- The Mar-a-Lago summit signaled political gravity, not grassroots crypto adoption

- USD1 is being positioned as regulator-adjacent finance, not just a payments tool

- Stablecoins are increasingly becoming influence instruments, not neutral infrastructure

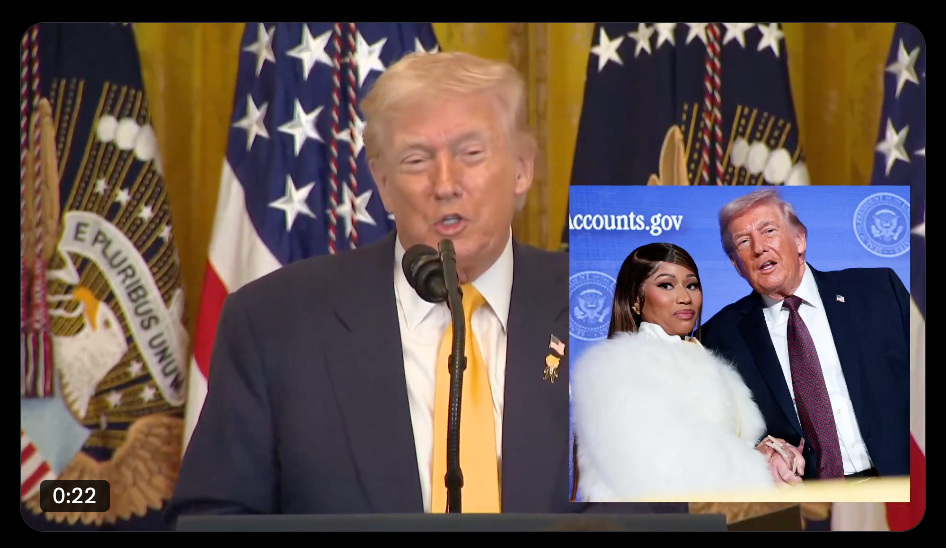

The Mar-a-Lago summit didn’t look like a normal crypto event. It wasn’t trying to persuade skeptics or win over developers. It was signaling to insiders. When exchange CEOs, regulators, senators, and billionaires gather under chandeliers to bless a stablecoin, the message is pretty blunt: this isn’t about innovation anymore. It’s about who gets safe passage as crypto hardens into policy.

That’s why the optics matter more than the slides. This wasn’t a hackathon vibe. It was political gravity on display. And in markets, gravity shapes outcomes long before products prove themselves.

USD1 Isn’t Competing on Tech, It’s Competing on Proximity

World Liberty’s pitch is dressed up as a “faster dollar,” but the real value proposition is access. USD1 isn’t trying to win because it has the best UX or the lowest fees. It’s trying to win because it’s relationship-powered. Treasury-backed reserves matter, sure. But being regulator-adjacent matters more, especially if the next stablecoin framework ends up favoring “trusted” issuers.

That’s how stablecoins move from wallets into corporate balance sheets. Not through memes or community. Through perceived safety, political cover, and distribution that doesn’t get throttled.

The Line Between Business and Governance Is Getting Uncomfortably Thin

This is the part the market doesn’t want to say out loud. When CFTC commissioners, senators pushing market structure bills, and major exchange heads share a stage with a private issuer, crypto stops pretending it’s neutral. Regulation becomes something you help write while launching products that benefit from it.

That may be legal. It’s certainly strategic. But it isn’t clean, and it isn’t what most people thought “open finance” was supposed to look like. The old separation between policymaking and product launch is fading fast, and stablecoins are where that shift is most visible.

DeFi Language, TradFi Reality

Even if the branding uses crypto language, nothing about this feels decentralized. It looks like traditional finance with new rails and louder marketing. Stablecoins are being framed as instruments of dollar dominance and policy influence, not as tools for financial freedom.

That framing appeals to institutions and policymakers because it’s familiar. It also quietly pushes the original crypto audience to the sidelines. The culture is shifting from permissionless experimentation to permissioned legitimacy, and USD1 is basically wearing that shift as a badge.

Stablecoins Are No Longer Plumbing, They’re Leverage

The market should be honest about what’s happening. Stablecoins are no longer just infrastructure. They’re leverage. They’re distribution. They’re political alignment. And in a world where regulation is tightening, those things may matter more than code.

USD1’s success won’t hinge on technology alone. It will hinge on whether political capital can convert into lasting trust once the spotlight fades. If it can, this becomes a blueprint. If it can’t, it becomes a very expensive spectacle.