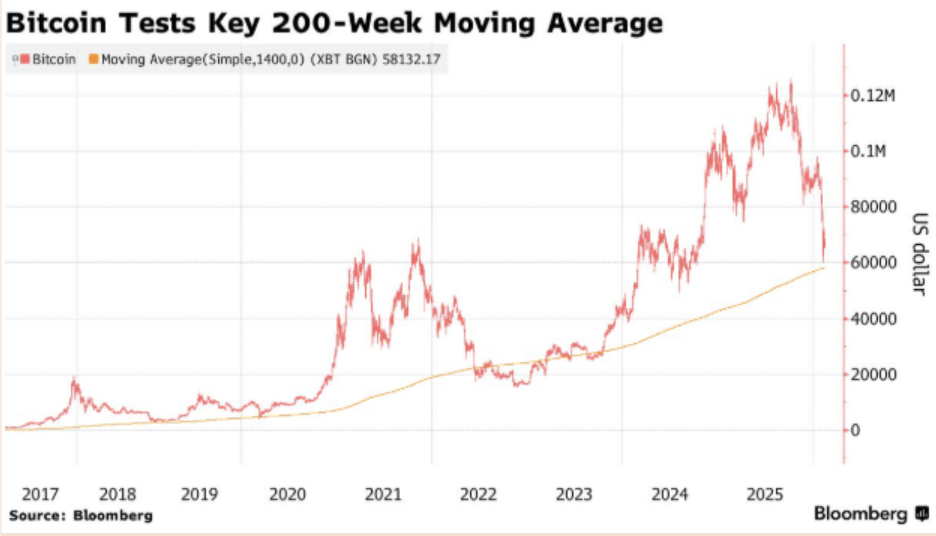

- $60K is a key Bitcoin support reinforced by the 200-week moving average and heavy options positioning.

- $1.24B in put options sit below $60K, with the next major cluster near $50K.

- Rising open interest and macro uncertainty make the current structure fragile for bulls.

Bitcoin is hovering near a level that feels less like support and more like a pressure plate.

Volatility hasn’t gone away. If anything, it’s been simmering just beneath the surface, weighing on sentiment and making traders extra sensitive to every red candle. Right now, all eyes are locked on one number: $60,000. Bulls really can’t afford to lose it. Because if that level cracks, the liquidity sitting underneath could get swept fast — and recovery attempts would suddenly look a lot harder.

Why $60K Is the Line in the Sand

Analysts are calling $60K a potential liquidation trigger zone. It’s not just psychological. There’s real structure behind it.

From a technical standpoint, Bitcoin’s 200-week moving average is hovering near that area. Historically, when BTC holds above the 200-week MA, the broader uptrend remains intact. Lose it, and the tone shifts. Not instantly catastrophic, but enough to shake confidence. Bulls start second-guessing.

And the derivatives data adds another layer.

Deribit shows the largest concentration of put options sitting below $60K, totaling roughly $1.24 billion. That means a huge number of traders are positioned for a break lower. If BTC slices through $60K cleanly, the next major put cluster sits closer to $50K. That’s not a small gap.

So structurally, $60K isn’t just support. It’s a cliff edge with a lot of leverage hanging off it.

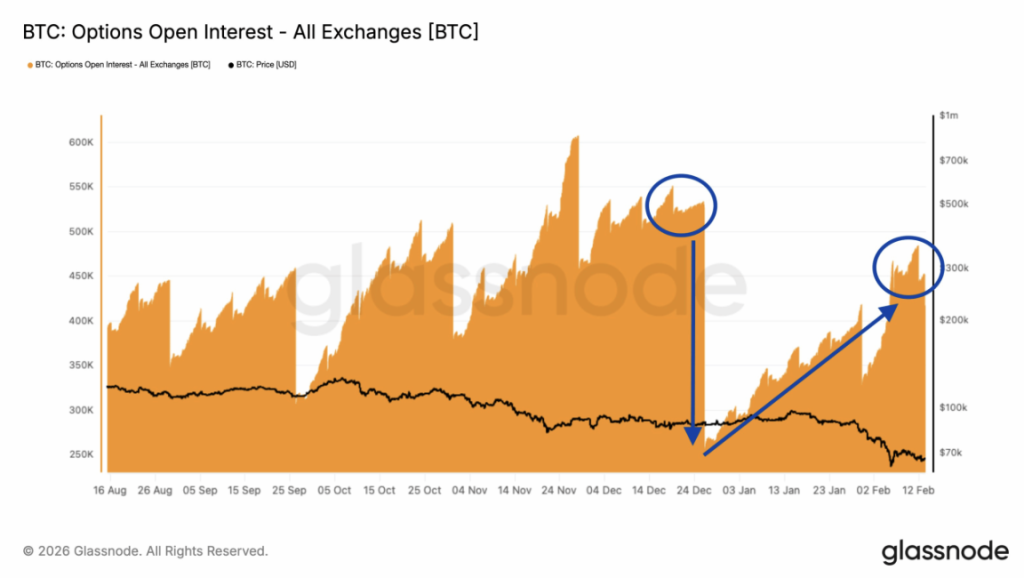

Options Stacking and Open Interest Are Raising the Stakes

Glassnode data reveals Bitcoin options open interest has surged back toward late Q4 2025 highs. It now sits around 452,000 BTC, up from 255,000 BTC. That’s a 77% increase in positioning.

When open interest rises like that, it tells you traders are loading up. The problem is, they’re not all leaning the same direction. And when positioning gets crowded near a key level, volatility tends to spike.

Right now, market-implied probability suggests only about 15% confidence that BTC will hold above $60K. That means 85% of traders are leaning toward a breakdown scenario. Whether that’s smart positioning or herd mentality… we’ll find out soon enough.

But when expectations get this lopsided, even a small move can trigger a chain reaction.

Macro Uncertainty Isn’t Helping

As if the options pressure wasn’t enough, macro uncertainty is creeping back in.

The U.S. Supreme Court is set to rule on February 20 regarding President Donald Trump’s tariff case, and traders don’t like not knowing. Policy shifts tied to trade or tariffs can ripple into equities, dollar strength, yields — and eventually crypto. It doesn’t even have to be dramatic. Just uncertain.

Meanwhile, sentiment across crypto remains heavy. It’s the kind of environment where small drops feel bigger than they are. Liquidity is thinner. Conviction is weaker. One sharp move could quickly snowball into capitulation.

Fragile Structure, Binary Outcome

Put it all together and the setup looks fragile.

Massive put positioning below $60K. Elevated open interest. A key long-term moving average sitting right at the edge. And macro FUD quietly building in the background.

If Bitcoin holds $60K and buyers step in aggressively, it could trap a lot of bearish bets and fuel a sharp relief rally. But if it breaks — decisively, with volume — the path toward $50K could open quickly, because that’s where the next liquidity pocket sits.

Right now, the market is leaning bearish. The 85% probability crowd thinks the level won’t hold.

But in crypto, crowded expectations sometimes create the opposite result.

Either way, $60K isn’t just another number on the chart. It’s the level that decides whether this is consolidation… or the start of something deeper.