues this structure positions Aave to capture growth over the next decade.

That’s the vision. Big, forward-looking, almost corporate in tone.

But there’s a catch.

In exchange for redirecting those revenue streams, Aave Labs is requesting $50 million from the DAO, including 75,000 AAVE tokens, to fund continued development. The logic is that since their current income would now go directly to the DAO, they need alternative funding to keep building.

It’s not a small ask.

The Foundation Proposal and Governance Tensions

Aave Labs also proposed forming a Foundation to manage Aave’s brands. The reasoning is that the DAO, being a decentralized governance body and not a legal entity, can’t effectively handle brand ownership or legal responsibilities.

Structurally, that makes some sense. But politically? It’s complicated.

For context, the DAO represents tokenholders and controls ecosystem funding decisions. Tensions escalated sharply in late 2025 when accusations surfaced that Aave Labs had diverted DAO revenue and sidestepped governance oversight regarding brand control. The dispute rattled the market. AAVE’s price fell from around $200 to nearly $140 during the peak of the conflict.

January’s ceasefire brought some relief, with Aave Labs promising a proposal aligned with tokenholder interests. This new framework is meant to be that solution.

Yet not everyone is convinced.

DAO Pushback: “Extraction” Concerns

Marc Zeller, a vocal DAO member, responded critically to the proposal.

While acknowledging that the framework could benefit the DAO, Zeller argued that the $50 million funding request feels like a one-sided negotiation. He described the situation as Aave Labs presenting a solution “for the good of the DAO” without prior coordination with delegates or service providers. His concern? That the incentives might lean more toward extraction than alignment.

He also called for greater transparency, including clarification and a potential audit of Aave Labs’ income streams to verify the claim that 100% of product revenue would indeed flow to the DAO.

In other words, trust remains thin. And in DAO politics, perception matters almost as much as the numbers.

Market Reaction and What Comes Next

Interestingly, AAVE’s price rose about 7% following the announcement. Traders, at least initially, seem to view the framework as constructive. A cleaner revenue model tied directly to the DAO could strengthen token value over time — if it works.

But the market has seen this movie before.

If the governance dispute escalates again, volatility could return quickly. Analysts warn that in a renewed crisis scenario, AAVE could fall toward $79 or lower. Governance risk, especially in DeFi, tends to reprice assets fast.

For now, the situation sits in a gray zone. The proposal aligns revenue with tokenholders, which is positive. Yet the funding request and structural control questions reopen old wounds.

The ceasefire isn’t broken. But it’s being tested. And whether this becomes a long-term alignment shift or another chapter in Aave’s governance saga depends on what happens next — and how much trust both sides are willing to rebuild.