- Stablecoin rewards are the main obstacle slowing US crypto legislation.

- Banks fear deposit flight more than consumer risk.

- The debate reveals where financial power is actually shifting.

At Davos, Donald Trump once again leaned into the idea that the United States should become the crypto capital of the world. The slogan is clean and confident. The reality behind it is far messier. While Trump wants a market structure bill signed quickly, negotiations keep grinding to a halt over a single issue that refuses to disappear. Stablecoin rewards.

Why Stablecoin Rewards Hit a Nerve

On paper, the rules already exist. The GENIUS framework blocks stablecoin issuers from paying direct interest. What it does not stop is platforms like Coinbase offering rewards on top of stablecoin balances. That gap is where the real fight lives. Banks argue it’s about safety and stability. In practice, it’s about deposits. Once users can hold dollar-backed assets, stay liquid, and earn yield without a traditional bank, the old model starts to look fragile.

The Coinbase Moment That Changed the Tone

Brian Armstrong’s public stance that no bill is better than a bad one wasn’t rhetorical flair. It was leverage. Lawmakers felt it immediately. If crypto firms agree to rules that quietly strip away their competitive edge, then the legislation becomes symbolic rather than functional. That pushback exposed how much negotiating power the industry now holds.

This Isn’t Crypto vs Government Anymore

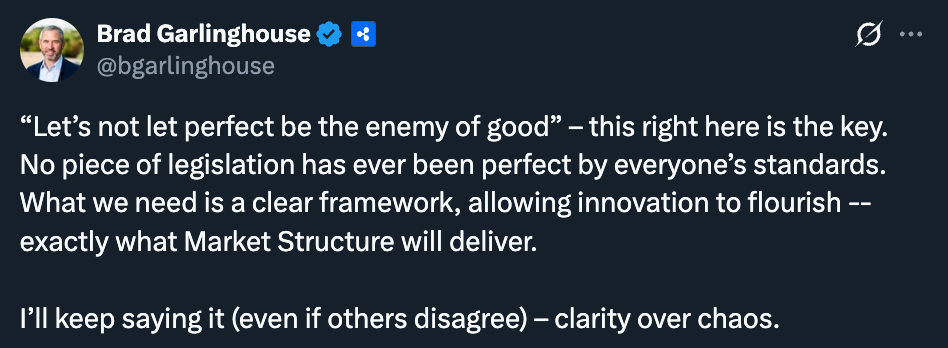

The lines have shifted. Support from industry leaders like Brad Garlinghouse, alongside attempts at mediation from figures such as David Sacks, show this is no longer an ideological fight about whether crypto belongs. It’s a commercial battle between industries over who controls the future of dollar-based value transfer. Banks and crypto firms are now openly competing for the same users.

Where the Bill Will Actually Be Won or Lost

This legislation won’t be decided by speeches about innovation or national leadership. It will hinge on whether Washington acknowledges the real threat banks are responding to. Stablecoin rewards don’t just challenge products, they challenge dominance. That’s why this issue keeps resurfacing, and why it’s slowing everything down. Power rarely moves quietly, and this is what that friction looks like.